Things have gone from bad to worse for a stumbling smartphone market in 2020. Already plateauing and decline figures have taken a big hit from COVID-19. The pandemic has hampered sales of non-essential items, particularly those best enjoyed outside of the home. According to new figures from Canalys, smartphone shipments are set to experience a 10.7% decline for the year.

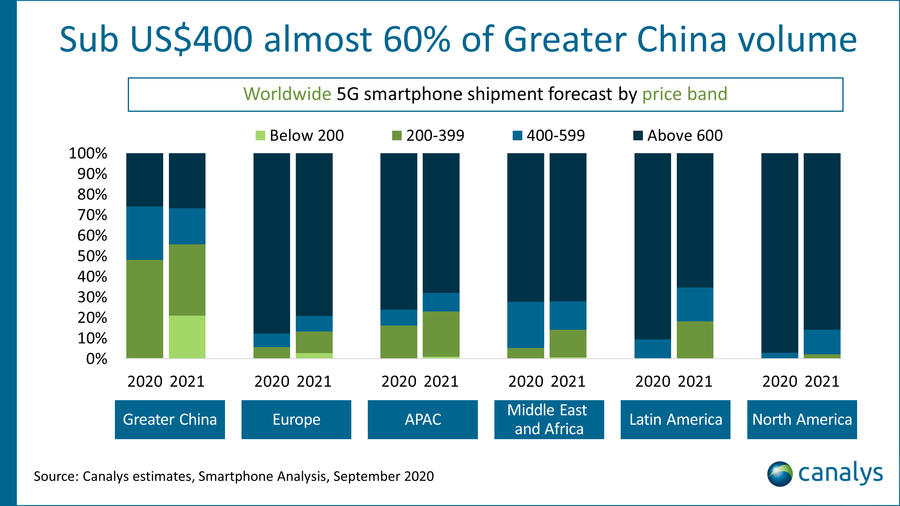

There are a couple of silver linings worth noting. For starters, 5G adoption continues to growth. The firm projects that some 280 million units will be shipped in 2020, with the Greater China market making up a majority at 62% of the total figure, thanks in part to lower cost devices like the Realme V3, which retails for less than $150 U.S. — a remarkable price for a product with next-gen wireless.

Image Credits: Canalys

North America is in second place, with around 15% of shipments, while EMEA and Asia Pacific (sans Greater China) are projected to each make up around 11%. A 5G-enabled iPhone 12 should help speed up adoption as well, when it’s launched in the next month or so.

“Smartphone vendors have relentlessly pushed new product launches, as well as online marketing and sales during the post-lockdown period, generating strong consumer interest for the latest gadgets,” analyst Ben Stanton says in a release. “Gradual reopening of offline stores, improving logistics and production have provided necessary uplift for most markets to move into a more stabilized second half of 2020.”

5G was expected to have a rebounding effect for the industry — though the pandemic quickly hampered those plans. Likely it has gone a ways toward helping prohibit a further slide in sales. And numbers are still expected to rebound somewhat in the 2021, at 9.9% year over year. That’s not quite enough to return things to pre-2020 levels, but would no doubt be a welcome sign for an industry that has shown signs of decline for some time now.