Electronic components manufacturer Knowles (NYSE: KN) reported Q1 CY2025 results exceeding the market’s revenue expectations, but sales fell by 32.7% year on year to $132.2 million. On top of that, next quarter’s revenue guidance ($140 million at the midpoint) was surprisingly good and 3.4% above what analysts were expecting. Its GAAP profit of $0.18 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Knowles? Find out by accessing our full research report, it’s free.

Knowles (KN) Q1 CY2025 Highlights:

- Revenue: $132.2 million vs analyst estimates of $128.9 million (32.7% year-on-year decline, 2.5% beat)

- EPS (GAAP): $0.18 vs analyst estimates of $0.08 (significant beat)

- Revenue Guidance for Q2 CY2025 is $140 million at the midpoint, above analyst estimates of $135.4 million

- Operating Margin: 3%, down from 4.1% in the same quarter last year

- Free Cash Flow Margin: 13.8%, up from 7.1% in the same quarter last year

- Market Capitalization: $1.3 billion

“I am pleased we completed the first quarter of 2025 with revenues at the high end of our guided range, cash provided by operating activities above our guided range, and non-GAAP diluted EPS from continuing operations at the mid-point of our guided range,” commented Jeffrey Niew, President, and CEO of Knowles.

Company Overview

With roots dating back to 1946 and a focus on components that must perform flawlessly in critical situations, Knowles (NYSE: KN) designs and manufactures specialized electronic components like high-performance capacitors, microphones, and speakers for medical technology, defense, and industrial applications.

Electronic Components & Manufacturing

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $621.9 million in revenue over the past 12 months, Knowles is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

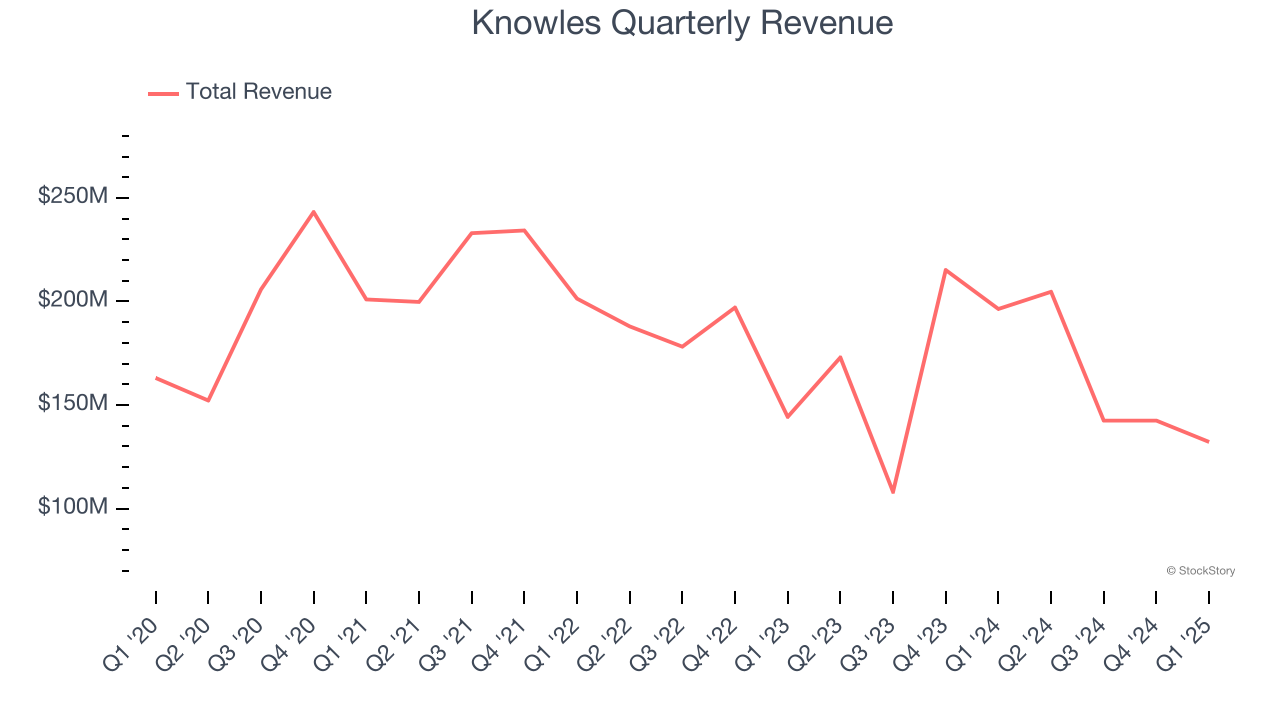

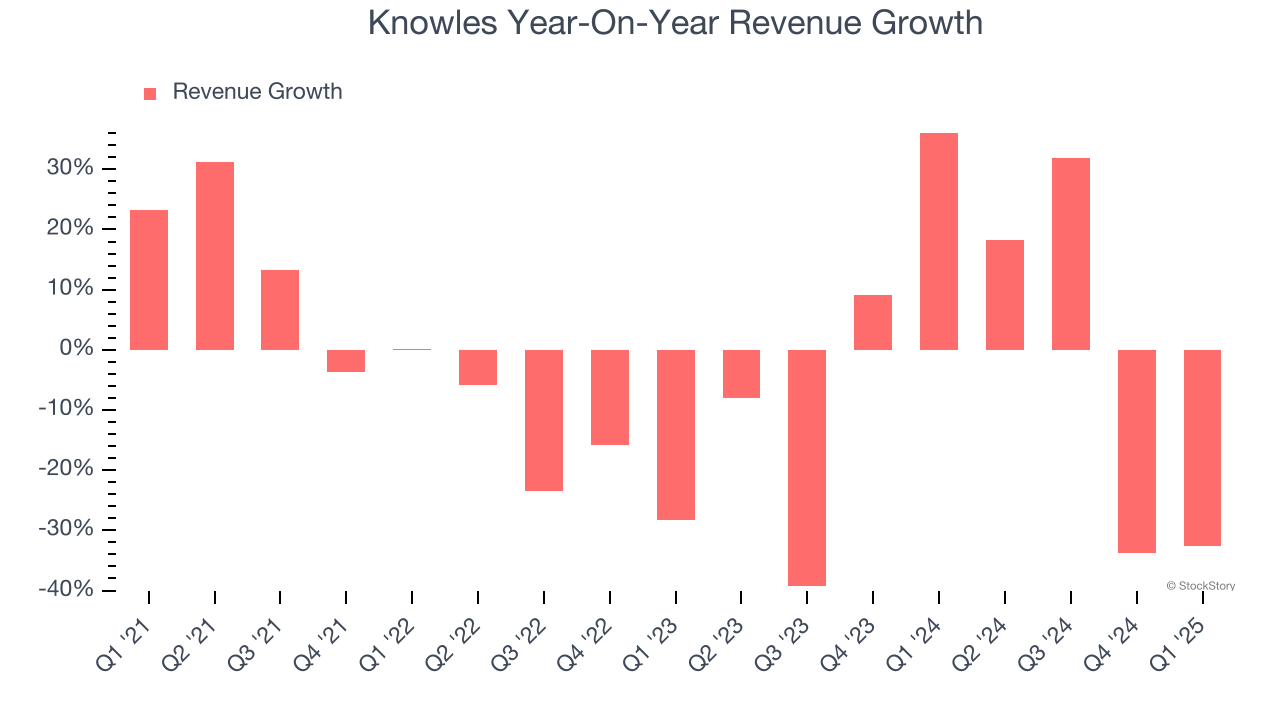

As you can see below, Knowles struggled to generate demand over the last four years. Its sales dropped by 6.2% annually, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Knowles’s annualized revenue declines of 6.3% over the last two years align with its four-year trend, suggesting its demand has consistently shrunk.

This quarter, Knowles’s revenue fell by 32.7% year on year to $132.2 million but beat Wall Street’s estimates by 2.5%. Company management is currently guiding for a 31.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 7.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

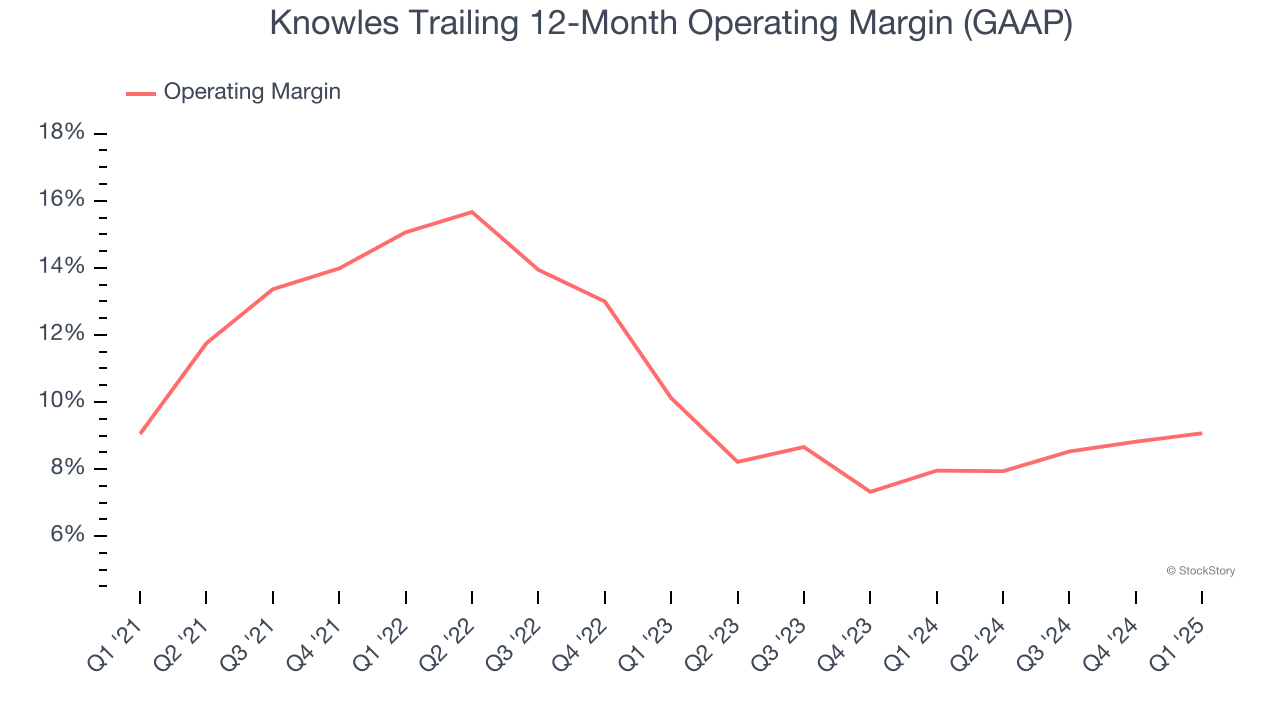

Knowles has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 10.5%, higher than the broader business services sector.

Looking at the trend in its profitability, Knowles’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. Shareholders will want to see Knowles grow its margin in the future.

This quarter, Knowles generated an operating profit margin of 3%, down 1.1 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

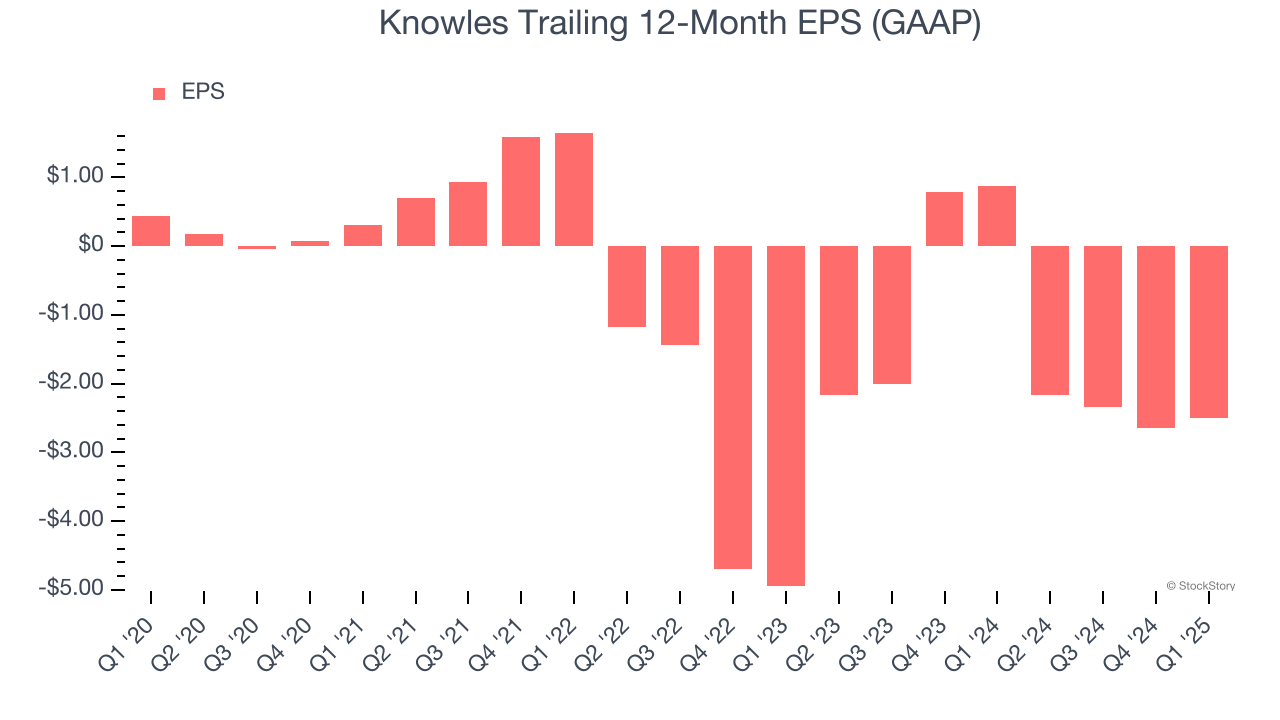

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Knowles’s full-year EPS turned negative over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Knowles’s low margin of safety could leave its stock price susceptible to large downswings.

In Q1, Knowles reported EPS at $0.18, up from $0.03 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Knowles’s full-year EPS of negative $2.50 will flip to positive $0.70.

Key Takeaways from Knowles’s Q1 Results

We were impressed by how significantly Knowles blew past analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock remained flat at $15.65 immediately after reporting.

Is Knowles an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.