Fluid and gas handling company MRC (NYSE: MRC) met Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 11.7% year on year to $712 million. Its GAAP loss of $0.26 per share was significantly below analysts’ consensus estimates.

Is now the time to buy MRC Global? Find out by accessing our full research report, it’s free.

MRC Global (MRC) Q1 CY2025 Highlights:

- Revenue: $712 million vs analyst estimates of $710 million (11.7% year-on-year decline, in line)

- EPS (GAAP): -$0.26 vs analyst estimates of $0.09 (significant miss)

- Adjusted EBITDA: $36 million vs analyst estimates of $35.7 million (5.1% margin, 0.8% beat)

- Operating Margin: 2.5%, down from 4.7% in the same quarter last year

- Free Cash Flow Margin: 0.7%, down from 4% in the same quarter last year

- Backlog: $603 million at quarter end

- Market Capitalization: $1.04 billion

Rob Saltiel, MRC Global’s President and CEO stated, “First quarter results were strong across all of our key metrics, consistent with our recent press release. Our business has continued to perform well into the second quarter, with our backlog as of April 30, 2025, up 13% over year-end levels, with solid gains across all three market sectors. This backlog growth, along with increasing intake levels and improving visibility on near-term project deliveries, reinforces our outlook that second quarter revenues should increase sequentially by a high-single to a low-double digit percentage.

Company Overview

Producing bomb casings and tracks for vehicles during WWII, MRC (NYSE: MRC) offers pipes, valves, and fitting products for various industries.

Sales Growth

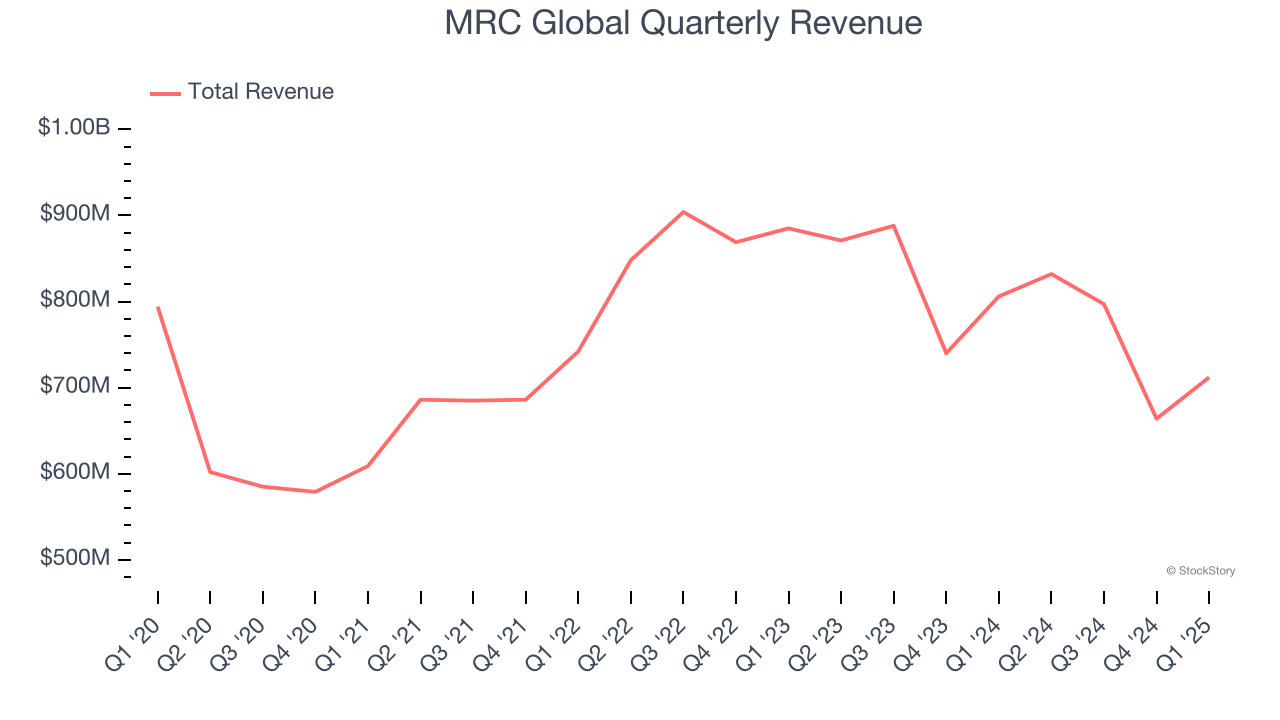

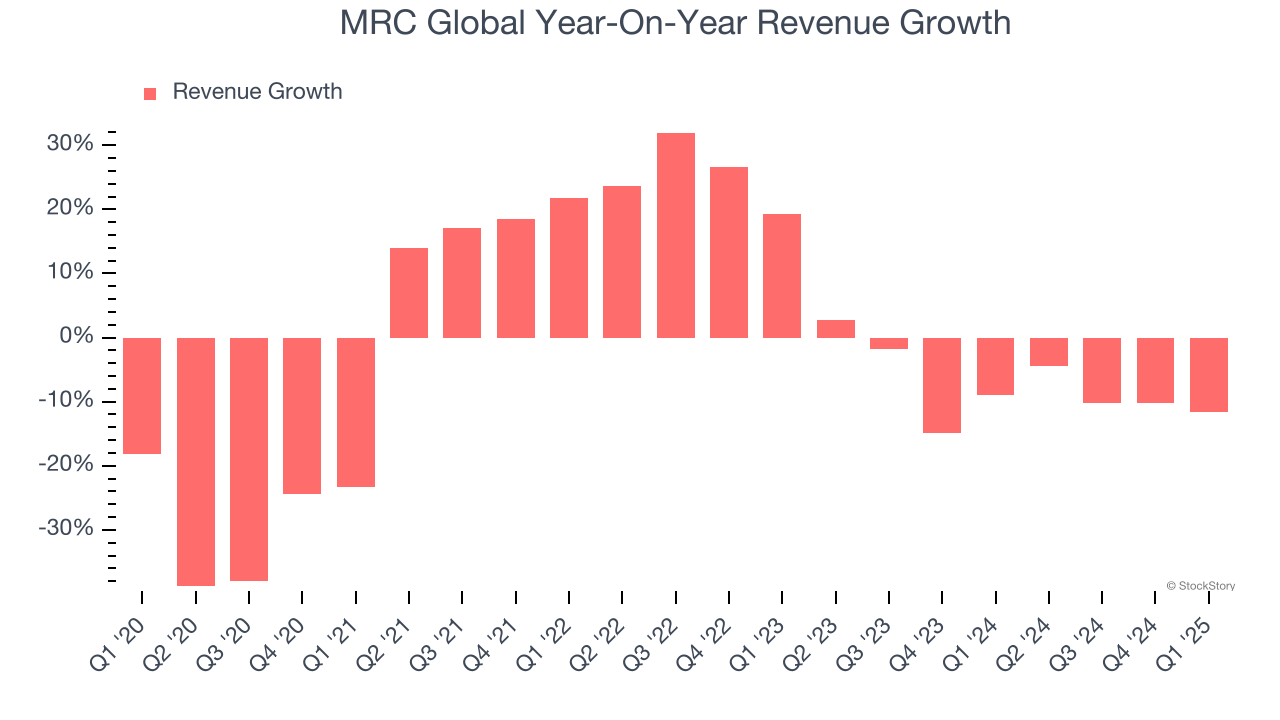

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. MRC Global’s demand was weak over the last five years as its sales fell at a 2.9% annual rate. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. MRC Global’s recent performance shows its demand remained suppressed as its revenue has declined by 7.4% annually over the last two years.

MRC Global also breaks out the revenue for its most important segments, Valves and Fittings, which are 38.9% and 22.8% of revenue. Over the last two years, MRC Global’s Valves revenue (fluid control) averaged 2.6% year-on-year declines while its Fittings revenue (pipe connectors) averaged 4.2% declines.

This quarter, MRC Global reported a rather uninspiring 11.7% year-on-year revenue decline to $712 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.1% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

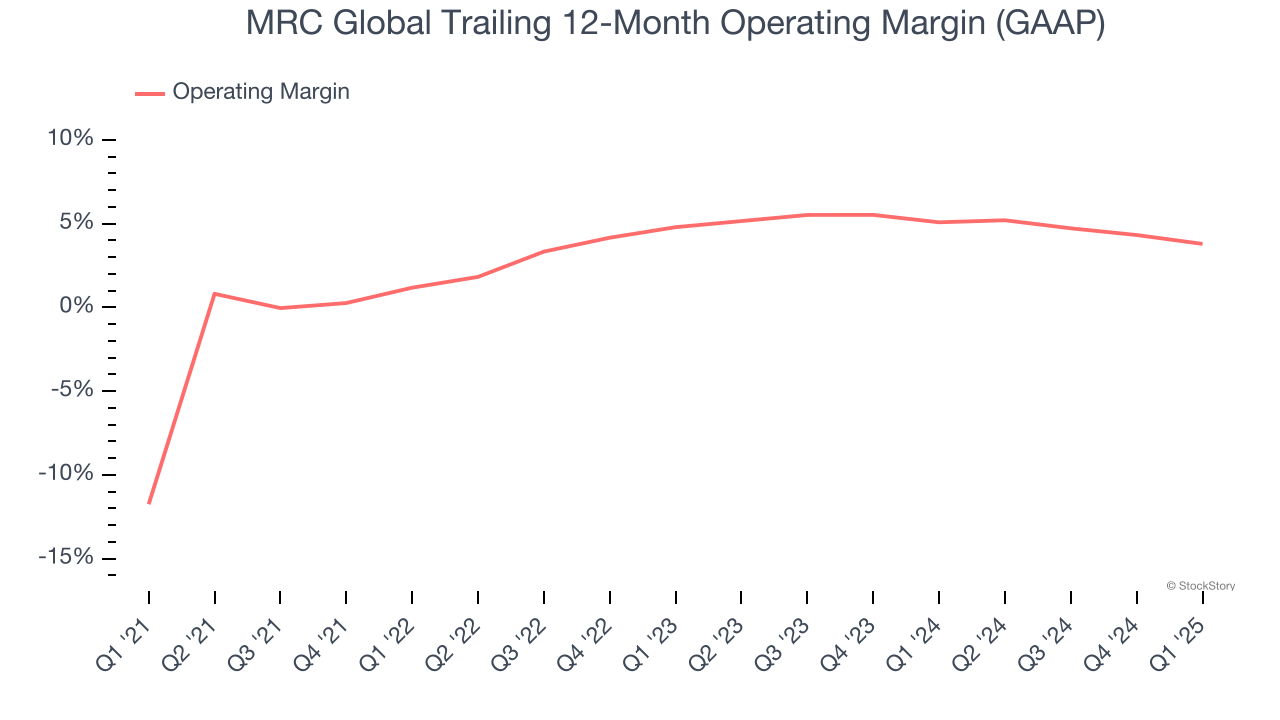

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

MRC Global was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.4% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, MRC Global’s operating margin rose by 15.5 percentage points over the last five years.

This quarter, MRC Global generated an operating profit margin of 2.5%, down 2.2 percentage points year on year. Since MRC Global’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

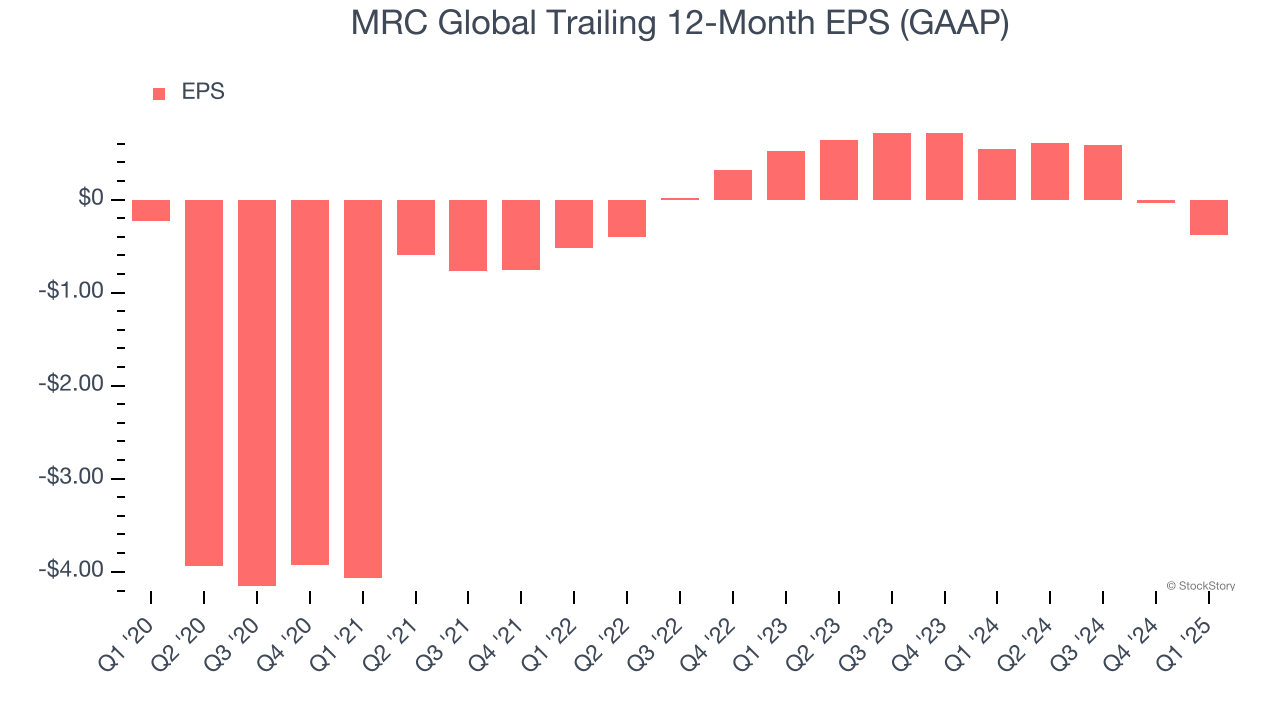

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

MRC Global’s earnings losses deepened over the last five years as its EPS dropped 11.1% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, MRC Global’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for MRC Global, its EPS declined by more than its revenue over the last two years, dropping 65.1%. This tells us the company struggled to adjust to shrinking demand.

Diving into the nuances of MRC Global’s earnings can give us a better understanding of its performance. MRC Global’s operating margin has declined by 3.9 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, MRC Global reported EPS at negative $0.26, down from $0.08 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast MRC Global’s full-year EPS of negative $0.38 will flip to positive $1.18.

Key Takeaways from MRC Global’s Q1 Results

It was good to see MRC Global narrowly top analysts’ EBITDA expectations this quarter. On the other hand, its Valves revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock remained flat at $12.20 immediately following the results.

MRC Global may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.