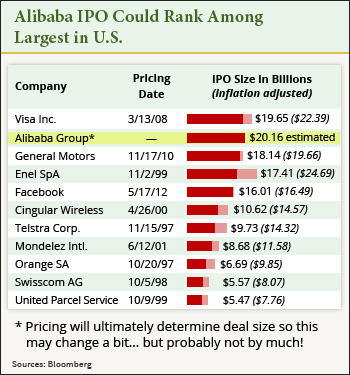

The Alibaba IPO is expected to be one of the largest U.S. IPOs of all time, with some projections placing the deal north of $20 billion.

The official Alibaba IPO date has yet to be announced - it may still be months away - but that hasn't stopped investors from looking for ways to begin profiting from the Alibaba IPO now.

The official Alibaba IPO date has yet to be announced - it may still be months away - but that hasn't stopped investors from looking for ways to begin profiting from the Alibaba IPO now.

That's because the profit potential from the initial public offering is tremendous, and not only for Alibaba stock...

Alibaba dominates the Chinese e-commerce industry, with 80% of the online transactions in the country taking place on one of Alibaba's sites. According to the research firm McKinsey & Co., Chinese e-commerce was a $210 billion industry in 2012. That number is expected to reach $420 billion by 2020.

This week, Alibaba announced that in the quarter ending March 31, it had revenue growth of 39%. In the initial IPO filing, it was revealed that Alibaba had revenue of $5.6 billion for the fiscal year 2013 and $6.5 billion for the first nine months of fiscal year 2014. Net income for those two time periods was $1.6 billion and $3.2 billion, respectively.

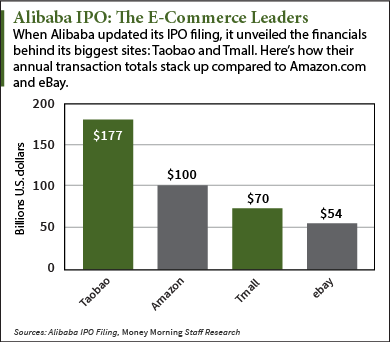

Alibaba also far outpaces its U.S. competition when it comes to transaction volume. In 2013, Alibaba's biggest site, Taobao, handled $177 billion worth of transactions. Tmall, Alibaba's second-biggest site, handled approximately $70 billion. That compares to $100 billion for Amazon.com Inc. (Nasdaq: AMZN) and $54 billion for eBay Inc. (Nasdaq: EBAY) in the same time.

With a company and IPO that big, the profit opportunities aren't just limited to Alibaba stock. Other companies and stocks are already starting to rise as Wall Street notices the profit potential in China's e-commerce industry.

Money Morning's Defense and Tech Specialist Michael A. Robinson has been following the Alibaba IPO since rumors first started swirling about the deal in 2013.

Money Morning's Defense and Tech Specialist Michael A. Robinson has been following the Alibaba IPO since rumors first started swirling about the deal in 2013.

In February, he pinpointed a stock that had gained 40% in the previous six months and was poised for further growth as the IPO approached.

And since Alibaba's IPO filing, this pick has gained 13%...

Play the Alibaba IPO Now

The investment Robinson picked was the KraneShares CSI China Internet ETF (Nasdaq: KWEB), a broad play on the Chinese Internet market.

KraneShares has 30 Chinese Internet companies in its portfolio. These companies deal with everything from social media and gaming, to e-commerce, to real estate Internet portals.

KWEB does not hold Alibaba stock since the company isn't public yet, and there's no definitive proof it will invest in Alibaba. However, Alibaba is exactly the type of company that KWEB would add to its portfolio.

KWEB invests almost 11% of its holdings in Tencent Holdings (OTCMKTS ADR: TCEHY). Tencent offers online payments, social networks, gaming, advertising, music, and video to its customers. It's the fifth-largest Internet company in the world and the largest Chinese Internet company.

Other KWEB holdings include China's largest search engine Baidu Inc. (Nasdaq ADR: BIDU), one of China's oldest e-commerce companies NetEase Inc. (Nasdaq ADR: NTES), and a leading Chinese software company Qihoo 360 Technology Co. Ltd. (NYSE: QIHU).

KWEB's exposure to China's lucrative e-commerce industry - and the anticipation of the Alibaba IPO - has helped push up shares in recent weeks.

Alibaba officially filed for its IPO on Tuesday, May 6, and KWEB shares finished that week just north of $31 per share. Since Monday, May 12, KWEB shares have climbed more than 13%. Prior to the Alibaba IPO filing, KWEB had underperformed, dropping nearly 24% in the previous two months.

The best news for investors is that KWEB isn't the only profit opportunity ahead of the Alibaba IPO... There's another happening right now, a "backdoor" play on this massive IPO...

In fact, this could be your best chance to make the kind of huge gains normally reserved for the high-net-worth investors and bankers. You can learn more about this Alibaba profit play here.

Will you be investing in the Alibaba IPO when the company comes to market? Let us know on Twitter @moneymorning using #Alibaba.

Tags: Alibaba IPO, alibaba ipo 2014, Alibaba IPO date, alibaba stock, investing in alibabaThe post Alibaba IPO Frenzy Triggers Double-Digit Gains in These Investments appeared first on Money Morning - Only the News You Can Profit From.