Barclays today released a new Impact Series study, entitled Increased corporate concentration and the influence of market power, which analyzes whether decreased competition is threatening the US economy or whether competitive pressures remain sufficiently strong to benefit industries, investors and consumers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190326005591/en/

(Graphic: Business Wire)

To facilitate the analysis, Barclays constructed a new methodology to measure competitiveness: the Barclays Competitiveness Indicator (BCI). The BCI was created using principal components analysis, a widely employed statistical tool that identifies a small number of uncorrelated factors that help explain movements in a larger set of data. Leveraging the BCI, the report examines which of the commonly cited explanations for market concentration, market power or winner-take-all, is the dominant influence on the aggregate US economy and in select sectors today. The “market power” narrative assumes conditions with less competition and negative influences like price manipulation and wage suppression, while the “winner-take-all” narrative assumes more benign conditions in which the most productive firms capture market share and drive positive outcomes like heightened price competition and greater efficiency.

“Investors and economists have long grappled with how to measure an industry’s competitive landscape. To address this challenge, we leveraged our leading data science capabilities to create the new Barclays Competitiveness Indicator,” said Jeff Meli, Global Head of Research at Barclays. “When applied to a given sector, the BCI not only provides a new measure of competitiveness, but also helps assess the effect of concentration on economies. This report is one example of how Barclays’ investment in data science enables us to deliver differentiated insights to our clients.”

The key findings of the report include:

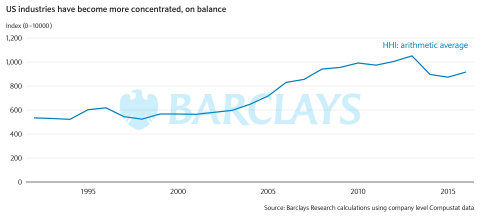

- Market concentration is increasing in the US on aggregate and within most markets. Such concentration is consistent with both the market power and winner-take-all narratives.

- However, we see declines in US market competitiveness as the dominant dynamic.

- US business dynamism, labor’s share of income and capital growth have all decreased since 2000. All three of these factors are consistent with intensifying market power, while only the decline in labor’s share of income is consistent with winner-take-all.

- Market power poses binary risks for equity markets. Although further intensification would help boost market valuations and profits, it would also raise risks of governmental action to limit this power, with associated fallout on equity prices in the short run.

- Increased regulation is likely as evidence of market power grows, including more scrutiny of mergers and acquisitions, more stringent rules against market abuse and incentives to encourage competition.

- Although such policies may have the desired effect, past experience highlights the risk that common approaches can backfire by further entrenching the position of dominant firms.

- Remedies need to be targeted at industries where market power is elevated, not just where concentration is high and large firms are aggregating share. For example, both Retail and Media have experienced rising concentration. However, our BCI indicates that competition in Retail appears healthy, whereas Media is more likely to be experiencing reduced competition.

For more information or to view the full report and executive summary infographic, please click here.

About Barclays’ Social Innovation Facility

The Barclays Social Innovation Facility is a catalyst for the development of innovative products and services that deliver both an ongoing commercial return and a sustained social impact. It was launched in 2012 and is a key part of the firm’s Shared Growth Ambition. The Impact Series is designed to explore the social impact of economic, demographic and disruptive changes affecting markets, sectors and society at large.

About Barclays

Barclays is a transatlantic consumer and wholesale bank offering products and services across personal, corporate and investment banking, credit cards and wealth management, with a strong presence in our two home markets of the UK and the US.

With over 325 years of history and expertise in banking, Barclays operates in over 40 countries and employs approximately 83,500 people. Barclays moves, lends, invests and protects money for customers and clients worldwide.

For further information about Barclays, please visit our website home.barclays

View source version on businesswire.com: https://www.businesswire.com/news/home/20190326005591/en/

Contacts:

+1 212 526 5963

danielle.popper@barclays.com