Data-mining and analytics company Palantir (NYSE: PLTR) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 39.3% year on year to $883.9 million. On top of that, next quarter’s revenue guidance ($936 million at the midpoint) was surprisingly good and 4.2% above what analysts were expecting. Its non-GAAP profit of $0.13 per share was in line with analysts’ consensus estimates.

Is now the time to buy Palantir? Find out by accessing our full research report, it’s free.

Palantir (PLTR) Q1 CY2025 Highlights:

- Revenue: $883.9 million vs analyst estimates of $862.3 million (39.3% year-on-year growth, 2.5% beat)

- Adjusted EPS: $0.13 vs analyst estimates of $0.13 (in line)

- Adjusted Operating Income: $390.7 million vs analyst estimates of $361.1 million (44.2% margin, 8.2% beat)

- The company lifted its revenue guidance for the full year to $3.90 billion at the midpoint from $3.75 billion, a 3.9% increase

- Operating Margin: 19.9%, up from 12.8% in the same quarter last year

- Free Cash Flow Margin: 41.9%, down from 62.5% in the previous quarter

- Market Capitalization: $293.3 billion

“Our Rule of 40 score increased to 83% in the last quarter, once again breaking the metric. We are in the middle of a tectonic shift in the adoption of our software, particularly in the U.S. where our revenue soared 55% year-over-year, while our U.S. commercial revenue expanded 71% year-over-year in the first quarter to surpass a one-billion-dollar annual run rate,” said Alexander C. Karp, co-founder and CEO of Palantir Technologies.

Company Overview

Started by Peter Thiel after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks, Palantir (NYSE: PLTR) offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Sales Growth

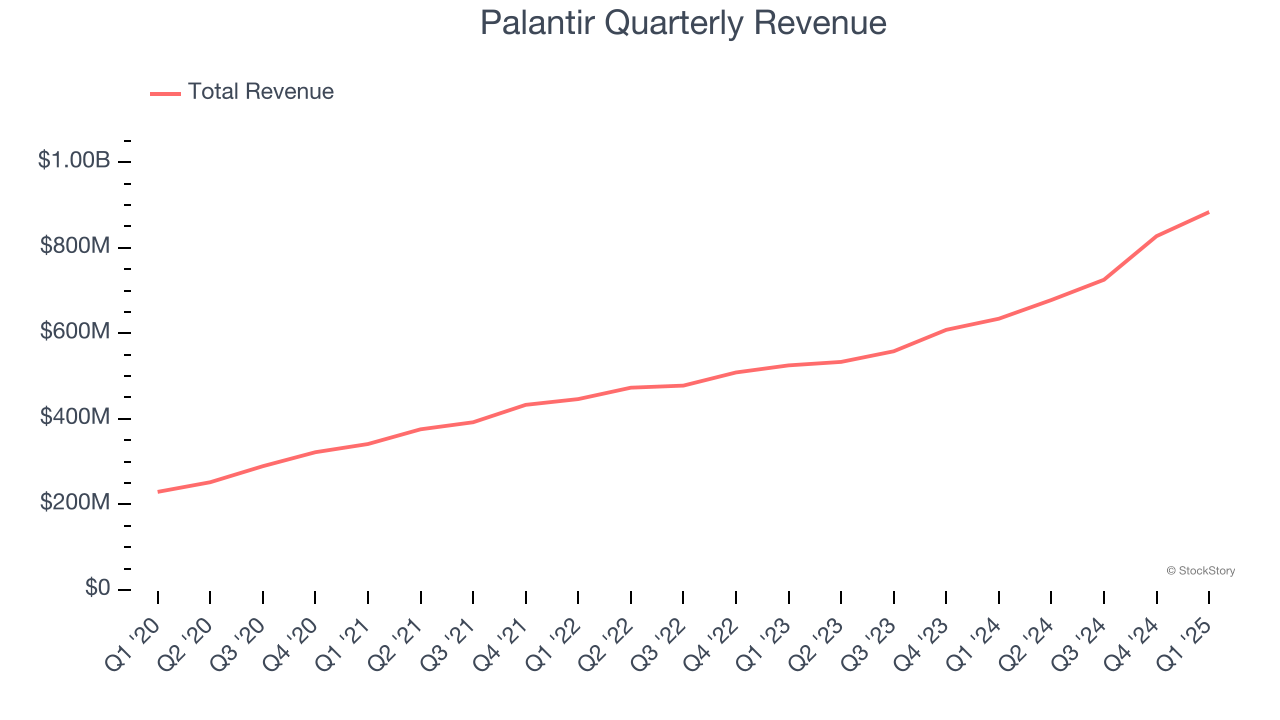

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Palantir grew its sales at a decent 23.7% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, Palantir reported wonderful year-on-year revenue growth of 39.3%, and its $883.9 million of revenue exceeded Wall Street’s estimates by 2.5%. Company management is currently guiding for a 38% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 27.5% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and indicates its newer products and services will catalyze better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Palantir is extremely efficient at acquiring new customers, and its CAC payback period checked in at 14.7 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Palantir more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Palantir’s Q1 Results

We enjoyed seeing Palantir beat analysts’ revenue and adjusted operating income expectations this quarter. We were also glad it raised its full-year revenue and adjusted operating income guidance. Zooming out, we think this was a solid print. Expectations were sky-high going into the results, however, and shares traded down 5.6% to $117.01 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.