Household products company Kimberly-Clark (NYSE: KMB) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 6% year on year to $4.84 billion. Its non-GAAP profit of $1.93 per share was 2% above analysts’ consensus estimates.

Is now the time to buy Kimberly-Clark? Find out by accessing our full research report, it’s free.

Kimberly-Clark (KMB) Q1 CY2025 Highlights:

- Revenue: $4.84 billion vs analyst estimates of $4.89 billion (6% year-on-year decline, 1% miss)

- Adjusted EPS: $1.93 vs analyst estimates of $1.89 (2% beat)

- Adjusted EBITDA: $1.02 billion vs analyst estimates of $1.04 billion (21.1% margin, 2.3% miss)

- Operating Margin: 15.9%, in line with the same quarter last year

- Free Cash Flow Margin: 2.5%, down from 4.7% in the same quarter last year

- Organic Revenue fell 1.6% year on year (6% in the same quarter last year)

- Sales Volumes were flat year on year (1% in the same quarter last year)

- Market Capitalization: $46.45 billion

"Building on the strong foundation we established in 2024, we made further progress across the three pillars of our Powering Care strategy in the first quarter of 2025," said Kimberly-Clark Chairman and CEO, Mike Hsu.

Company Overview

Originally founded as a Wisconsin paper mill in 1872, Kimberly-Clark (NYSE: KMB) is now a household products powerhouse known for personal care and tissue products.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

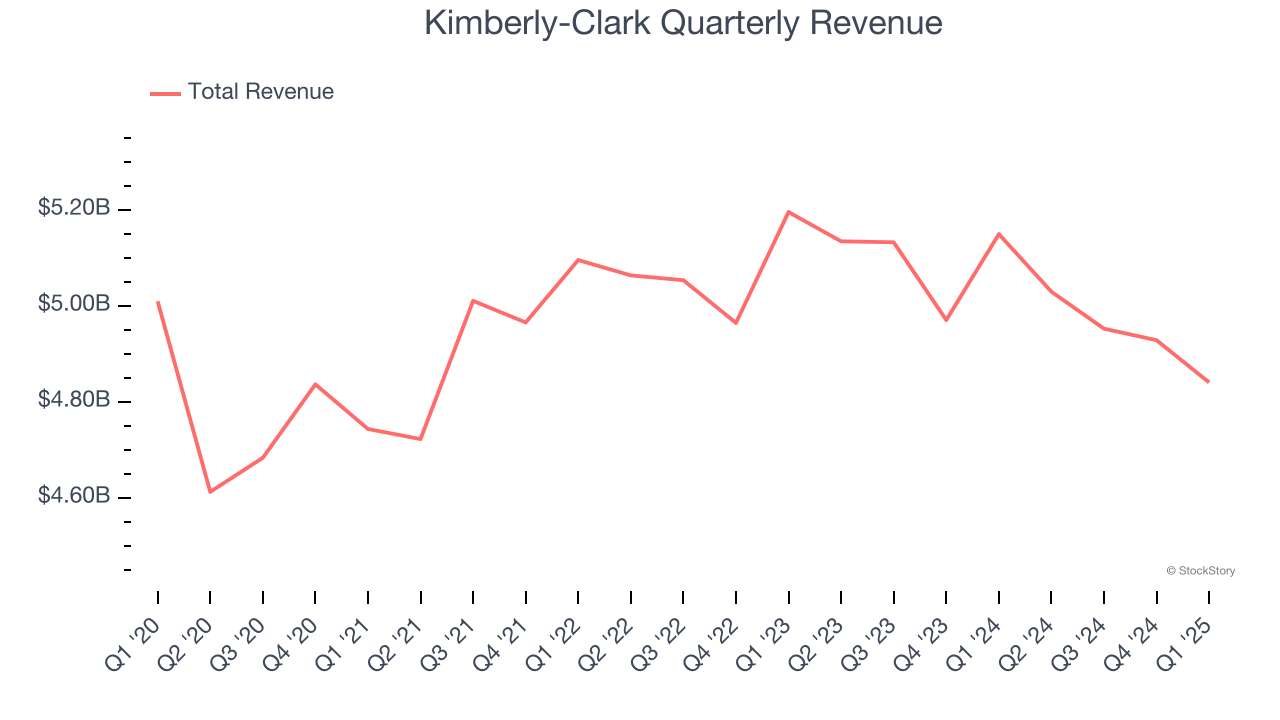

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $19.75 billion in revenue over the past 12 months, Kimberly-Clark is larger than most consumer staples companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. Its size also gives it negotiating leverage with distributors, allowing its products to reach more shelves. However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. For Kimberly-Clark to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

As you can see below, Kimberly-Clark struggled to increase demand as its $19.75 billion of sales for the trailing 12 months was close to its revenue three years ago. This is mainly because it failed to grow its volumes.

This quarter, Kimberly-Clark missed Wall Street’s estimates and reported a rather uninspiring 6% year-on-year revenue decline, generating $4.84 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and indicates its newer products will not accelerate its top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Kimberly-Clark generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, Kimberly-Clark’s quarterly sales volumes have, on average, stayed about the same. This stability is normal as the quantity demanded for consumer staples products typically doesn’t see much volatility. The company’s flat volumes also indicate its average organic revenue growth of 3.1% was generated from price increases.

In Kimberly-Clark’s Q1 2025, year on year sales volumes were flat. This result was more or less in line with its historical levels.

Key Takeaways from Kimberly-Clark’s Q1 Results

We struggled to find many positives in these results. Its organic revenue missed and its gross margin fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.3% to $135.50 immediately following the results.

Kimberly-Clark didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.