What a time to have to review our Member Portfolios!

Indexes are back at the lows – it's like taking a picture when nobody's ready – you KNOW it's going to come out terrible and everyone will want a do-over. Nonetheless, it is options expiraiton week so we're going to plow ahead and see what we can do with this mess. Remember, the only reason we didn't cash out is BECAUSE we wanted to practice what to do in a market correction – so here it is...

The first thing we do, of course, is adjust our hedges. In this case, we took a chance and cashed in over $500,000 worth of long hedges (TZA and SQQQ) and then added back more TZA protection in yesterday's Live Member Chat Room. It's a messy transitional period and raising cash cost us in the portfolio's net value but, if we are right and this is a short-term bottom – we'll be hitting new highs in our Long and Short-Term Portfolios next week.

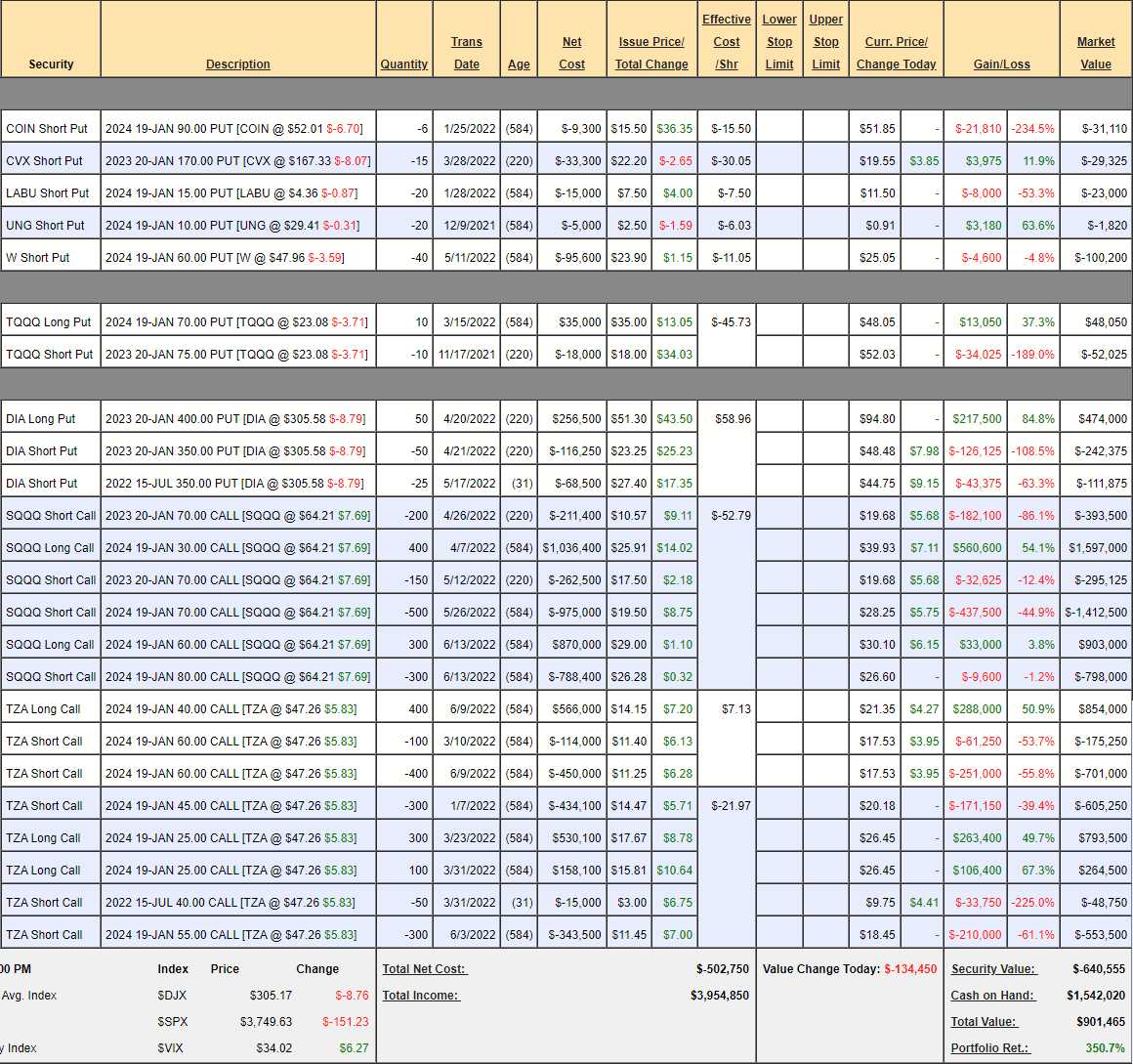

Short-Term Portfolio Review (STP): At the moment though, the STP is at $901,465 and that's DOWN $100,999 from our 5/24 review but we have $530,849 more CASH!!! which we can use to adjust our long positions in our other Member Portfolios AND we moved $100,000 to the Future is Now Portfolio – so closer to even overall.. That's the point of the STP – it's our hedging portfolio to balance out the rest and, when you consider that we started with $200,000 back on Oct 28th, 2020, $901,465 is a pretty nice gain (350%).

- COIN – I was going to wait for 2025 puts to come out but now that they are down to $50, I think we have to take advantage and sell 10 of the 2024 $50 puts for $22.50 ($22,500). It's the first leg of a roll and, ideally, COIN pops back up and we can buy back the short $90 puts for $22,500 and then we've completed our roll. We should also put a stop on 3 (1/2) the current $90 puts at $60 ($18,000) and the other 3 at $70 ($21,000) because we