Applied Industrial currently trades at $232.21 per share and has shown little upside over the past six months, posting a small loss of 3.9%. The stock also fell short of the S&P 500’s 2.8% gain during that period.

Is now the time to buy Applied Industrial, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Applied Industrial Not Exciting?

We don't have much confidence in Applied Industrial. Here are three reasons why AIT doesn't excite us and a stock we'd rather own.

1. Core Business Falling Behind as Demand Plateaus

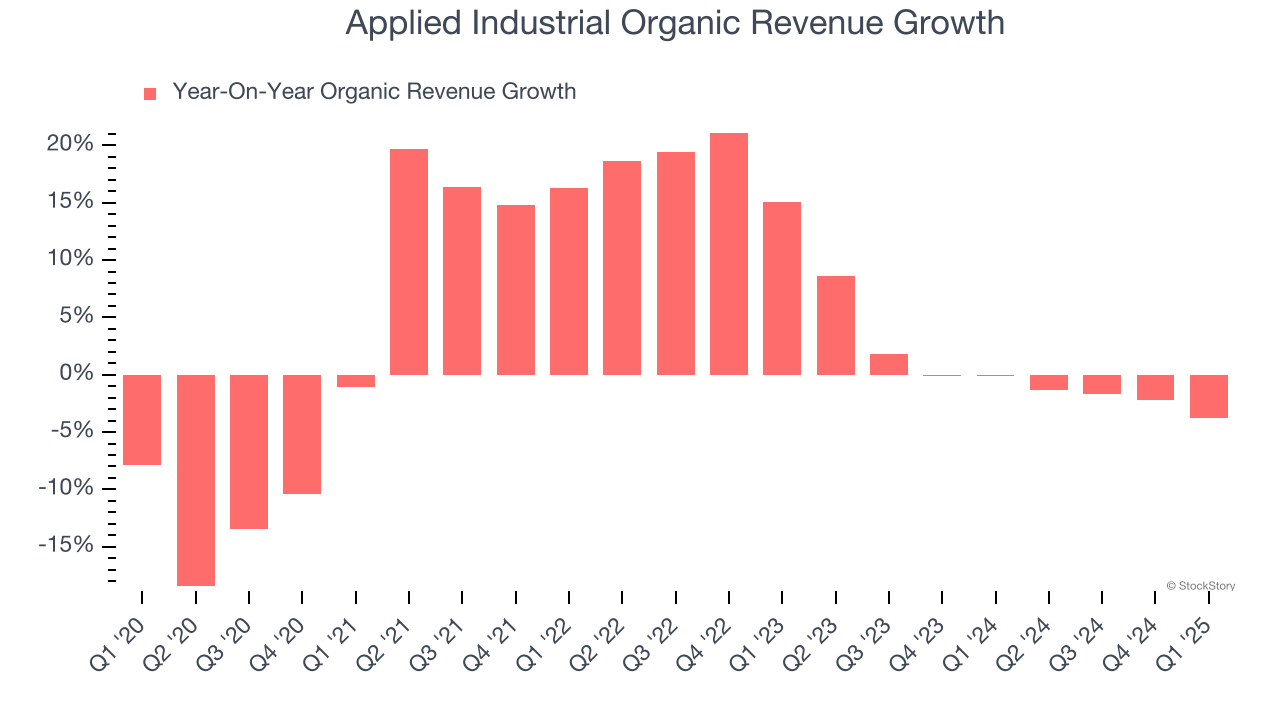

Investors interested in Engineered Components and Systems companies should track organic revenue in addition to reported revenue. This metric gives visibility into Applied Industrial’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Applied Industrial failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Applied Industrial might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Applied Industrial’s revenue to rise by 5%. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

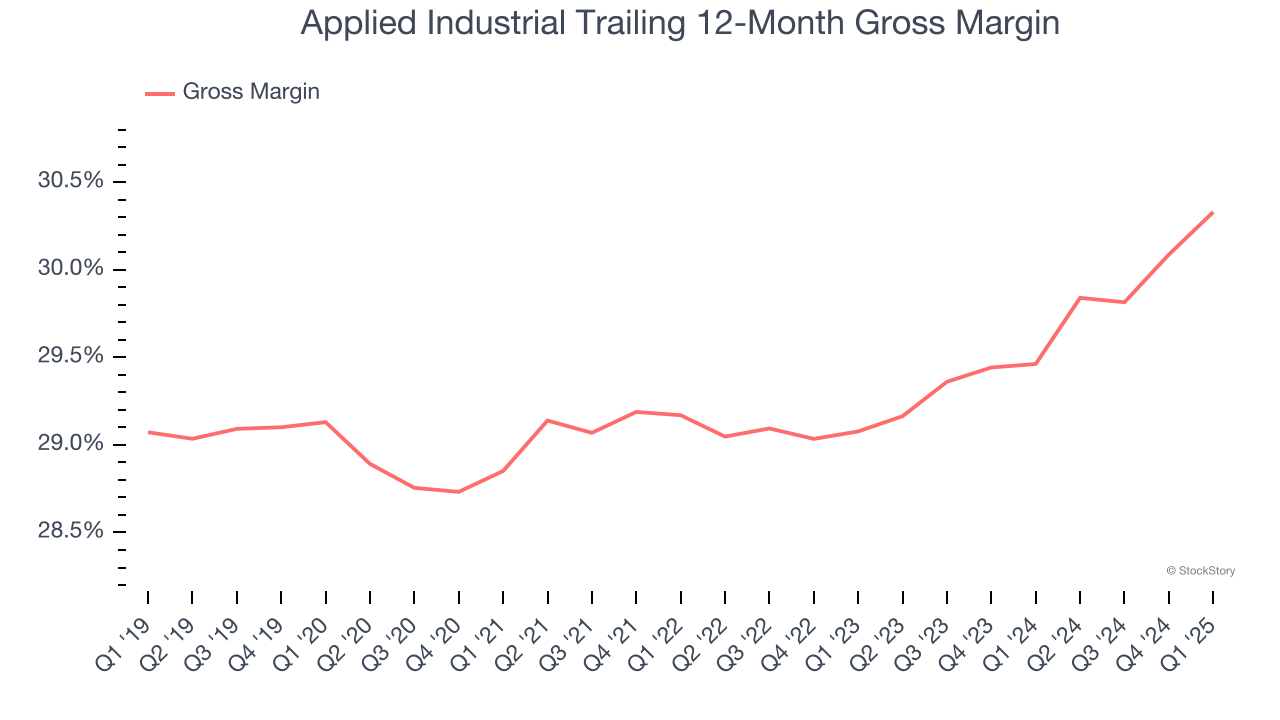

3. Low Gross Margin Hinders Flexibility

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Applied Industrial’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 29.4% gross margin over the last five years. Said differently, Applied Industrial had to pay a chunky $70.57 to its suppliers for every $100 in revenue.

Final Judgment

Applied Industrial isn’t a terrible business, but it doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 21.7× forward P/E (or $232.21 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Like More Than Applied Industrial

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.