I would like to remind everybody once again that Benzinga is offering 1 month of its streaming platform for just $1. This is a limited offer that is about to run out. It delivers real-time financial news straight to your desktop. CLICK HERE

( click to enlarge )

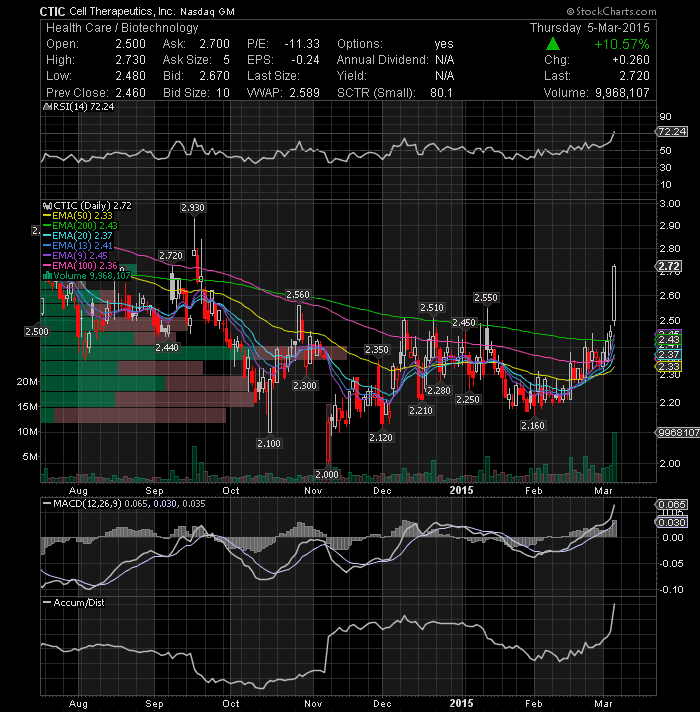

( click to enlarge )CTI BioPharma Corp (NASDAQ:CTIC) confirmed my previous outlook and broke decisively above its 200-day EMA today. I will be watching the stock again on Friday for a continuation move through Thursday’s highs of $2.73. The daily MACD shows the strength of conviction behind this Bullish trend. From here we can expect a run to the $3 area. Lets keep an eye on it.

( click to enlarge )

( click to enlarge )SanDisk Corporation (NASDAQ:SNDK) needs to take out 83.91 in order to convince bullish buyers at current levels. The technical daily indicators are looking mildly bullish with MACD rising above its signal line but in negative territory.

( click to enlarge )

( click to enlarge )PDL BioPharma Inc (NASDAQ:PDLI) is still trading around its 50-day EMA which has been a strong resistance over the past several weeks. I plan to buy the stock if it can break and close above this key resistance level.

( click to enlarge )

( click to enlarge )JA Solar Holdings Co., Ltd. (NASDAQ:JASO) Strong breakout of resistance on volume confirmation. The breakout signals a continuation of the prior advance. As long as 8.50 holds (rising 50EMA) this breakout is in a great shape.

( click to enlarge )

( click to enlarge )Halozyme Therapeutics, Inc. (NASDAQ:HALO) had a nice surge four weeks ago and has been consolidating that move since then. Watch for break above this consolidation area and go long.

( click to enlarge )

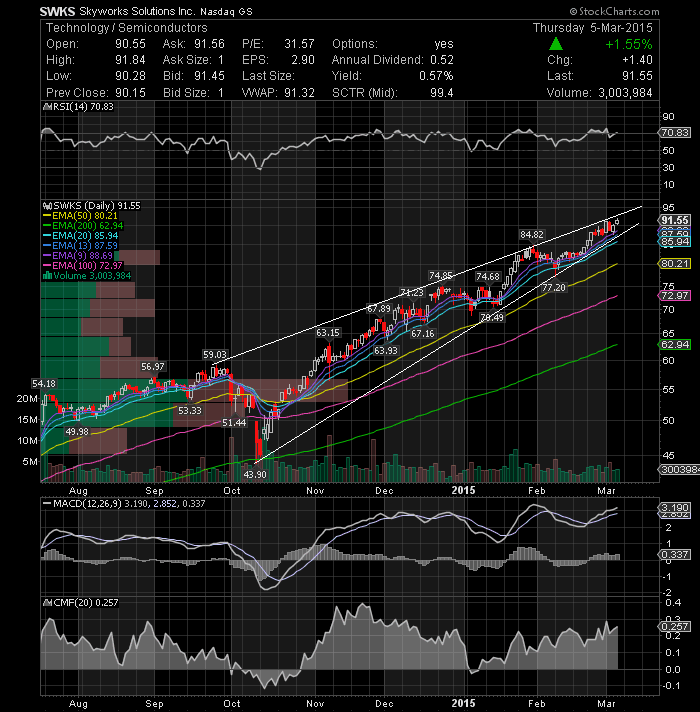

( click to enlarge )Skyworks Solutions Inc (NASDAQ:SWKS) has had a monster run over the last six months but looks a bit overextended to me.

( click to enlarge )

( click to enlarge )Pacific Ethanol Inc (NASDAQ:PEIX) Rallied hard Thursday on massive volume. A break over today's high could push it to test $15. The near-term outlook is bullish for the stock. MACD is positive and above the signal line. RSI is moving up and above its 50% level. Long setup.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC