( click to enlarge )

( click to enlarge )Net Element International Inc (NASDAQ:NETE) had a good move on Friday. The stock broke and closed above the 50-day EMA for the first time since Nov2014 on expanding volume. It was the second heaviest volume this year. The stock could touch an upside target of $1.95/2 in the short term. The technical daily chart shows the stock is now back to uptrend and with MACD crossing to the upside we may see more upside. The ADX is also indicating a strong bullish outlook with +DI on top of -DI. Friday’s high was $1.31, which is resistance for the follow through move on Tuesday. If we see follow-through tomorrow it might run hard. Next major resistance lies at $1.56. Folks, always keep a trailing stop loss to book profits in case to exit any reversal in the trend. Technically speaking, the stock is now painting a short-term Bullish picture.

( click to enlarge )

( click to enlarge )USA Technologies, Inc.(NASDAQ:USAT) caught my eye last month when price broke out of a solid looking chart pattern near 1.90/share and have been watching patiently ever since. The stock is currently breaking out of a base formation and the probability is that it will move up sharply in the next sessions. As I said on twitter i bought shares on Friday and I will add more shares on a move above $2.23.

( click to enlarge )

( click to enlarge )Shares of Groupon Inc (NASDAQ:GRPN) were on fire Friday after the company released its financial report. At this level, the stock might retest its recent highs located at $8.43. Momentum indicators are slightly bullish now with RSI inching away above the middle level. The strongest sign of a bullish momentum is the MACD indicator which is currently above the 0 line. Watching for $8.43 breakout. This momentum could push this stock much higher from here, so keep the stock on your radar for Tuesday’s trading day. The support level is adjusted to $7.28

( click to enlarge )

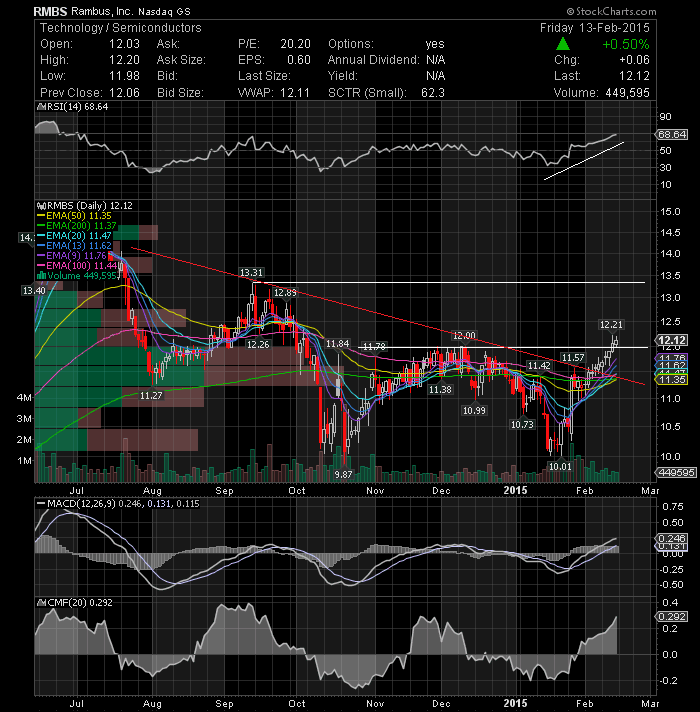

( click to enlarge )Rambus Inc. (NASDAQ:RMBS) has been is on a remarkable run this month and it does not look like the trend will change soon. As you can see on daily chart, last week the stock finally broke the $12 level again, confirming the break of the downtrend (Red line) early this month. The chart looks Bullish, with both 50-day EMA and 100-day EMA turning up and MACD on top of 0. I would like to see more volume in this rally, but keep the stock on watch on Tuesday nonetheless. As long as the stock stays above all major EMAs, the stock is exhibiting strength.

( click to enlarge )

( click to enlarge )The hottest stock of the market right now is Genetic Technologies Limited (NASDAQ:GENE), look at this daily chart Wow just amazing. The stock broke out again on Friday, rallying more than 30% on heavy volume, closing the session at 8.04 well below the highs made in early morning trading. I'm a bit concerned after looking at the chart. The stock is making new highs in this new uptrend while the A/D line is forming a negative divergence. If it reverses next week, you should use tight stops on your long position. This could get ugly on a breakdown below $7. In addition, the stock is very overbought on RSI14 (85). I have no positions here.

( click to enlarge )

( click to enlarge )The daily MACD generated a buy signal last week, so keep an eye on CytRx Corporation (NASDAQ:CYTR) for a possible breakout over $3.09.

( click to enlarge )

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) has been basing around its 200EMA in the last trading sessions but indicators are starting to put in positive divergences. The stock made a nice move on volume Friday. I see stock on verge of breaking up out of this compression.

Attention everyone! Use this weekend to take a look at these excellent offers. Don't miss this chance at getting some of the best products out there, recommended by myself. You better hurry up! This will end soon.

Four Free 14-Day Trials to make my readers happy !!

Options Trading Alerts - Trading options is one of the best ways to maximize profits and minimize risk. Join Dr. Thomas Carr in his Options Portfolio that performed 45.01% v. S&P 9.94% in 2014.

Get Macro Trading Alerts - Ron Insana one of the Top 100 Business News Journalists of the 20th Century. Keep up with the market's fastest moving trends. Join Ron Insana in his Macro Portfolio up +5.67%.

Get an Edge on Biotech Stocks - The biotech sector is home to some of the market's fastest-growing stocks. Join Biotech Technician, Christian Tharp in his Biotech Portfolio that performed +21.76% v. S&P +11.81% in 2014.

Swing Trading Alerts - Get insider tips and see live trading alerts every day. Join expert, Serge Berger, in his portfolio that performed +21.07% v. 11.81% S&P in 2014.

Enjoy !!!

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC