According to a new study, published today by Moody’s Analytics, Visa and Equifax rapidly rising asset prices such as stock and house values have been a significant source of support to consumer spending during the current economic expansion. The impact on consumer spending of changes in household wealth is known as the “wealth effect” and it has important implications for the U.S. economy.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180321005224/en/

Mark Zandi, Moody's Analytics Chief Economist: "Continued sturdy consumer spending is critical to the ongoing strength of the U.S. economic expansion, and this study shows that the wealth effect is critical to the consumer." (Graphic: Business Wire)

In this paper, “Weighing the Wealth Effect”, Moody’s Analytics economists quantify the wealth effect based on unique anonymized consumer sales data from Visa and data on household stock and financial asset holdings from Equifax.

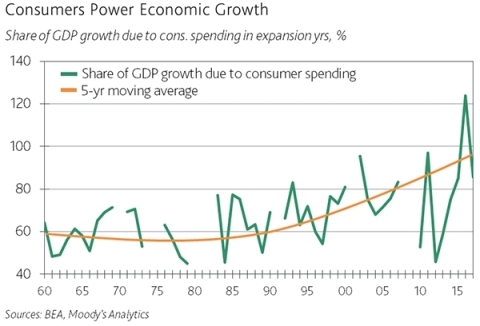

We estimate that the wealth effect on total consumer spending is 4.5 cents - for every $1 change in household wealth, consumer spending ultimately changes by 4.5 cents. Despite the recent correction in the stock market, close to a quarter of the growth in consumer spending during the current economic expansion since 2009, and more than one-third of the spending over the past year, is due to the wealth effect.

This effect has translated to a meaningful contribution to annual GDP growth. Real GDP has expanded at close to a 2.2% per year pace during the eight years of the economic recovery since 2009. Without the positive wealth effect, real GDP growth during this period would have been just 1.7% per annum.

“Continued sturdy consumer spending is critical to the ongoing strength of the U.S. economic expansion, and this study shows that the wealth effect is critical to the consumer,” said Mark Zandi, Moody’s Analytics Chief Economist. “The wealth effect is powerful, and rapidly declining stock or house prices could overwhelm the positives now driving consumer spending. A correction in the stock market as the Federal Reserve normalizes monetary policy could change consumer behavior and limit further economic growth.”

“These findings are a valuable take-away for any business observing consumer financial and spending behaviors,” said Mykolas Rambus, general manager of Data-driven Marketing at Equifax. “This Moody’s Analytics study of the wealth effect demonstrates the real power of household wealth in affecting consumer spending behavior. We know wealth matters―this tells us just how much.”

About Moody’s Analytics

Moody’s Analytics provides financial intelligence and analytical tools supporting our clients’ growth, efficiency and risk management objectives. The combination of our unparalleled expertise in risk, expansive information resources, and innovative application of technology helps today’s business leaders confidently navigate an evolving marketplace. We are recognized for our industry-leading solutions, comprising research, data, software and professional services, assembled to deliver a seamless customer experience. Thousands of organizations worldwide have made us their trusted partner because of our uncompromising commitment to quality, client service, and integrity.

Moody's Analytics is a subsidiary of Moody's Corporation (NYSE:MCO). MCO reported revenue of $4.2 billion in 2017, employs approximately 11,900 people worldwide and maintains a presence in 41 countries. Further information about Moody’s Analytics is available at www.moodysanalytics.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20180321005224/en/

Contacts:

Katerina Soumilova, 212-553-1177

Assistant

Vice-President

katerina.soumilova@moodys.com

moodysanalytics.com

twitter.com/moodysanalytics

linkedin.com/company/moody’s-analytics