With 45 million Americans contributing to the $1.6 trillion in student loan debt in the U.S.,1 the impact felt by education expenses is widespread, especially when it comes to long-term financial planning. According to a new survey conducted by The Harris Poll on behalf of TD Ameritrade, education spending is the No. 1 financial disruptor among Americans. One bright spot for financially disrupted Americans — those who have experienced an event or situation that had a negative effect on their financial plans for the long-term or retirement — is that they feel more prepared in 2019 than five years ago.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200206005098/en/

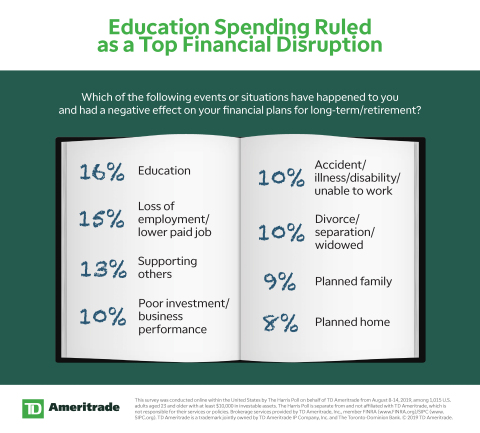

Education Spending Ruled as a Top Financial Disruption (Graphic: TD Ameritrade)

“Today, many young Americans are struggling to save for the future while paying off their past,” said Tom Butch, managing director of retail distribution at TD Ameritrade. “Between paying down student loans, contributing to retirement and saving for their children’s college, they are striking a delicate balance to set themselves on a path to long-term financial security.”

Financial disruptions: cause and effect

Education spending is the leading financial disruptor among Americans in 2019, and of the surveyed disruptors, it’s also the only one to experience growth in the last five years. In 2014, loss of employment and poor investment/business performance significantly outstripped education as sources of disruption.

“The cost of education has risen proportionally as a source of disruption, as low unemployment and strong market performance seem to have blunted what were the greatest concerns five years ago,” Butch said.

- Financial disruption causes, ranked:

1. | Education for self and/or dependent family members (e.g., student debt): 16% | |||

2. | Loss of employment/lower paid job: 15% | |||

3. | Supporting others financially: 13% | |||

4. | Poor investment/business performance: 10% | |||

5. | Accident/illness/disability/unable to work: 10% | |||

6. | Divorce/separation/widowed: 10% | |||

7. | Planned family: 9% | |||

8. | Planned home: 8% |

- Millennials are the most financially disrupted generation — they’re the most likely to experience financial disruptions across nearly every category.

- Supporting others financially is by far the most financially impactful disruption, resulting in 80% lower median monthly savings/investments.

The financially disrupted: then (2014) and now (2019)

-

Financially disrupted Americans feel more prepared for a financial disruption in 2019 than five years ago:

- 48% in 2019 had a steady, reliable income vs. 40% in 2014

- 45% in 2019 had money/savings put aside “for a rainy day” vs. 33% in 2014

- 25% in 2019 had to stop saving/investing for the long-term/retirement vs. 38% in 2014

- 20% in 2019 had to withdraw money from their retirement savings in 2019 vs. 26% in 2014

-

However, more than half of disrupted Americans (56%) are still behind on their long-term financial goals.

- Financial consequences of disruptions are lasting 33% longer than five years ago, on average (in 2019, Americans noted that disruptions lasted six years and three months vs. four years and eight months in 2014)

The threats ahead

- Looking to the future, Americans most fear increased cost of living (47%) and healthcare (44%) as threats to their financial security and long-term investing.

-

Millennials consider increased cost of living as the No. 1 threat (44%) to their financial security and long-term investing.

- Gen X (49%) and boomers (51%) worry more about the increased cost of healthcare.

- Millennials are the most concerned about job loss due to automation (19% vs. 14% of Gen X and 6% of boomers).

About TD Ameritrade Holding Corporation

TD Ameritrade provides investing services and education to approximately 12 million client accounts totaling approximately $1.4 trillion in assets, and custodial services to more than 7,000 registered investment advisors. We are a leader in U.S. retail trading, executing an average of approximately 1 million trades per day for our clients, more than a quarter of which come from mobile devices. We have a proud history of innovation, dating back to our start in 1975, and today our team of nearly 10,000-strong is committed to carrying it forward. Together, we are leveraging the latest in cutting edge technologies and one-on-one client care to transform lives, and investing, for the better. Learn more by visiting TD Ameritrade’s newsroom at www.amtd.com, or read our stories at Fresh Accounts. Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org)

Source: TD Ameritrade Holding Corporation

About The Harris Poll

The Harris Poll is one of the longest-running surveys in the U.S., tracking public opinion, motivations and social sentiment since 1963. It is now part of Harris Insights & Analytics, a global consulting and market research firm that strives to reveal the authentic values of modern society to inspire leaders to create a better tomorrow. We work with clients in three primary areas; building twenty-first-century corporate reputation, crafting brand strategy and performance tracking, and earning organic media through public relations research. Our mission is to provide insights and advisory to help leaders make the best decisions possible. TD Ameritrade is separate from and not affiliated with the Harris Poll, and is not responsible for their services or policies.

Survey Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of TD Ameritrade from August 8 to 14, 2019, among 1,015 U.S. adults aged 23 and older with at least $10,000 in investable assets. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. The survey includes: millennials (ages 23-38), Gen X (ages 39-54) and boomers (ages 55-73). The survey also includes: financially disrupted (n=536). Financially disrupted are defined as those who have experienced an event or situation that had a negative effect on their financial plans for the long/term retirement.

1 https://www.federalreserve.gov/releases/g19/HIST/cc_hist_memo_levels.html

View source version on businesswire.com: https://www.businesswire.com/news/home/20200206005098/en/

Contacts:

Tim Osiecki, 201-369-5908

Corporate Communications

timothy.osiecki@tdameritrade.com

@TDAmeritradePR