( click to enlarge )

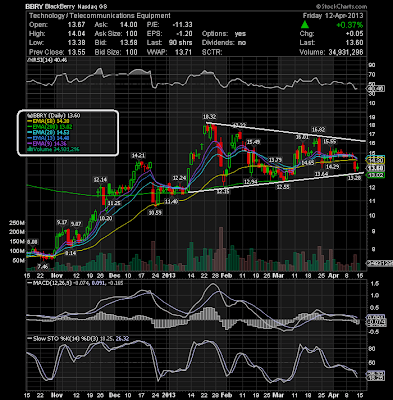

( click to enlarge )On daily chart, the stock is still exhibiting a symmetrical triangle formation and still trading above its 200-day EMA (which has been supporting the stock price since January). As long as BBRY trades above it the medium-term trend is considered intact. If it breaks the 200-day EMA on its way down, that should be considered a bearish sign and the medium-term trend could be reversing. Stop loss at 12.98 recommended.

( click to enlarge )

( click to enlarge )LinkedIn Corp (NYSE:LNKD) Strong on weak tape. Had a nice breakout today with a pop of $5.21 to 185.39 or 2.89% on 2.6 million shares. Stock is trading above its key moving averages like 9, 13, 20, 50 and 200 EMA. To add on any dip.

( click to enlarge )

( click to enlarge )Keep an eye on Baidu.com, Inc. (NASDAQ:BIDU) and monitor its volume for any potential breakouts. If the stock can manage to close above the 50-day moving average located at $90.71 on high volume, it would be a great buying opportunity but only on a breakout. Technical indicators are looking better for the stock. Chart shows a bullish sign as the stock is back on top of 20-day moving average with MACD rising and approaching the zero line from below.

( click to enlarge )

( click to enlarge )Mercury Systems Inc (NASDAQ:MRCY) The technical chart shows a stock that is right on the verge of a big breakout. If the stock can break through the 7.75 level, there is a strong chance MRCY can run back to the 8.5-8.7 range IMO. From a technical standpoint, the MACD and AC/AD are both showing us something similar: Uptrends. With the chart on the verge of a possible breakout, get MRCY on your radars.

( click to enlarge )

( click to enlarge )It was alerted last week. Rambus Inc. (NASDAQ:RMBS) soared to new highs today as the stock continues to see strong buying pressure. Looking at the technical chart above the stock is trading above all of three major moving averages. Plus, the MACD is positive and rising. Nevertheless, there is a need for some profit-taking for some consolidation from these high levels. For those who did not have a chance to buy the stock, any pull back is your buying opportunity.

( click to enlarge )

( click to enlarge )VIVUS, Inc. (NASDAQ:VVUS) closed at $11.65 back once again above its 50-day EMA, which closed at $11.59. MACD seems to be confirming a positive movement for this stock. Upcoming resistance is at 11.91.

( click to enlarge )

( click to enlarge )SINA Corp (NASDAQ:SINA) jumped over 2.5% today. It ended the day trading more than 1M shares and closed near the highs of the day. The technical daily chart shows the momentum indicators have turned up and the RSI is on the rise. It will be interesting to see next week if the momentum can continue through the $50.22 level, where the 50-day exponential moving average is located.

Get the best financial real-time streaming news / rumors and alerts with Benzinga Professional . They're my best source of information.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC