What a market!

What a market!

I know it's hard to talk about hedging when the market is doing so well but that's the lesson of Joseph and the Pharoh from the Bible – you have to prepare for the bad times DURING the good times or you get screwed. As a rule of thumb, we like to put 25-33% of our unrealized portfolio gains into our hedges in order to lock them in against a downturn. If we do our jobs well, we get out of our longs ahead of a correction and ride the shorts down to even more profits – that's been working well for us for the past two years.

At PSW, our two main portfolios are our Long-Term and Short-Term Portfolios (LTP and STP) and, very simply, the STP has our hedges as well as fun short-term plays while the LTP is generally full of bullish plays. We started with $500,000 in the LTP and $100,000 in the STP back in October of 2019 – after cashing out our previous set with a $2M balance (up 233%) that September. Now we're back over 2M again and it's very tempting to just cash out but the market has been so strong – and our long positions are so good – we don't have a good enough reason to sell yet. So we hedge….

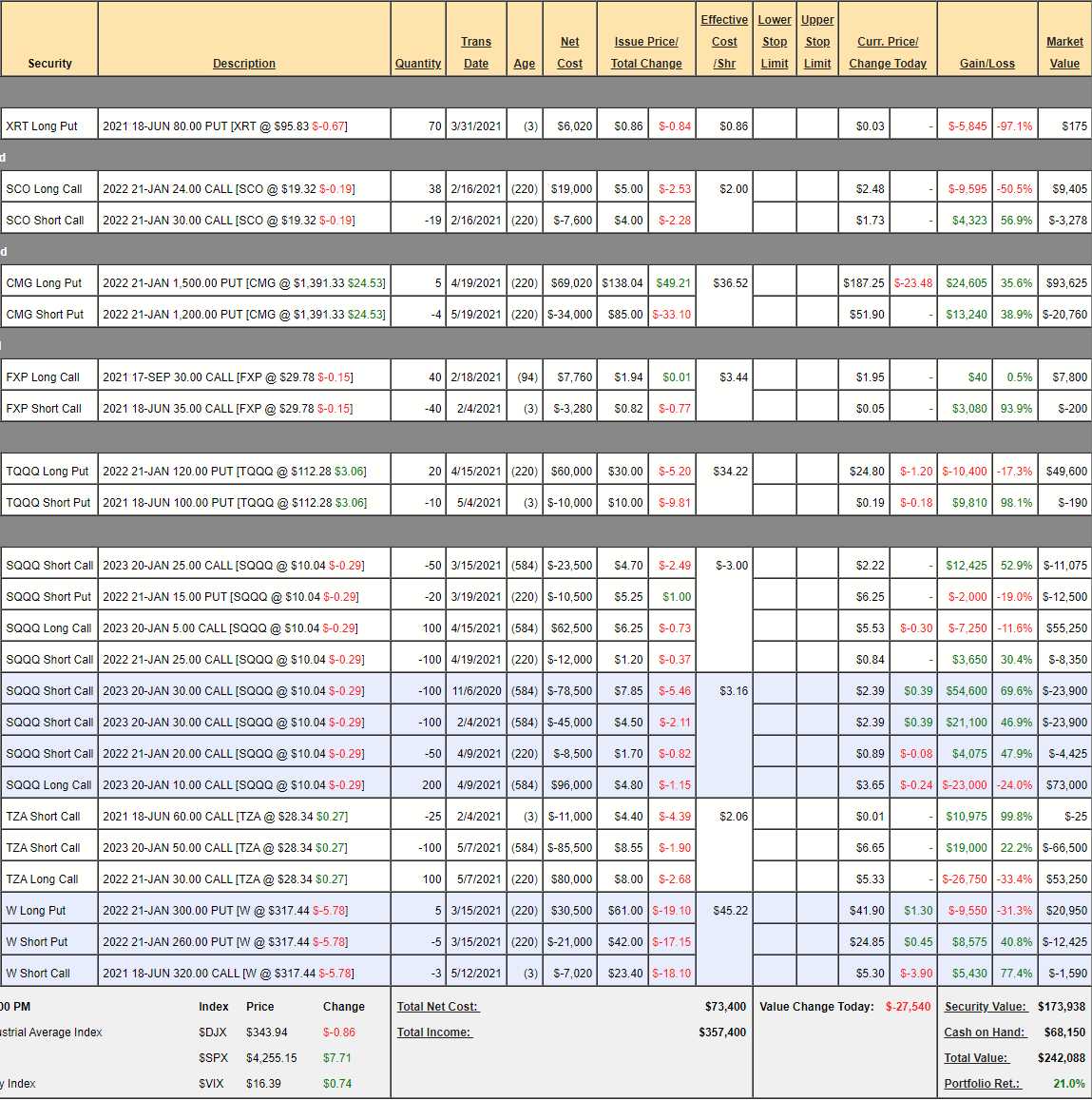

Our last STP Review was May 14th and our STP was up 40% at $281,128 (we had added $100,000 from the LTP when the STP was down to $50,000 after the big rally last year) and, as of yesterday's close, we're up 21% at $242,088, so we've lost $39,040 this month but the combined balance with the LTP is positive – and that's what we care about. We're hedged pretty much to neutral – not really trusting what I believe is a toppy market.

We made 4 changes to the STP last month and we felt adequately hedged and we also added a lot of LTP positions to shift a bit more bullish – but nothing too crazy.

- XRT – Our short play on retail did not work out – total loss.

- SCO – They