CHARLOTTE, NC / ACCESSWIRE / September 21, 2016 / VBI Vaccines, Inc. (Nasdaq: VBIV) is a biopharmaceutical company developing next-generation vaccines for infectious diseases and immuno-oncology. The company was formed from a merger between SciVac Therapeutics, Inc. and VBI Vaccines, Inc. in May 2016. VBI markets a third-generation hepatitis B vaccine called Sci-B-Vac™ that is currently available in Israel and 14 other countries outside the U.S. and Europe. Sci-B-Vac is under development for the U.S. and EU market.

In addition, the company is developing vaccine candidates for cytomegalovirus (CMV), respiratory syncytial virus (RSV), and Zika virus utilizing the enveloped virus-like particle (eVLP) technology. An immuno-oncology product is also in development targeting CMV expression in patients with glioblastoma multiforme (GBM). For the purposes of this article, I will focus on the opportunity for Sci-B-Vac.

Background On Hepatitis B

Hepatitis B is a liver infection caused by the hepatitis B virus (HBV). Infection with HBV can result in an acute infection, which only lasts for a short time before the virus is cleared from the body, or a chronic infection, which can persist a lifetime. In approximately two-thirds of patients, acute HBV infection causes a mild, asymptomatic illness that typically goes undetected (1). The other one-third of patients will develop clinical signs of infection, such as fatigue, nausea, and jaundice. For those that develop chronic HBV infection, the disease is highly variable from one patient to another. While most that go on to develop a chronic infection have high viral titers early on, over time the disease can resolve to persistently high levels of viral antigen and DNA (immune tolerant phase) or to the point where viral antigen and DNA are very low or undetectable (inactive carrier state).

The risk of developing a chronic infection is highly dependent upon when the infection occurs, as the majority of infants infected with HBV go on to develop chronic infection compared to only a small percentage of those infected with HBV as adults (Source: WHO). Those suffering from more severe chronic infections are prone to a number of long-term complications. The U.S. Centers for Disease Control (CDC) estimates that approximately 5,000 people die of cirrhosis and 1,500 people die of liver cancer in the U.S. each year as a result of chronic HBV infection. For patients with severe chronic hepatitis and cirrhosis, the five-year survival rate is approximately 50% (2).

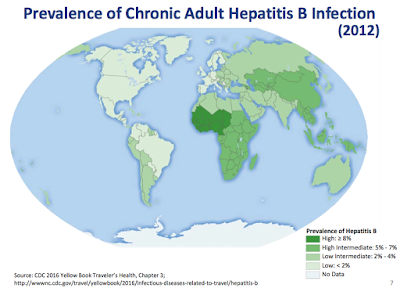

Thanks to a routine vaccination program in the U.S., the number of acute cases of HBV was estimated at only 19,200 in 2014 by the U.S. CDC. It is estimated that 850,000 - 2.2 million individuals in the U.S. have chronic HBV infections. However, the number of those with chronic infections is much higher in other parts of the world, as globally it is estimated that 240 million people have chronic HBV infection. This leads to an estimated 786,000 deaths each year from HBV-related liver disease (3). The following map shows the overall prevalence of chronic HBV infection around the world.

- HBV Vaccine

The first HBV vaccine was introduced in the 1980's. The first-generation vaccine consisted of one of the three HBV envelope proteins (S antigen), which was purified from the bloodstream of patients with chronic HBV infections. Due to safety concerns arising from the use of blood-derived antigens, the second generation HBV vaccine (which is in use today) utilizes a recombinant S antigen that is manufactured in yeast. In the U.S., these vaccines are sold by GlaxoSmithKline (Engerix-B®) and Merck (Recombivax-HB®). A combination vaccine for both hepatitis A and B is also available in the U.S. (Twinrix®). In Europe, GlaxoSmithKline markets an HBV vaccine (Fendrix®) with a novel adjuvant system that is intended for adults age 15 years and older with renal insufficiency

The HBV vaccine is a series of three doses, with the World Health Organization (WHO) recommending that the first dose is given as soon after birth as possible. This is designed to help prevent the maternal transfer of the virus, which is one of the most common modes of transmission of HBV in countries with highly endemic chronic infection rates. The complete vaccine series (i.e. all three injections) incites protective immunity in approximately 95% of infants, children, and young adults. Over one billion doses of HBV vaccines have been administered since 1982 with an excellent safety record.

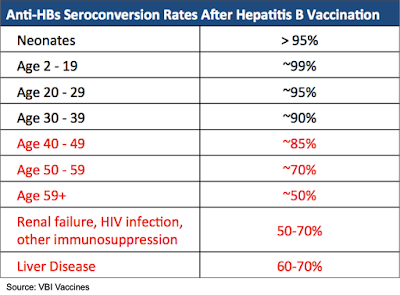

While the current HBV vaccine is highly effective in the young and healthy, the vaccine is not nearly as effective in the elderly, obese, heavy smokers, those with renal insufficiency, and immunocompromised patients. The following table shows the seroconversion rates for select groups of patients following completion of the HBV vaccine series. Seroconversion is defined as an anti-HBV antibody response ≥ 10 mIU/mL. The effectiveness of the current HBV vaccine begins to taper off for those receiving it after the age of 40. Immunocompromised patients or those with liver disease have even lower seroconversion rates.

A number of means have been attempted to compensate for the lack of immunogenicity in populations that do not respond adequately to the HBV vaccine, which includes increasing the dose or adding additional doses to the current vaccination regimen (e.g., hemodialysis patients receive up to eight injections of the HBV vaccine), using a stronger adjuvant, or using an intradermal injection instead of intramuscular. However, what is truly needed is a highly immunogenic vaccine that can offer seroprotection rates in at-risk patient groups that match those in healthy populations. In addition, a highly immunogenic vaccine that can be utilized for fast induction of immunity and to overcome the low compliance with the three-dose regimens would be highly desirable.

VBI's Sci-B-Vac

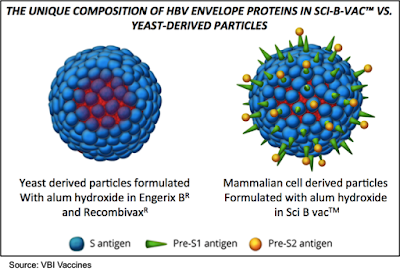

VBI's third generation HBV vaccine, Sci-B-Vac, is composed of the three surface antigens expressed on HBV (S, Pre-S1, Pre-S2). The vaccine is produced in Chinese Hamster Ovary (CHO) cells, which allows for glycosylation of the proteins thus potentially increasing their immunogenicity. This is not possible with the second-generation vaccines that are produced in yeast cells. Sci-B-Vac is approved for sale in 15 countries and currently has 50% market share in Israel, where approximately 500,000 patients have been vaccinated with 1.5 million doses of the vaccine.

The clinical development of Sci-B-Vac has involved more than 20 clinical trials in >3,000 patients, including infants, children, healthy adults, and immunocompromised adults. A number of these studies showed greater seroprotection in at-risk populations compared to Glaxo's Engerix-B. In addition, these studies showed that the vaccine was more immunogenic than Engerix-B, resulting in a more robust and faster seroconversion rate while having a similar safety profile. The following studies highlight the ability of Sci-B-Vac to elicit protective immune responses in at-risk patient populations.

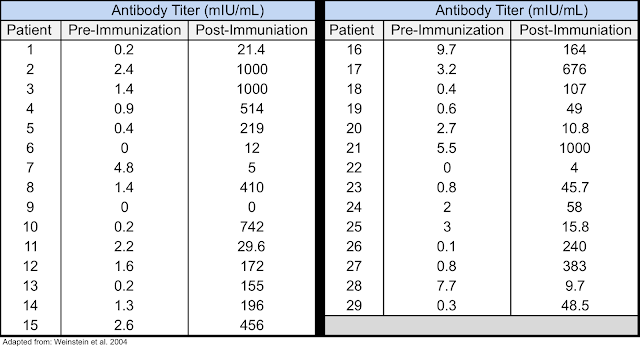

ESRD Patients: Standard vaccination regimens with the second-generation HBV vaccines in patients with end-stage renal disease (ESRD) only produce seroconversion rates of 50-60%. A study was performed in 29 ESRD patients who did not adequately respond to the second-generation HBV vaccine. Each patient was immunized with 10 μg of Sci-B-Vac at 0, 1, and 6 months, with anti-HBV antibody levels tested one month after completion of the vaccination protocol. Results showed that 25/29 patients (86%) achieved antibody levels ≥ 10 mIU/mL, as shown in the following table (4).

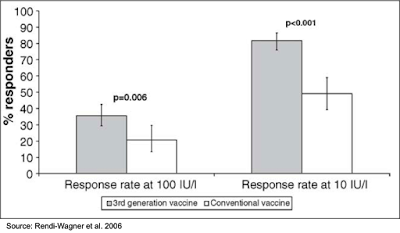

Non-Responders: A study was conducted in 716 individuals that were diagnosed as non-responders (anti-HBV titers <10 mIU/mL) or low-responders (anti-HBV titers <100 mIU/mL) to the current HBV vaccine. The primary analysis group was non-responders who had received ≥ 4 prior HBV vaccine injections. The secondary analysis group was non-responders who had received three prior HBV vaccine injections and low responders who had received ≥ 4 prior HBV vaccine injections. The results showed that one month after the first or second injection, the percentage of patients with titers >100 mIU/mL was greater for those immunized with Sci-B-Vac (35.7%) compared to those immunized with the second-generation vaccine (20.8%). This result was highly statistically significant (P=0.006). The response rate was even greater when using a threshold of >10 mIU/mL (81.7% for Sci-B-Vac immunized vs. 49.1% for second generation immunized; P<0.001) (5).

Immunosuppressed Patients: A study was conducted with 20 patients who received liver transplants for chronic HBV infection while being treated with lamivudine, an antiviral medication intended to prevent HBV recurrence. Patients received two courses of three double doses (20 μg) of Sci-B-Vac. Five patients responded to the first vaccination course while an additional five patients responded after the second course for an overall response rate of 50%. The response rate was 88% in patients <50 years old and 25% in older patients (6).

In addition to offering greater seroprotection to patients that don't adequately respond to the current HBV vaccine, Sci-B-Vac also offers the potential for higher immunogenicity and more rapid seroprotection in otherwise healthy individuals.

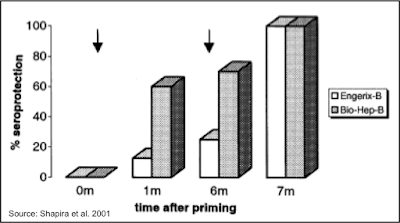

Rapid Seroconversion: A study was performed in 36 healthy volunteers to determine how quickly seroconversion occurred after administration of Sci-B-Vac or Engerix-B. The following chart shows that six months following a single dose, seroprotection occurred in 70% of those administered Sci-B-Vac (Bio-Hep-B) compared to 25% of those administered Engerix-B. All participants went on to achieve seroprotection following the second dose of each vaccine; however, anti-HBV titers were statistically significantly higher (P<0.025) in Sci-B-Vac immunized patients (mean = 28,800 mIU/mL) compared to those immunized with Engerix-B (mean = 923 mIU/mL) (7).

HEPLISAV-B - A Potential Competitor By Dynavax

Dynavax Technologies Corporation (NASDAQ: DVAX) is developing HEPLISAV-B, an investigational vaccine for immunization of adults against hepatitis B infection. It is a second generation HBV vaccine that uses a proprietary toll-like receptor 9 (TLR9) adjuvant to enhance the immune response. The vaccine is administered in two doses over one month, in comparison to the current second-generation vaccines that are administered in three doses over six months. For patients with chronic kidney disease (CKD), the vaccine is administered in at 0, 1, and 6 months.

HEPLISAV-B has been tested in over 10,000 adults through 11 clinical trials, including multiple Phase 3 trials comparing it with Engerix-B.

- Halperin et al. 2012: This study involved 2,415 patients age 18-55 randomized 3:1 to receive two doses of HEPLISAV-B (n=1,809) or three doses of Engerix-B (n=606). The primary endpoint was the seroprotection rate eight weeks after the second dose of HEPLISAV-B or four weeks after the third dose of Engerix-B. The data showed that patients immunized with HEPLISAV-B had a seroprotection rate of 95.1% compared to 81.1% for those immunized with Engerix-B. The rate of serious adverse events was similar in the two groups, with one person from each treatment group reporting an autoimmune illness. One patient from the HEPLISAV-B group discontinued the study after developing Guillain-Barré syndrome, which occurred 111 days after receiving the second HEPLISAV-B vaccine and 25 days after receiving an influenza vaccine (8).

- Heyward et al. 2013: This study involved 2,452 patients age 40-70 randomized 4:1 to receive two doses of HEPLISAV-B (n=1,969) or three doses of Engerix-B (n=483). The primary endpoint was the seroprotection rate eight weeks after the final dose of HEPLISAV-B or Engerix-B. The results showed a 90.0% seroprotection rate for those administered HEPLISAV-B compared to 70.5% for those administered Engerix-B. There were three events that were considered new-onset autoimmune events, two cases of hypothyroidism and one case of vitiligo, which all occurred in the HEPLISAV-B group (9).

- Jannsen et al. 2013: This study involved 521 patients age 18-75 years with CKD that compared three doses of HEPLISAV-B given at 0, 1 and 6 months to four doses of Engerix-B given at 0, 1, 2, and 6 months. The results showed that at the primary endpoint at week 28, the seroprotection rate was 89.9% for the HEPLISAV-B group compared to 81.8% for the Engerix-B group (10).

Dynavax originally filed a BLA in 2012 based on the results of the aforementioned Phase 3 clinical trials for the use of HEPLISAV-B in adults age 18 and older. The FDA issued a Complete Response Letter (CRL) in 2013 due to the theoretical potential for new autoimmune conditions brought about by the TLR9 adjuvant and in order to gain approval the company would need to have a larger safety database to assess the possibility for rare autoimmune side effects. This led to the initiation of an additional Phase 3 clinical trial to increase the safety database to over 10,000 individuals.

HBV-23: This was a Phase 3 safety and immunogenicity study that compared HEPLISAV-B to Engerix-B in adults age 18-70 years old. As with the previous trials, participants received either two doses of HEPLISAV-B, at 0 and 1 month, while those receiving Engerix-B received three doses at 0, 1, and 6 months. Both primary endpoints for the study were met. The peak seroprotection rate for the HEPLISAV-B group was 95.4%, while for the Engerix-B group it was 81.3%. In those with type 2 diabetes, the peak seroprotection rate was 90.0% in the HEPLISAV-B group compared to 65.1% in the Enerix-B group. While safety results were consistent with what had previously been seen in other trials, the study did show an imbalance in the cases of Bell's Palsy (N=5, 0.09%) for HEPLISAV-B™ treated patients compared with for Engerix-B® treated patients (N=1, 0.04%) and overall "new-onset" autoimmune diseases (N=8 on HEPLISAV-B™ vs. N=1 on Engerix-B®).

Dynavax resubmitted the BLA for HEPLISAV-B, which was accepted by the FDA on March 30, 2016, and assigned a PDUFA date of September 15, 2016. The FDA has since extended the PDUFA date to December 15, 2016, due to Dynavax submitting additional individual trial data that had previously been provided as integrated data in the BLA submission in March 2016. In August 2016, the Vaccines and Related Biological Products Advisory Committee (VBRPAC) scheduled a review of the BLA for HEPLISAV-B at its meeting on November 16, 2016; however, that meeting was cancelled by the FDA, as the agency said any additional questions or information requests would be passed on to the company in the coming weeks. In addition, the FDA will review the overall immunogenicity data from HBV-23, and will not make a decision on immunogenicity in sub-populations including the data obtained in diabetic patients. Thus, the data regarding diabetic patients will need to be submitted as a supplemental BLA filing following approval.

The dosing regimen for HEPLISAV-B is likely to be attractive to both patients and physicians; however, the data appears to be in line with what is seen with Sci-B-Vac. The product will likely face a difficult path to approval in the EU, which is typically more apprehensive about the use of novel adjuvants.

Development Pathway for Sci-B-Vac

VBI will be meeting with regulators from the U.S. and EU to design a regulatory path forward to attain approval for the vaccine to be used in both healthy and immunocompromised individuals. I expect the Phase 3 program to be conducted on a global basis. To attain approval in both the EU and U.S., it will likely require two Phase 3 clinical trials that will involve both healthy and immunocompromised individuals (e.g., diabetic or ESRD patients) from each region with a comparison between Sci-B-Vac and Engerix-B.

The trials are not likely to be as large as those conducted for HEPLISAV-B, based on the fact that Sci-B-Vac has already been tested in >3,000 patients thus far and has attained approval in various jurisdictions around the world. If a Phase 3 program began in 2017, I believe that could lead to approval of the vaccine in the U.S. and EU in 2020 or 2021.

HBV Vaccine Market Analysis

Vaccines sold by GlaxoSmithKline, which offers Engerix-B in the U.S. and Fendrix in the E.U., and Merck, which offers Recombivax-HB in the U.S. and HBVaxPro in the E.U, currently dominate the HBV vaccine market. The vaccines sold by Glaxo and Merck are second generation vaccines targeting only S antigen. Sanofi markets GenHevac B in France, which is a combination S antigen/Pre-S2 vaccine produced in CHO cells. Combination vaccines are also available, including Twinrix (hepatitis A and hepatitis B), Comvax (hepatitis B and Haemophilus influenza B), and Pediarix (hepatitis B and DTaP). The combination vaccines are mostly used in infants, thus are unlikely to be major competition for Sci-B-Vac.

Based on the data accumulated thus far for Sci-B-Vac, the most likely initial target markets in the U.S. and EU are for those populations that have an inadequate response to the second generation vaccines, including otherwise healthy non-responders, immune suppressed patients, and renal failure patients. To be conservative in my assumptions, I expect limited uptake of Sci-B-Vac in the general population, as Sci-B-Vac is likely to command a premium price compared to Engerix-B and Recombivax HB based on its production in mammalian cell culture, although certainly the impressive seroconversion rates and potential for less stringent dosing may increase market share for VBI.

Engerix-B is administered through three injections at month 0, 1, and 6 at either 10 μg (age ≤ 19) or 20 μg (age 20+). In addition to its use in otherwise healthy individuals, the vaccine is also approved for use in hemodialysis patients; however, it requires a series of four double doses (40 μg) at 0, 1, 2, and 6 months. In a clinical trial of 56 hemodialysis patients, seroconversion at 8 months was 67% (Engerix-B prescribing information). Engerix-B is also indicated for use in type 2 diabetics based on a study involving 378 diabetic patients and 189 matched controls. The data showed that one month following the third dose, seroprotection rates were 75% for the diabetic group and 82% for the controls. The seroprotection rates in the diabetic group based on age were 89%, 81%, 83%, and 58% for those aged 20-39 years, 40-49 years, 50-59 years, and 60+ years, respectively. Engerix-B currently costs $22.40 per dose (CDC).

Fendrix is based on Engerix-B, only it includes the MPL adjuvant and is not approved for use in the U.S. In the EU, Fendrix is approved for patients with renal insufficiency age 15 and older. The vaccination regimen consists of four injections at 0, 1, 2, and 6 months each with 20 μg S antigen and 50 μg MPL adjuvant. Clinical trial data showed seroprotection of 91% of patients at month 7; however, a four-dose regimen is a major drawback.

Recombivax HB is administered at 0, 1, and 6 months at either 5 μg (age ≤ 19) or 10 μg (age 20+). Its use in hemodialysis patients is based on a study of 28 patients dose with 40 μg at 0, 1, and 6 months, which resulted in a seroconversion rate of 89% (Recombivax HB prescribing information). There is no information in the label about the use of Recombivax HB in type 2 diabetics. Recombivax HB currently costs $23.95 per dose (CDC).

Conclusion

With Sci-B-Vac, VBI is targeting an HBV vaccine market that is estimated to be $270 million in the U.S. and $960 million globally (PharmaPoint). The target market for Sci-B-Vac is likely to center on immunocompromised patients and those that do not respond well to the second generation vaccine, such as those with kidney disease, diabetics, transplant recipients, and older patients. The CDC estimates that approximately 20 million individuals have CKD and another 25 million have diabetes, thus even attaining a very small share of the market (<1%) for these patients could lead to peak revenues of $50-75 million.

The incidence of CKD and diabetes are similar in the EU, and with a larger overall population, I estimate for peak revenues of approximately $75-100 million. I believe another $40 to $50 million is attainable from targeting those that are non-responders to the second generation vaccine and those who need rapid seroconversion, such as healthcare workers. All told, I believe peak estimates for Sci-B-Vac of $150-200 million are possible. The competition from Dynavax is real, but VBI looks to have an equally-as-effective vaccine without the concerns on new onset autoimmune diseases. Nevertheless, I believe Dynavax, which currently trades at a market capitalization of $465 million, represents an interesting comparable and potential roadmap for future valuation of VBI Vaccines, which currently trades at a market value of only $130 million.

In addition to Sci-B-Vac, VBI is also developing novel vaccines based on the company's eVLP platform, including one for CMV, which is likely to have an interim readout in the first half of 2017. A very interesting immuno-oncology program targeting glioblastoma multiforme (GBM) is in the preclinical stage with a Phase 1 clinical trial set to initiate in the first half of 2017. I hope to explain these opportunities in more detail in follow-up articles. With a number of programs in development and a revenue-generating asset, VBI is a company I will be keeping a close eye on.

Please see important information about BioNap,Inc. in our Disclaimer.

BioNap has no direct business relationship with VBIV.

Work for this article was sponsored by an individual investor.

BioNap holds no position in shares of VBIV.

SOURCE: BioNap, Inc.

ReleaseID: 445734