Santa Clara, Calif.-based NVIDIA Corporation (NVDA) is a leading semiconductor and networking solutions firm located in the United States. The company operates in two segments: Graphics; and Computing and Networking. Its products are used in gaming devices, data centers, and automobiles.

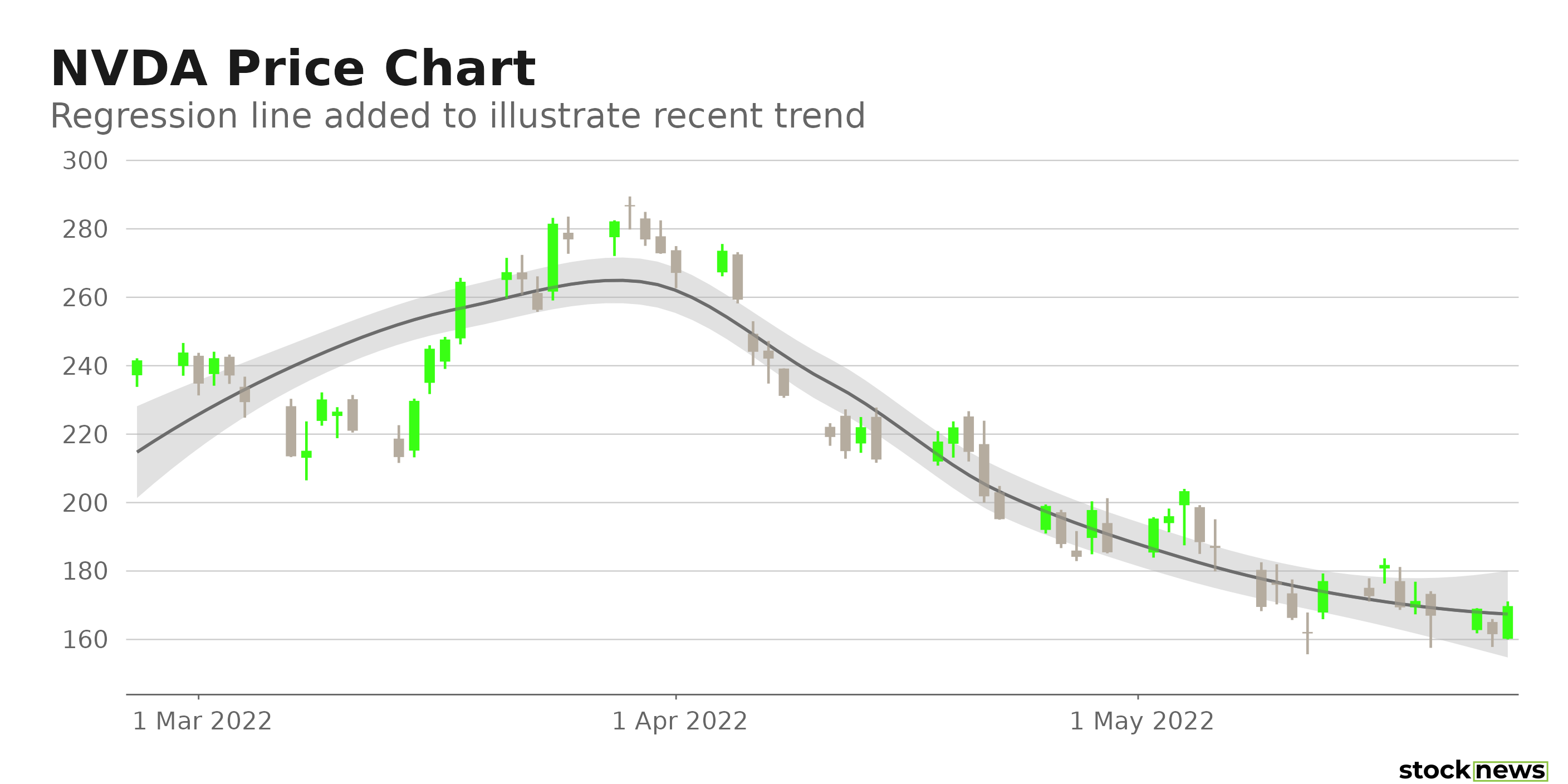

While the company's shares are up 8.5% in price over the past year, the stock is down 42.3% year-to-date, closing yesterday's trading session at $169.75. In addition, the stock was down nearly 5.5% in late trading yesterday after the chipmaker issued a softer-than-expected outlook for the July quarter. The company blamed diminished revenue in Russia and COVID-19-related production shutdowns in China.

NVDA's revenue has increased 46% year-over-year to $8.29 billion in the third quarter, ended May 1, 2023. This significant growth was driven by an 83% rise in data center sales to $3.75 billion and a 31% increase in gaming revenue to $3.62 billion. Its non-GAAP operating income increased 55% from the prior-year quarter to $3.96 million. In turn, its adjusted EPS climbed 49% to $1.36.

Click here to checkout our Semiconductor Industry Report for 2022

Here is what could shape NVDA's performance in the near term:

Impressive Growth Prospects

The Street expects NVDA's revenues and EPS to rise 29.1% and 26.4%, respectively, year-over-year to $34.74 billion and $5.61 in fiscal 2022. In addition, NVDA's EPS is expected to rise at a 24.6% CAGR over the next five years. Furthermore, the company has an impressive earnings surprise history; it topped the Street’s EPS estimates in each of the trailing four quarters.

Premium Valuation

In terms of forward Non-GAAP P/E, the stock is currently trading at 28.68x, which is 60.9% higher than the 17.83x industry average. Also, its 11.92x forward EV/Sales is 327.7% higher than the 2.79x industry average. And NVDA's 10.83x forward Price/Book is 188.3% higher than the 3.76x industry average.

Consensus Rating and Price Target Indicate Potential Upside

Among the 27 Wall Street analysts that rated NVDA, 22 rated it Buy, and five rated it Hold. The 12-month median price target of $305.08 indicates a 79.7% potential upside. The price targets range from a low of $190.00 to a high of $410.00.

POWR Ratings Reflect Uncertainty

NVDA has an overall C rating, which equates to a Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. NVDA has a D grade for Stability and Value. Its 1.59 stock beta is in sync with its Stability grade. In addition, the company's higher-than-industry valuation is consistent with the Value grade.

Among the 95 stocks in the B-rated Semiconductor – Wireless Chip industry, NVDA is ranked #63.

Beyond what I have stated above, one can view NVDA ratings for Growth, Quality, Momentum, and Sentiment here.

Bottom Line

Given the high demand for semiconductors, NVDA is expected to grow significantly in the coming years. However, the company’s weak growth outlook and the Fed's hawkish stance may limit its growth in the near term. Furthermore, if adverse market trends continue, NVDA shares may retreat even further. So, given the company's premium valuation compared to its peers, we believe investors should wait before scooping up its shares.

How Does NVIDIA Corporation (NVDA) Stack Up Against its Peers?

While NVDA has an overall C rating, one might want to consider its industry peer, United Microelectronics Corp. (UMC), Cirrus Logic Inc. (CRUS), and Photronics Inc. (PLAB), which has an overall A (Strong Buy) rating.

Click here to checkout our Semiconductor Industry Report for 2022

NVDA shares fell $6.57 (-3.87%) in premarket trading Thursday. Year-to-date, NVDA has declined -42.27%, versus a -16.08% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post NVIDIA: Buy, Sell, or Hold? appeared first on StockNews.com