According to a study released today by eHealth, Inc. (NASDAQ:EHTH), which operates eHealth.com, the average family of three earning slightly too much to qualify for subsidies in 2018 would need to increase its household income by nearly $29,000 before health insurance became “affordable” based on Obamacare criteria.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170926005576/en/

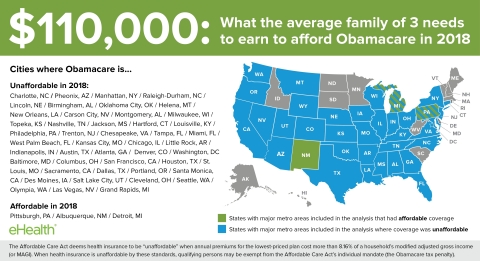

Obamacare affordability projected for 2018 (Photo: Business Wire)

The Affordable Care Act (ACA or Obamacare) considers health insurance to be “unaffordable” when annual premiums for the lowest-priced plan in a market cost more than 8.16% of a household’s modified adjusted gross income (or MAGI). When health insurance is unaffordable by this standard, individuals and families may qualify for an exemption from Obamacare’s individual mandate to buy health insurance.

Government subsidies are available to people earning up to 400% of the federal poverty level, but middle-income households earning 401% or more of the federal poverty level are not eligible for subsidy assistance.

In preparing its analysis, eHealth reviewed the lowest-price 2017 plan available for families of three comprised of two adults age 35 and one child. The same family model was analyzed using data from Healthcare.gov in 40 cities, data from eHealth.com in 9 cities not utilizing Healthcare.gov, and data from the New York state exchange for New York City.

After applying a relatively modest annual rate increase of 10% to 2017 rates to project 2018 rates, eHealth discovered the following:

- In 47 of 50 cities surveyed, the lowest-priced plan would be officially unaffordable under Obamacare affordability standards for families earning 401% of the federal poverty level (about $82,000 per year in the contiguous US, making them ineligible for Obamacare subsidies).

- Among these, the average three-person household would need to earn an additional $28,939 per year before the lowest-cost plan becomes affordable according to Obamacare rules.

These figures are based on a uniform, conservative 10% increase in health insurance premiums between 2017 and 2018. In fact, some independent projections for 2018 have estimated that premiums may increase 20% or more on average. There will likely be significant variability in the actual rate increase in 2018 for each plan and each market.

Specific findings for surveyed cities are found below. A detailed analysis providing additional context may also be reviewed as an appendix prepared by eHealth which pairs the findings here with demographic data describing each city’s median age, median household size, and median income.

“Coverage under the Affordable Care Act is becoming seriously unaffordable for many families, even by Obamacare’s own rules,” said eHealth CEO Scott Flanders. “I find it hard to believe that the framers of the law ever intended the cost of family health insurance to rival that of a second mortgage. Without the introduction of lower-cost options into the market or expanded government subsidies, many middle-income Americans are in danger of being priced out of the health insurance market entirely.”

Of the fifty cities surveyed, only Detroit, MI; Albuquerque, NM; and Pittsburgh, PA showed no affordability gap with the projected 2018 rate increases. These cities are described first in the table below, while subsequent cities are given in order from least affordable (that is, with the largest affordability gap) to most affordable (with the smallest affordability gap).

Affordability by Surveyed City for a Family of Three | |||||||||||

| Affordability | Affordability gap | ||||||||||

Projected 2018 | Subsidy threshold | threshold (annual | (additional | ||||||||

| 2017 annual | premiums | (annual income at | income at which | income needed to | |||||||

City/Metro area | premium for | with 10% | which subsidies | projected | make projected | ||||||

| lowest-cost | increase | are no longer | premiums become | premiums | |||||||

| plan | over 2017 | available) | "affordable") | "affordable") | |||||||

| Detroit, MI | $5,544.00 | $6,098.40 | $81,884.00 | $74,735.29 | $(7,148.71) | ||||||

| Albuquerque, NM | $5,800.08 | $6,380.09 | $81,884.00 | $78,187.35 | $(3,696.65) | ||||||

| Pittsburgh, PA | $5,972.16 | $6,569.38 | $81,884.00 | $80,507.06 | $(1,376.94) | ||||||

| Charlotte, NC | $13,659.00 | $15,024.90 | $81,884.00 | $184,128.68 | $102,244.68 | ||||||

| Phoenix, AZ | $12,881.28 | $14,169.41 | $81,884.00 | $173,644.71 | $91,760.71 | ||||||

| Manhattan, NY | $12,552.60 | $13,807.86 | $81,884.00 | $169,213.97 | $87,329.97 | ||||||

| Raleigh-Durham, NC | $11,083.80 | $12,192.18 | $81,884.00 | $149,413.97 | $67,529.97 | ||||||

| Lincoln, NE | $11,082.36 | $12,190.60 | $81,884.00 | $149,394.56 | $67,510.56 | ||||||

| Birmingham, AL | $10,247.16 | $11,271.88 | $81,884.00 | $138,135.74 | $56,251.74 | ||||||

| Oklahoma City, OK | $10,083.24 | $11,091.56 | $81,884.00 | $135,926.03 | $54,042.03 | ||||||

| Helena, MT | $9,978.12 | $10,975.93 | $81,884.00 | $134,508.97 | $52,624.97 | ||||||

| New Orleans, LA | $9,819.00 | $10,800.90 | $81,884.00 | $132,363.97 | $50,479.97 | ||||||

| Carson City, NV | $9,746.16 | $10,720.78 | $81,884.00 | $131,382.06 | $49,498.06 | ||||||

| Montgomery, AL | $9,632.16 | $10,595.38 | $81,884.00 | $129,845.29 | $47,961.29 | ||||||

| Milwaukee, WI | $9,544.80 | $10,499.28 | $81,884.00 | $128,667.65 | $46,783.65 | ||||||

| Topeka, KS | $9,342.84 | $10,277.12 | $81,884.00 | $125,945.15 | $44,061.15 | ||||||

| Nashville, TN | $9,240.96 | $10,165.06 | $81,884.00 | $124,571.76 | $42,687.76 | ||||||

| Jackson, MS | $9,020.16 | $9,922.18 | $81,884.00 | $121,595.29 | $39,711.29 | ||||||

| Hartford, CT | $8,985.72 | $9,884.29 | $81,884.00 | $121,131.03 | $39,247.03 | ||||||

| Louisville, KY | $8,905.32 | $9,795.85 | $81,884.00 | $120,047.21 | $38,163.21 | ||||||

| Philadelphia, PA | $8,778.60 | $9,656.46 | $81,884.00 | $118,338.97 | $36,454.97 | ||||||

| Trenton, NJ | $8,770.68 | $9,647.75 | $81,884.00 | $118,232.21 | $36,348.21 | ||||||

| Chesapeake, VA | $8,724.84 | $9,597.32 | $81,884.00 | $117,614.26 | $35,730.26 | ||||||

| Tampa, FL | $8,270.64 | $9,097.70 | $81,884.00 | $111,491.47 | $29,607.47 | ||||||

| Miami, FL | $7,921.68 | $8,713.85 | $81,884.00 | $106,787.35 | $24,903.35 | ||||||

| West Palm Beach, FL | $7,834.68 | $8,618.15 | $81,884.00 | $105,614.56 | $23,730.56 | ||||||

| Kansas City, MO | $7,806.00 | $8,586.60 | $81,884.00 | $105,227.94 | $23,343.94 | ||||||

| Chicago, IL | $7,779.12 | $8,557.03 | $81,884.00 | $104,865.59 | $22,981.59 | ||||||

| Little Rock, AR | $7,662.00 | $8,428.20 | $81,884.00 | $103,286.76 | $21,402.76 | ||||||

| Indianapolis, IN | $7,607.64 | $8,368.40 | $81,884.00 | $102,553.97 | $20,669.97 | ||||||

| Austin, TX | $7,377.12 | $8,114.83 | $81,884.00 | $99,446.47 | $17,562.47 | ||||||

| Atlanta, GA | $7,351.80 | $8,086.98 | $81,884.00 | $99,105.15 | $17,221.15 | ||||||

| Denver, CO | $7,321.20 | $8,053.32 | $81,884.00 | $98,692.65 | $16,808.65 | ||||||

| Washington, DC | $7,254.24 | $7,979.66 | $81,884.00 | $97,790.00 | $15,906.00 | ||||||

| Baltimore, MD | $7,251.12 | $7,976.23 | $81,884.00 | $97,747.94 | $15,863.94 | ||||||

| Columbus, OH | $7,063.08 | $7,769.39 | $81,884.00 | $95,213.09 | $13,329.09 | ||||||

| San Francisco, CA | $7,034.88 | $7,738.37 | $81,884.00 | $94,832.94 | $12,948.94 | ||||||

| Houston, TX | $6,993.24 | $7,692.56 | $81,884.00 | $94,271.62 | $12,387.62 | ||||||

| St. Louis, MO | $6,972.96 | $7,670.26 | $81,884.00 | $93,998.24 | $12,114.24 | ||||||

| Sacramento, CA | $6,904.92 | $7,595.41 | $81,884.00 | $93,081.03 | $11,197.03 | ||||||

| Dallas, TX | $6,858.72 | $7,544.59 | $81,884.00 | $92,458.24 | $10,574.24 | ||||||

| Portland, OR | $6,768.00 | $7,444.80 | $81,884.00 | $91,235.29 | $9,351.29 | ||||||

| Santa Monica, CA | $6,662.76 | $7,329.04 | $81,884.00 | $89,816.62 | $7,932.62 | ||||||

| Des Moines, IA | $6,641.64 | $7,305.80 | $81,884.00 | $89,531.91 | $7,647.91 | ||||||

| Salt Lake City, UT | $6,595.44 | $7,254.98 | $81,884.00 | $88,909.12 | $7,025.12 | ||||||

| Cleveland, OH | $6,516.72 | $7,168.39 | $81,884.00 | $87,847.94 | $5,963.94 | ||||||

| Seattle, WA | $6,415.08 | $7,056.59 | $81,884.00 | $86,477.79 | $4,593.79 | ||||||

| Olympia, WA | $6,415.08 | $7,056.59 | $81,884.00 | $86,477.79 | $4,593.79 | ||||||

| Las Vegas, NV | $6,251.16 | $6,876.28 | $81,884.00 | $84,268.09 | $2,384.09 | ||||||

| Grand Rapids, MI | $6,127.80 | $6,740.58 | $81,884.00 | $82,605.15 | $721.15 | ||||||

| 50 City Average | $8,221.08 | $9,043.18 | $81,884.00 | $110,823.32 | $28,939.32 | ||||||

Refer to the appendix prepared by eHealth providing additional context including median age, household size, and income for each of the cities surveyed in this report.

Methodology

eHealth prepared the present analysis by surveying 2017 premiums for the lowest-cost ACA-compliant plan available in fifty cities and/or metropolitan areas. Rates were gathered through the federally-run health insurance exchange Healthcare.gov, with the exceptions of New York, New York (gathered from the New York state exchange) and the following cities located in states not served by Healthcare.gov where rates were gathered from plans offered through eHealth.com: Hartford, CT; Washington, DC; Baltimore, MD, Denver, CO, Santa Monica, San Francisco and Sacramento, CA; Seattle and Olympia, WA.

The rates quoted in eHealth’s analysis are for family groups of three in which two adults are aged 35 years. Premium projections for 2018 are calculated as a ten percent increase over 2017. This uniform ten percent projected increase is simply an assumption used for this analysis and is not intended to imply that all plans will uniformly increase at the same rate or to reflect the actual rate increase for any specific plan in any market or for any aggregated set of plans. Each plan in each market will have its own actual rate increase (or, possibly in some cases, decrease) for 2018. It should be noted that rates may in some cases vary from zip code to zip code within the same metropolitan area or state and that less costly plans may be available in some cases to consumers who do not utilize the health insurance exchanges and marketplaces noted above. In addition, this analysis does not attempt to predict legislative, regulatory, or other changes that may affect the actual 2018 rates for plans.

In determining the subsidy threshold – the point at which government subsidies are no longer available to persons purchasing qualifying health plans – eHealth employed federal poverty level guidelines for 2017. Subsidies may be available to persons with a household income of up to 400% of the federal poverty level; as such, eHealth’s described “subsidy threshold” is calculated at 401% of the federal poverty level for 2017. The “affordability threshold” is calculated as the annual household income level at which eHealth’s 2018 premium projections attain to 8.16% of household income. This is the point at which the lowest-priced available plan is considered unaffordable under the rules of the Affordable Care Act for 2017.

About eHealth

eHealth, Inc. (NASDAQ:EHTH) owns eHealth.com, a leading private online health insurance exchange where individuals, families and small businesses can compare health insurance products from brand-name insurers side by side and purchase and enroll in coverage online and over the phone. eHealth offers thousands of individual, family and small business health plans underwritten by many of the nation's leading health insurance companies. eHealth (through its subsidiaries) is licensed to sell health insurance in all 50 states and the District of Columbia. eHealth also offers educational resources, exceptional telephonic support, and powerful online and pharmacy-based tools to help Medicare beneficiaries navigate Medicare health insurance options, choose the right plan and enroll in select plans online or over the phone through Medicare.com (www.Medicare.com), eHealthMedicare.com (www.eHealthMedicare.com) and PlanPrescriber.com (www.PlanPrescriber.com).

For more health insurance news and information, visit eHealth's Consumer Resource Center.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170926005576/en/

Contacts:

Sande Drew, 916-207-7674

sande.drew@ehealth.com

or

eHealth,

Inc.

Nate Purpura, 650-210-3115

nate.purpura@ehealth.com