And already Q1 comes to a close. We've had War, we've had Rising Interest Rates, we've had Inflation, we've had new strains of Covid. we've had a Yield Curve Inversion… If this were a history book you'd say: " Oh yes, that was obviously the start of the Great Depression – how could they have not seen it coming? " But it isn't so obvious when you are in the middle (or beginning) of it, is it? I suppose while you are being eaten by a shark you rationalize that you'll be able to get along without the leg and then you start thinking about how you can get a replacement arm… assuming you're an optimistic sort. Optimistic sorts are what the market is full of these days – the pessimists are long gone so now you have filtered in just the optimists, all bidding against each other to see who can overpay the most for stocks while ignoring the macro environment completely. At the moment, we are using hedges to repel the sharks but shark repellent doesn't work if the can is empty so we tend to go over our hedges A LOT in turbulent times. We did an STP review in last Wednesday's PSW Report (" Which Way Wednesday – Trouble at 4,500 for the S&P 500 )" and this morning the S&P is at 4,596 – up almost 100 points (2.2%) for the week and our Long-Term Portfolio is at $2,606,583 – which is up $27,015 since last Wednesday and we'll see how much of that we want to use to add more protection in our Hedges in the Short-Term Portfolio: Short Puts – W is a bit of a worry but our net is $126.55 and the stock is at $121.47 so almost all of the loss is premium – so our best bet is to let that burn off. CVX – That was easy. It was trading stupidly high. This is a $45,000 spread at net $31,875 so $13,125 downside protection if CVX stays below $170. …

And already Q1 comes to a close.

And already Q1 comes to a close.

We've had War, we've had Rising Interest Rates, we've had Inflation, we've had new strains of Covid. we've had a Yield Curve Inversion… If this were a history book you'd say: "Oh yes, that was obviously the start of the Great Depression – how could they have not seen it coming?" But it isn't so obvious when you are in the middle (or beginning) of it, is it? I suppose while you are being eaten by a shark you rationalize that you'll be able to get along without the leg and then you start thinking about how you can get a replacement arm… assuming you're an optimistic sort.

Optimistic sorts are what the market is full of these days – the pessimists are long gone so now you have filtered in just the optimists, all bidding against each other to see who can overpay the most for stocks while ignoring the macro environment completely.

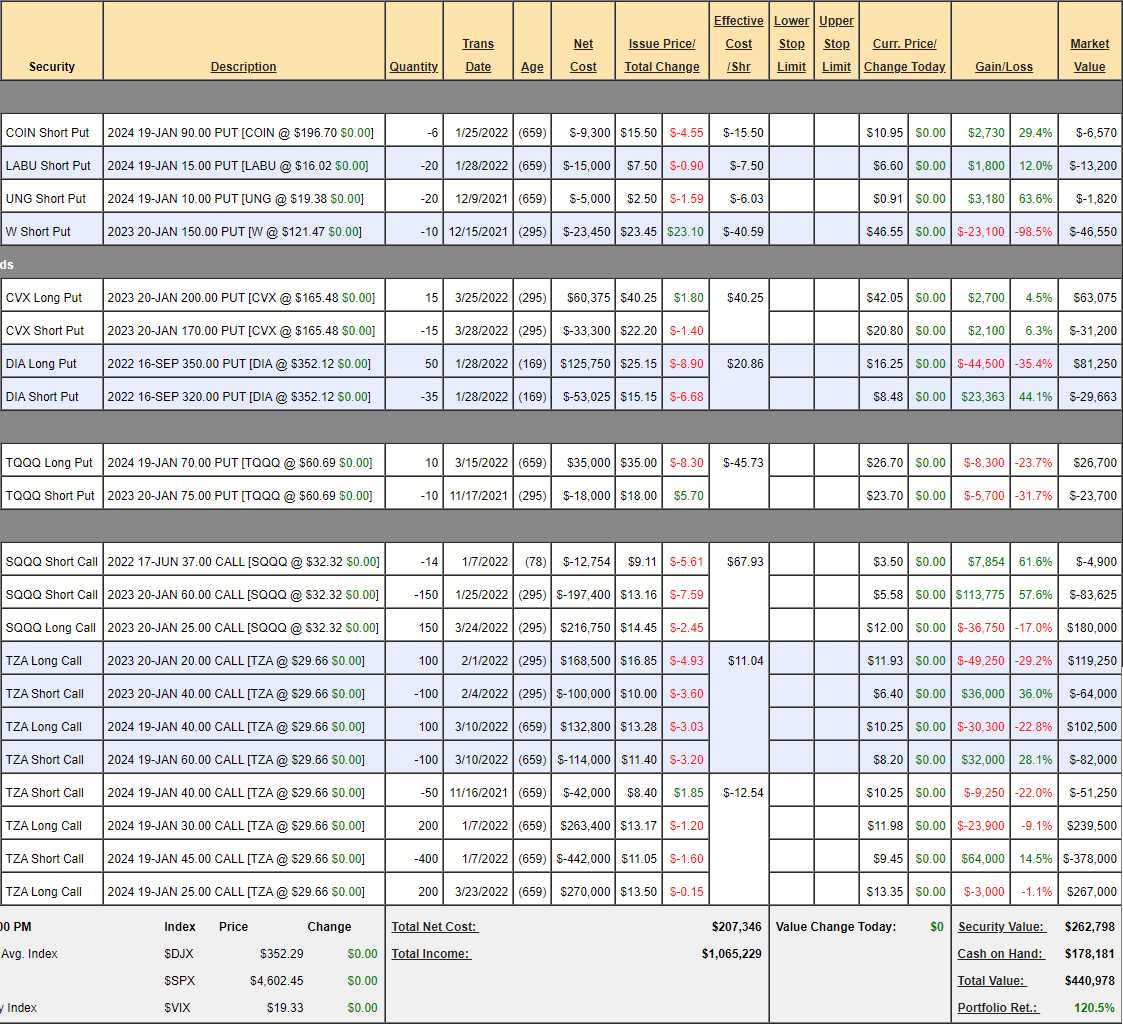

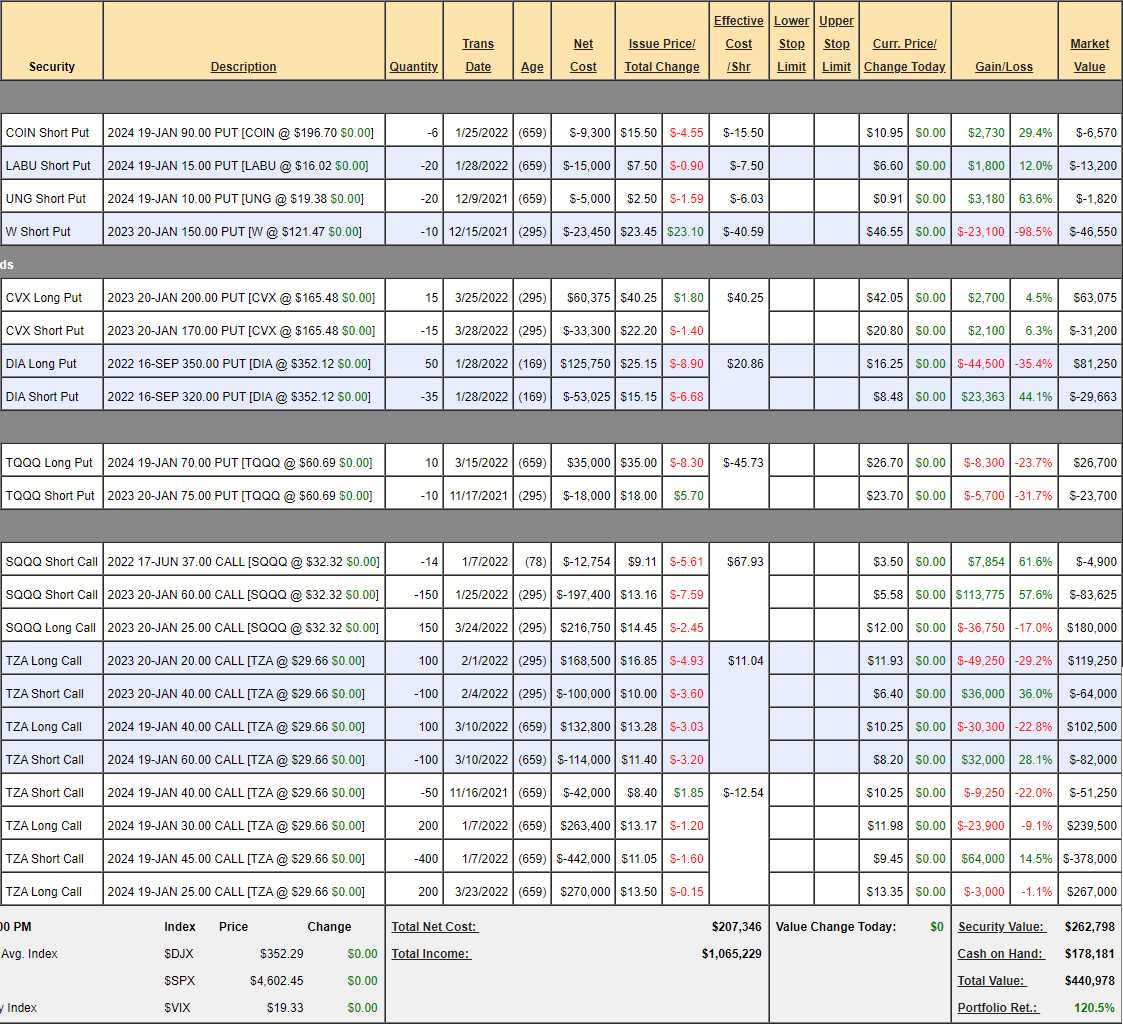

At the moment, we are using hedges to repel the sharks but shark repellent doesn't work if the can is empty so we tend to go over our hedges A LOT in turbulent times. We did an STP review in last Wednesday's PSW Report ("Which Way Wednesday – Trouble at 4,500 for the S&P 500)" and this morning the S&P is at 4,596 – up almost 100 points (2.2%) for the week and our Long-Term Portfolio is at $2,606,583 – which is up $27,015 since last Wednesday and we'll see how much of that we want to use to add more protection in our Hedges in the Short-Term Portfolio:

- Short Puts – W is a bit of a worry but our net is $126.55 and the stock is at $121.47 so almost all of the loss is premium – so our best bet is to let that burn off.

- CVX – That was easy. It was trading stupidly high. This is a $45,000 spread at net $31,875 so $13,125 downside protection if CVX stays below $170.

…

And already Q1 comes to a close.

And already Q1 comes to a close.