Here we are again.

Here we are again.

Back on May 3rd, our self-explanatory headline for the Morning Report was: "Monday Market Movement – Dow 34,000, S&P 4,200, Nasdaq 13,900 – Again" and, this morning, we're at 34,346, 4,169 and 13,385 respectively. The Dow is up 1%, S&P flat and the Nasdaq is down 3.7% respectively. The Dollars those indexes are priced in, however, have lost 1.5% of their buying power during the same two weeks as our currency is teetering on the cliff of the May lows.

This is the stealthy way the market can take your money when you don't realize it – especially in an inflationary environment - so we need to keep on our toes. For example, I could have traded a $32 shares of AT&T (T) for 10 gallons of Gasoline (/RB) on May 3rd but now I'd be lucky to get 9 gallons for the same share. I would have needed 55 shares of T to trade for an ounce of gold at $1,760 but now I need 58.33 shares at $1,867.

You can delude yourself that your portfolio hasn't lost any money but losing buying power is the same thing.

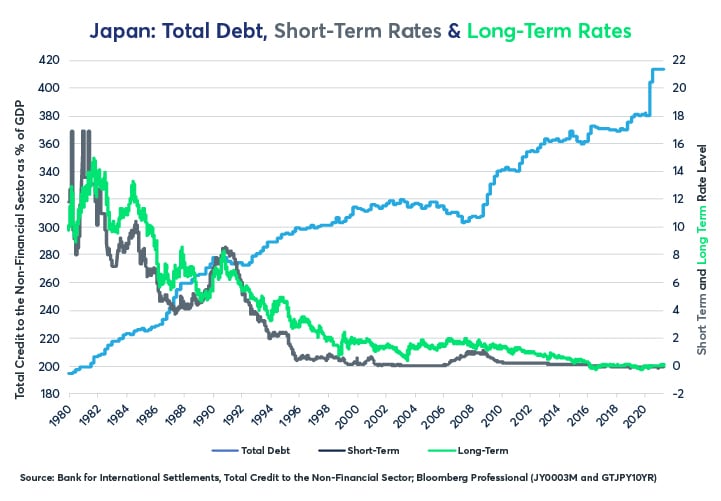

Japan's unstimulated (in Q1) GDP fell 5.1% and that's very likely where we'd be without $2Tn being added to ours in March. Japan is the World's 3rd largest economy at $5Tn but they are the king of debt at $13.5Tn, which is 270% of their GDP after adding 20% last year alone. As long as people are still willing to lend Japan money, I'm not too worried about the US as our own $28,000,000,0000,000 in debt, which is "only" 140% of our own GDP. Japan will be our canary in the Debt coal mine but take that warning seriously when it does come.

Japan's unstimulated (in Q1) GDP fell 5.1% and that's very likely where we'd be without $2Tn being added to ours in March. Japan is the World's 3rd largest economy at $5Tn but they are the king of debt at $13.5Tn, which is 270% of their GDP after adding 20% last year alone. As long as people are still willing to lend Japan money, I'm not too worried about the US as our own $28,000,000,0000,000 in debt, which is "only" 140% of our own GDP. Japan will be our canary in the Debt coal mine but take that warning seriously when it does come.

Of course, the reality Japan does have to face is that they can't really afford to add more stimulus as they get dangerously close to the 300% mark in debt to GDP (and already past it in Total Debt) and only the fact that they are getting away with paying 0% on their bonds is keeping that island nation afloat on their sea of debt. Imagine if they paid 5% interest on…