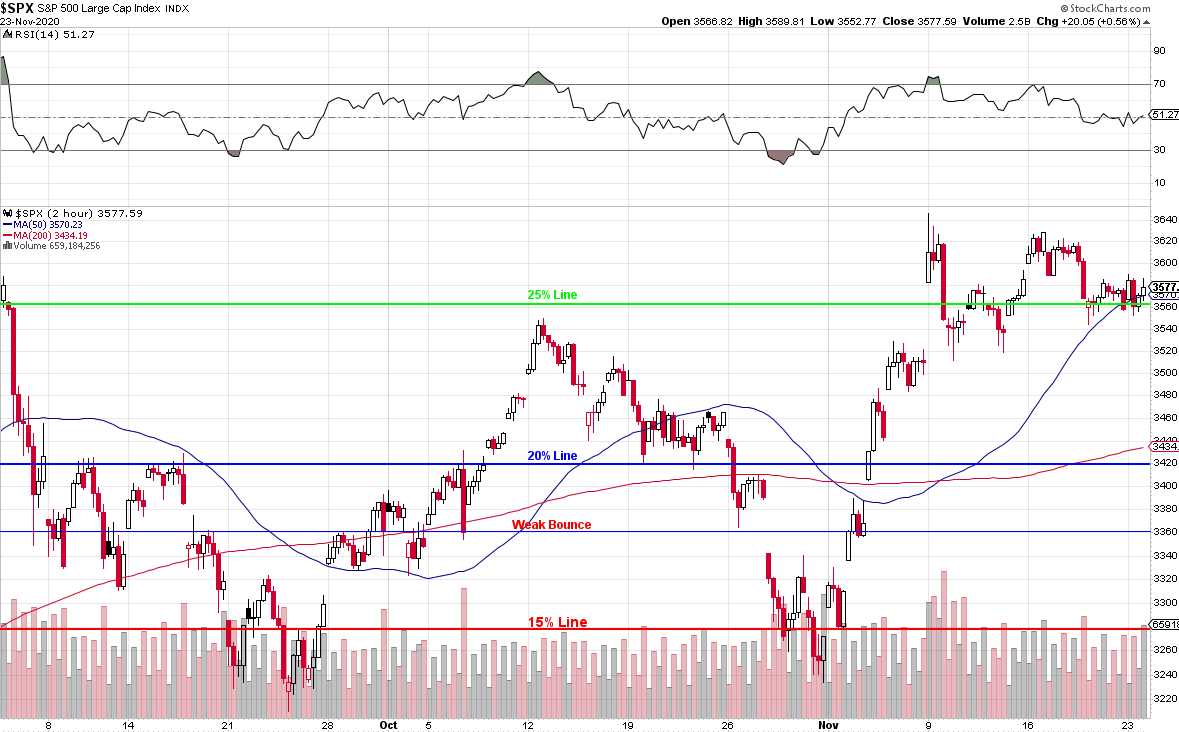

This is a strong-looking chart:

The S&P 500 is clearly consolidating ABOVE the 3,600 line at this point and, if we hold it into the end of the year, that will bode very well for next year. Nonetheless, we're still shorting the S&P (/ES) Futures if they dip back below the 3,600 line (now 3,602) with tight stops above simply because it's a very positive risk/reward play as we can stop out at, for example, 3,602.50 with a $125 loss but, just yesterday, /ES was down at 3,550, which would have been a $2,500 gain. When you can win $2,500 and risk $125, you only have to be right once in a while to do very well.

Yes there is going to be a vaccine, I would say by May, things should be getting back to normal but they aren't normal now and they won't be normal for Christmas so I really don't see how Q4 GDP will be any good and Q1 not so great either. So it's another sub-par year for the first half, at least and, even if there is not a coup, Biden will not be likely to run up $6Tn in debt – as Trump did this year. Biden is also very likely to raise taxes on the wealthy (over $400,000 in income) and wealthy Corporations – doesn't that impact their bottom-line earnings?

Biden is likely to move us towards a stronger Dollar and that too, is not great for stocks and Biden wants stronger wages – not good for the bottom line. That's why Chipotle (CMG) is one of my favorite shorts – higher wages hit them hard, as will reality if it ever rears its ugly head and notices that CMG is trading at over 150 TIMES their annual earnings.

$1,300 per share is a $36Bn valuation for a company whose best year was a profit of $475M – and that was back in 2015! Since then, $22M (when they poisoned their customers), $176M, $176M and $350M last year. Even if they get back to $500M ($164M in the first 3 quarters of 2020) – they'd still be at an insane 72x earnings for a restaurant that is near its saturation point. Labor…