How many times have we seen this?

How many times have we seen this?

Low volume rallies followed by big volume sell-offs are the norm in an end-stage bubble as institutional investors do their best to reel in retailers to "hold their bags" for them as the institutions run for the exits.

Seeing how fast the market falls as soon as the volume picks up should be sobering but the music is still playing and we've trained those dip-buyers like Pavlov's dog and they can't resist a chance to throw their cash at anything that's cheaper than it was yesterday which, today, is 80% of NYSE, which had a very broad sell-off on double the volume of the previous two bullish sessions.

Remember how I was a stick in the mud all last week saying "don't buy, don't buy, don't buy"? This is the day I get to say "I told you so" but that's OK because we're going to bounce in the morning and all the bulls can make fun of me again but it's only the bounce we predicted in our Live Member Chat Room at 11:28 yesterday when I called the bottom and laid our our expected Futures bounce levels at:

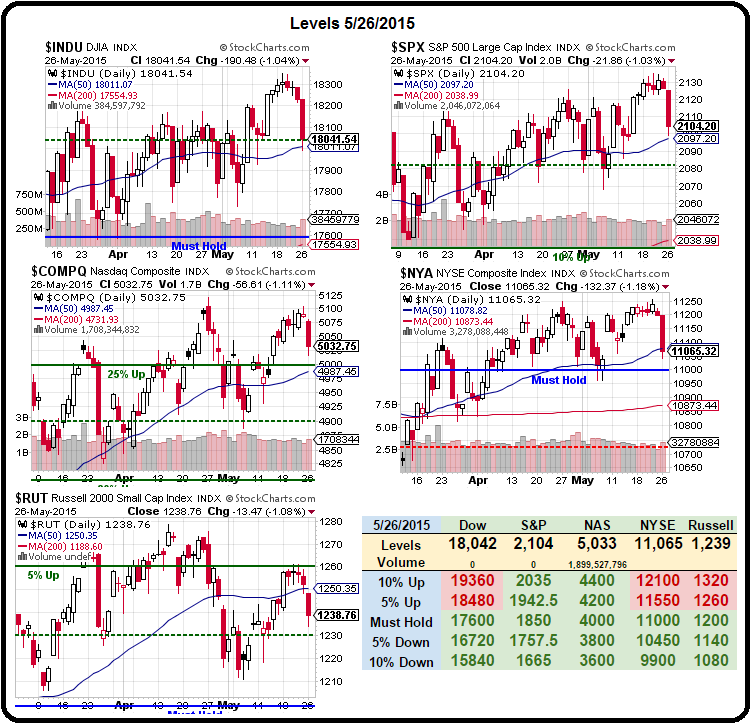

- Dow (/YM) 18,050 (weak) and 18,100 (strong)

- S&P (/ES) 2,104 (weak) and 2,108 (strong)

- Nasdaq (/NQ) 4,473 (weak) and 4,481 (strong)

- Russell (/TF) 1,235 (weak) and 1,240 (strong)

There was great money to be made, of course, playing those bottoms and, in our Live Trading Webinar at 1pm, we found some laggards to play as well and we even added another bullish play to our Long-Term Portfolio because, even in a correcting market, there are still values to be had if you know where to look (and thanks to Jim for suggesting that one!).

We didn't need to find any short trades as we locked those in on the way up last week and our Member Portfolios are very well-balanced for this correction so far. We did lean a bit more bearish last week so we'll do better on a 5% move down than a move back up and, so far, after these bounces play out, that's still what we'll…