(BPT) - Are you on track for retirement? New research shows many women are not, and what's more, women are lagging significantly behind men when it comes to being financially prepared for the future.

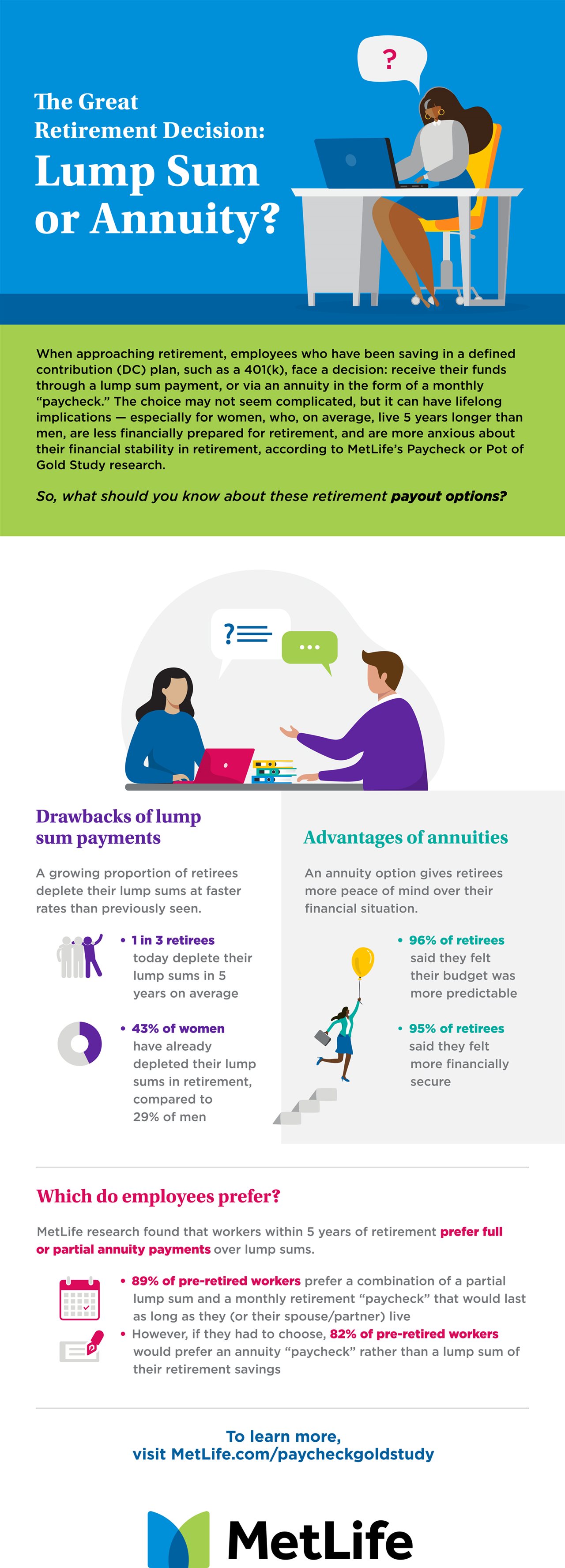

According to MetLife's 'Paycheck or Pot of Gold Study' women have suffered a more significant blow to their retirement due to the pandemic, leaving them increasingly concerned about their ability to maintain financial stability. In the MetLife study, nearly six in 10 women (58%) said the pandemic has impacted their retirement - whereas only 46% of men felt the same. Furthermore, 35% of women (versus 28% of men) believe they will have to ultimately delay their retirement, as a result.

Add to that the gender wage gap, existing debt and soaring inflation, and it's no wonder women are feeling so financially behind. The study also found that women are nearly twice as likely to have cut their spending due to concerns about running out of money in retirement (74% of women compared to 43% of men).

If you're a woman concerned about maintaining financial stability in retirement, these strategies can help:

1. Prioritize saving for retirement

The key to a secure retirement? Plan ahead - particularly when it comes to your retirement savings. MetLife's research found that women were more likely than men to overestimate how long their retirement savings will last (57% for women versus 43% for men).

Even when saving seems difficult, start small and then, each month when you can, gradually increase the amount you stash away. Doing so will give your money more time to grow. Remember, when it comes to saving, it's never too late to start but it's always better to start early.

2. Learn about your employer's offerings

An important step many people preparing for retirement may skip is taking stock of all that their employer has to offer.

If your employer offers a retirement savings defined contribution (DC) plan such as a 401(k), sign up right away and contribute as much as you can. If your employer matches a percentage of your savings, consider matching or exceeding that percentage to take full advantage of that benefit. Over time, compound interest and tax deferrals will make a big difference in the total amount you can accumulate.

However, you don't know what you don't know - so be sure to ask your HR department about how you can best maximize your employer's offerings.

3. Consider retirement income solutions as a distribution option

Make sure that you fully understand all the tools and solutions available through your employer - and ask questions if you don't. For example, you may have access to retirement income solutions as a distribution option for your defined contribution plan at retirement. This can include offerings such as institutional income annuities, which provide a guaranteed monthly "paycheck" in retirement.

Compared to receiving your retirement savings as a lump sum at the point of retirement, annuity payments can offer more successful retirement outcomes, and according to the MetLife study, may be a better option for women, as more women retirees (43%) than men (29%) have already depleted their lump sums in retirement - and have done so more quickly. It took, on average, 4.5 years for women compared to 5.6 years for men to deplete the lump sum they took from their DC plan. Among those who took lump sum payments, more women believe they would have been better off financially if they'd had the option to convert part or all of the DC plan account balance into an annuity (62% of women versus 47% of men).

Overall, it's best never to underestimate how much money you'll need in retirement - or overestimate how long that money will last. Be sure to speak with your employer's HR department to learn about your company's retirement benefits and start getting proactive about how you'll make your retirement savings last.

To see the full study, visit MetLife.com.