The coronavirus is wrecking the travel industry. TSA data shows that the number of people traveling through airports is down 70% from the same time last year. And this figure has significantly improved from the lowest levels of late-March to mid-April. The weakness of the travel industry is also apparent in the stock charts of hotels, casinos, airlines, or cruise operators which are 50-70% lower than their 52-week highs.

However, one segment of the industry is booming. Despite the coronavirus, people still have the urge to take vacations and explore new places. Therefore, companies that allow for social distancing, outdoor recreation, and other types of low-risk activities are thriving. Given that many experts predict another second wave in the fall and that the first wave hasn’t even fully receded, these stocks could keep moving higher the rest of the year.

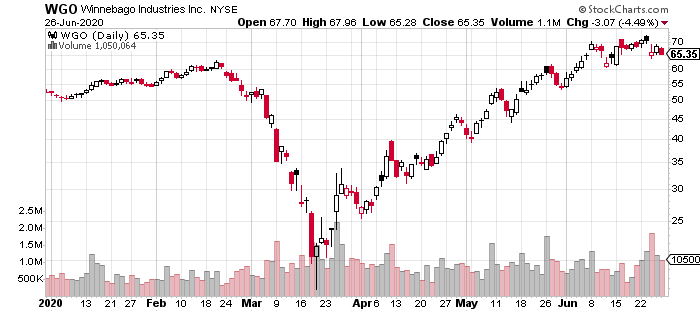

Winnebago (WGO)

WGO makes and sells recreation vehicles. It hit a new, all-time high earlier this month and is currently 4% off these levels. The stock has seen a surge in buying and inquiries with a huge jump in pre-orders.

(source: stockcharts.com)

Taking an RV trip is one of the safest ways for people to travel during the coronavirus epidemic with the least exposure risk. Its recent earnings results showed that the company has struggled to meet this surge in demand, especially with production shutdowns. However, its sales backlog for its RVs increased by nearly 100%, and production has come back with the company increasing the number of shifts to meet the jump in demand.

The POWR Ratings for WGO also confirm this narrative. It has an overall rating of “A”. Its Trade Grade, Buy and Hold Grade, and Peer Grade are all an “A”, while its Industry Rank is a “B”. It’s ranked #4 among the Auto and Vehicle Manufacturer group.

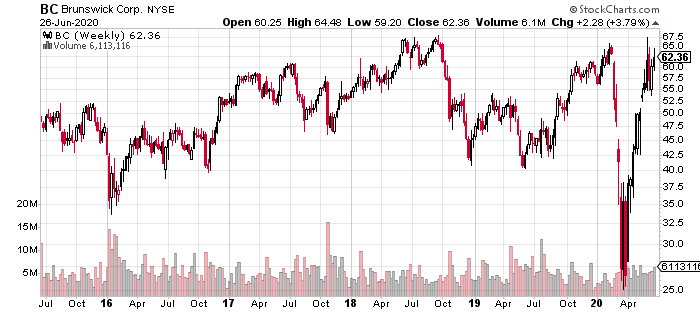

Brunswick Corporation (BC)

BC is the best pure-play stock for boating. Its stock has also experienced a major rebound off its March lows with more than a 100% gain. The stock has retraced its coronavirus crash and is just 10% off its all-time high from October 2018.

(source: stockcharts.com)

Like RVs, boating is a perfect recreational activity for the current climate. It allows for social distancing while staying outdoors. It’s likely to be an activity of choice during the summer and fall months for many families.

Its stock is at October 2018 levels, however, over that period, BC has made acquisitions in the boating space to grow its market share and monetization opportunities with Power Products, a leading manufacturer of electrical components and parts for boats.

Another acquisition was Freedom Boat Club, which gives members fractional ownership in boats and has approximately 20,000 members in North America. Boat clubs will likely see a surge in interest as well which feeds into more sales for BC. They also promote boating and boat activities for younger people who may not be in a position to buy a boat but could do so in the future.

Boating is a cyclical industry that’s typically connected to the economic cycle. However, the coronavirus is a unique catalyst which is resulting in a secular shift towards boating. Even when things normalize, demand for boating will likely be higher than previous levels due to some new enthusiasts. Due to these developments in the short-term, BC will also get more pricing power over its products which will translate into higher earnings.

The POWR Ratings for Brunswick are consistent with its improving fundamentals. Its stock is rated a “Strong Buy” with an “A” rating. It also has an “A” rating In all categories across the board – Trade Grade, Buy & Hold Grade, Peer Grade, and Industry Rank.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Top 3 Investing Strategies for the Year Ahead

7 “Safe-Haven” Dividend Stocks for Turbulent Times

WGO shares were unchanged in after-hours trading Friday. Year-to-date, WGO has gained 24.22%, versus a -5.82% rise in the benchmark S&P 500 index during the same period.

About the Author: Jamini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. As a reporter, he covered the bond market, earnings, and economic data, publishing multiple times a day to readers all over the world. Learn more about Jaimini’s background, along with links to his most recent articles.

The post 2 Travel Stocks Near All-Time Highs appeared first on StockNews.com