Another day, another new high.

Another day, another new high.

Yawn. We'd be a lot more impressed if all the gains for the day didn't come pre-market – in the even thinner-traded futures, followed by a day of choppy trading on anemic volume.

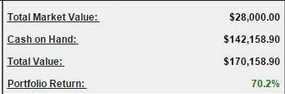

Still, it is what it is and what it is is another new high and another record monthly gain and we don't know why but we made $10,000 yesterday in our Short-Term Portfolio as our bullish positions (because we thought we were too bearish last week) came through for us in spades.

$10,000 is, of course, a ridiculous amount of money to make in a single day in a $100,000 porfolio. In part, it's a reflection of the extreme volatility in the options chains, as those prices fluctuate wildly. Since we sell a lot of premium when the VIX is high, we benefit when it gets low again. Also, we're getting closer to January and we have a lot of January plays where time is on our side – it's not really an accident, this is how we set up our trades – they are simply working out better than we expected them to.

Now we're up 70% for the year again and we have to consider whether or not we should take the money and run or just let them ride. To some extent, we're protecting the much larger gains in our $500,000 Long-Term Portfolio, which is up 26% for the year ($130,000), which puts our $70,000 gain in the STP into the proper perspective.

Now we're up 70% for the year again and we have to consider whether or not we should take the money and run or just let them ride. To some extent, we're protecting the much larger gains in our $500,000 Long-Term Portfolio, which is up 26% for the year ($130,000), which puts our $70,000 gain in the STP into the proper perspective.

If we cash the STP, then the LTP is unprotected (as it's all bullish) and that's not acceptable but we COULD decide to cash out our longs and that would leave us VERY BEARISH in the STP, probably over-protecting the LTP but that might be a good thing into January.

So, let's consider our STP longs and what we should do with them:

20 USO Jan $29 calls at $1.05, now $1.30 – up 23.8%

We just bought these last Thursday and our premise remains (success at the OPEC meeting this weekend – I guess…