Boy is this getting silly.

Boy is this getting silly.

Apparently, we never learn. Well, we at PSW learn, we've been hedging the crap out of this rally for reasons that should be entirely evident on this chart – earnings are NOT GOOD!

If earnings aren't good, then why are companies racing up to all-time high valuations? Simply because (as I noted yesterday) monetary manipulation is at work.

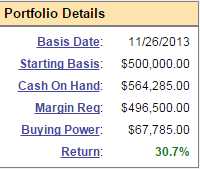

It's not like we haven't gone along for the ride – we're still up 30.7% in our bullish, Long-Term Portfolio, which is the where the vast majority of our allocations are put to work (see "Smart Portfolio Management" in the PSW Wiki). Sure it's been 15 months now, so less impressive than 30% in a year – but not a bad pace (2% per month), nonetheless.

It's not like we haven't gone along for the ride – we're still up 30.7% in our bullish, Long-Term Portfolio, which is the where the vast majority of our allocations are put to work (see "Smart Portfolio Management" in the PSW Wiki). Sure it's been 15 months now, so less impressive than 30% in a year – but not a bad pace (2% per month), nonetheless.

Our Short-Term Portfolio, where we do our hedging, has taken a beating in February as we have spent a good deal of money adding protective short positions to protect the $150,000+ we gained in the Long-Term Portfolio – just in case the market isn't as safe as people seem to think it is. Our STP has dropped from $204,000 in February (up 104% in the same 15 months) to just $193,720 as of yesterday's close, down $10,000 but still a nice, combined $844,000 – up 40.6% as a pair.

IN PROGRESS