While Biden's away.

While Biden's away.

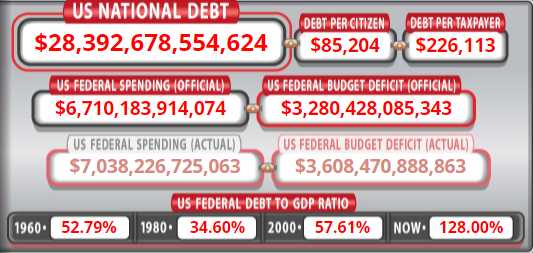

A bipartisan group of 10 Senators have agreed to $579Bn in additional spending (from the Republican's first offer) over 8 years and, rather than raise taxes to pay for it, they have played with the numbers enough to show no tax hikes are necessary – even though we are currently running a $3.6Tn deficit by spending $7Tn and only collecting $3.4Tn (Corporations are paying $231Bn). This is not a problem that's going to fix itself.

$3.6Tn is close to 20% of our GDP and we're already 128% of our GDP in debt and the solution is not to raise taxes – even though the markets and jobs and inflation data are indicating tremendous economic strength. If we can't raise taxes now, when can we ever? And, if we can't ever raise taxes, then the debt will simply keep growing until it's completely out of control and wrecks the economy – that seems to be our current plan.

$1.2Tn is still $500Bn below Biden's proposed $1.7Tn. The proposal is limited to core physical infrastructure and omits the social programs such as elderly care Biden included in his “American Jobs Plan.” There is also the possibility of a gasoline tax, which is a tax the Republicans don't mind as it disproportionately taxes poor people. But the White House has made it clear to lawmakers that such a measure, as well as any discussion about an electric vehicle mileage tax, would violate Biden’s red line of not raising taxes on Americans who earn under $400,000 a year, and cannot be part of any package,

The current Federal Gasoline Tax is 0.184/gallon and hasn't changed since 1993, when gas was $1. We use about 125Bn gallons of gas so we're talking $23Bn and adding 0.368 (proportional) would bring in $46Bn of additional revenue – still nowhere near enough but at least we didn't ask Jeff Bezos to chip in – that would have been a catastrophe, right? Jeff is leaving the planet next month – so he won't be subject to US taxes anyway.

IN PROGRESS