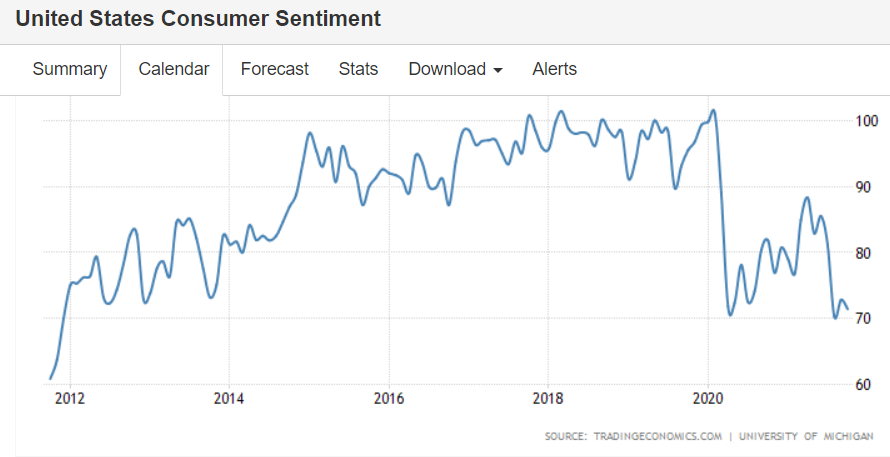

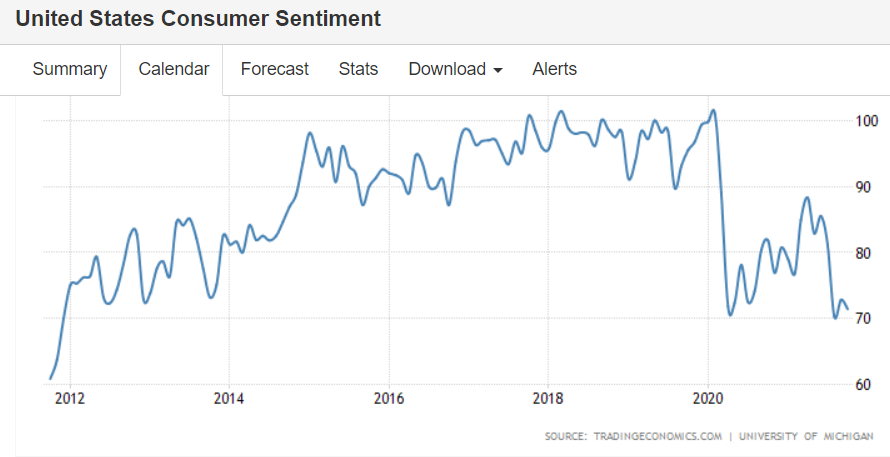

Not looking good:

Russians and Saudis now cooperating to set crude oil prices.

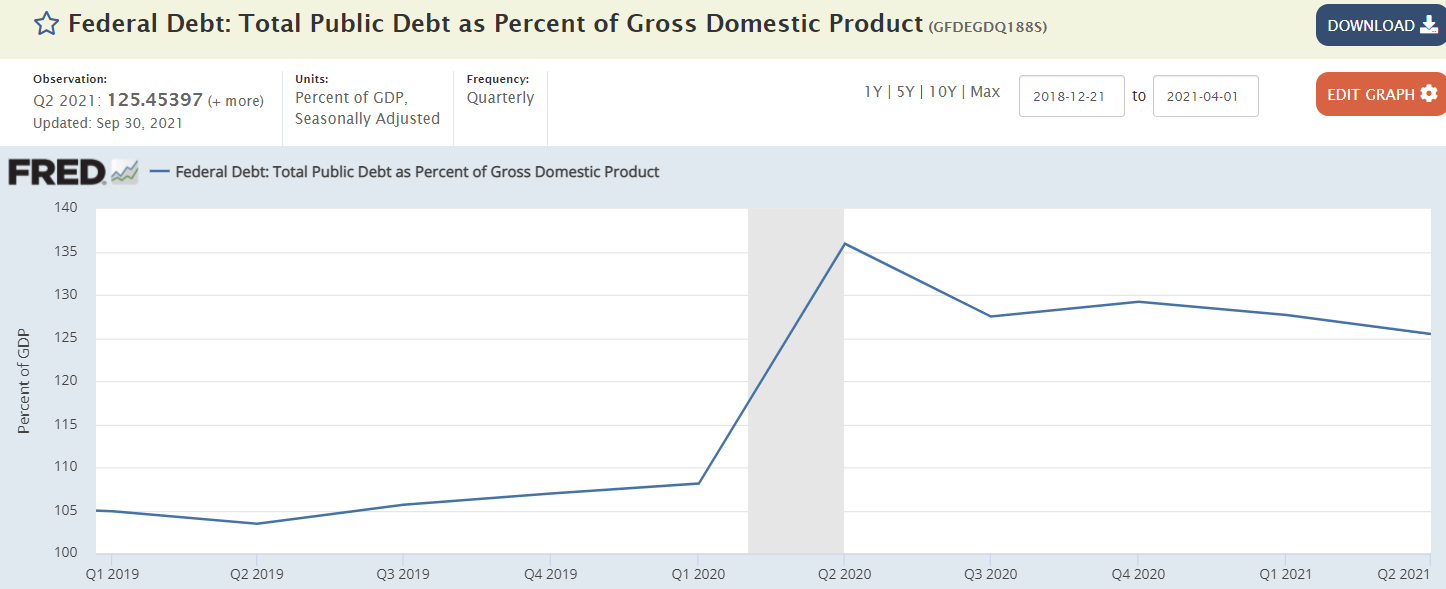

Not good:

Post covid fiscal contraction is underway and debt/gdp is forecast to fall a lot further.

Most of the Federal assistance was the likes of unemployment benefits which have

now expired and new spending programs from Congress seem to be not happening,

at least any time soon. Also, higher prices mean the inflation adjusted value of the

outstanding public debt falls which is a drag on private sector spending as agents seek

to sustain the value of their savings:

The post Consumer sentiment, oil prices, federal debt/GPD appeared first on Mosler Economics / Modern Monetary Theory.