TD SYNNEX has been treading water for the past six months, recording a small return of 2.3% while holding steady at $145.74.

Is now the time to buy TD SYNNEX, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is TD SYNNEX Not Exciting?

We're cautious about TD SYNNEX. Here are three reasons why you should be careful with SNX and a stock we'd rather own.

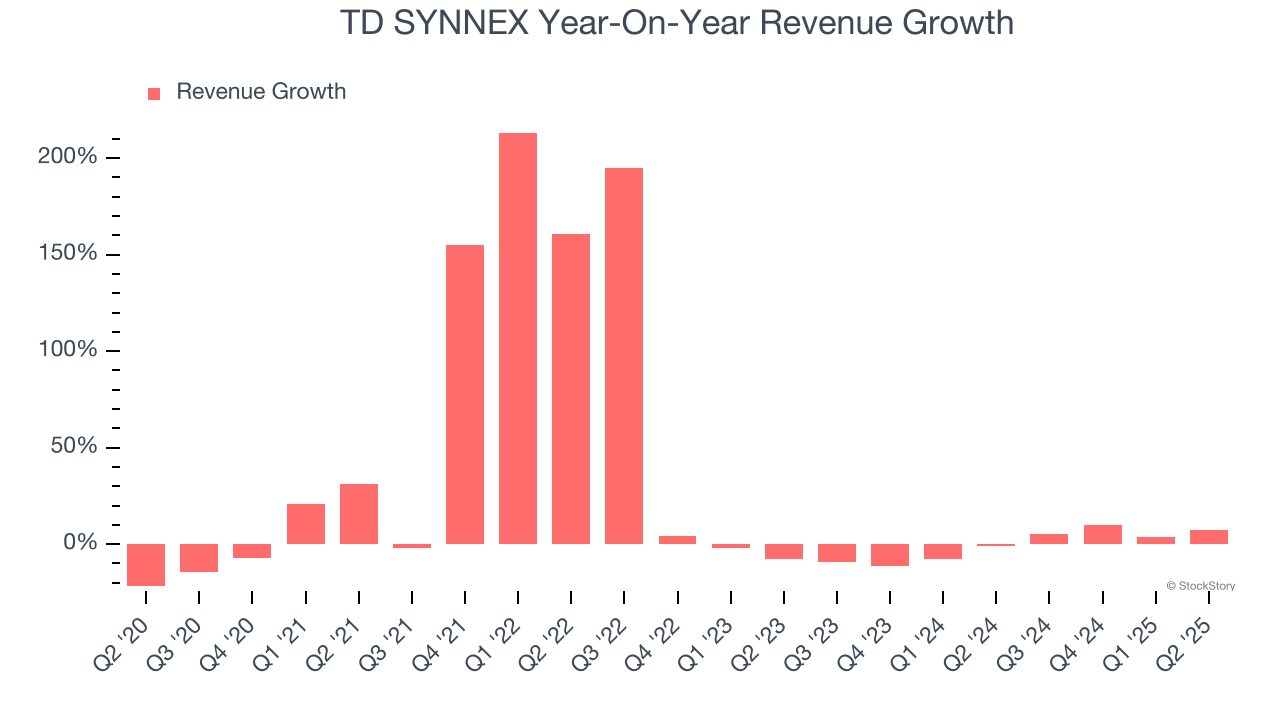

1. Revenue Growth Flatlining

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. TD SYNNEX’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

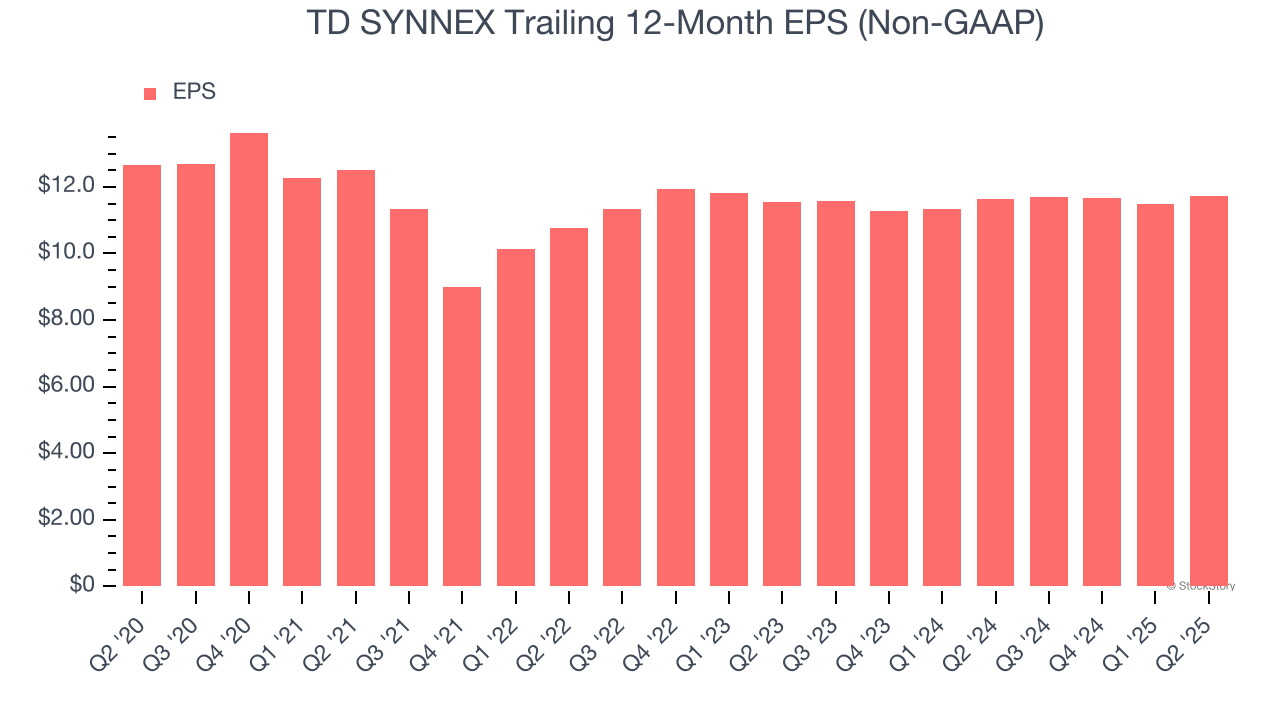

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for TD SYNNEX, its EPS declined by 1.5% annually over the last five years while its revenue grew by 23%. This tells us the company became less profitable on a per-share basis as it expanded.

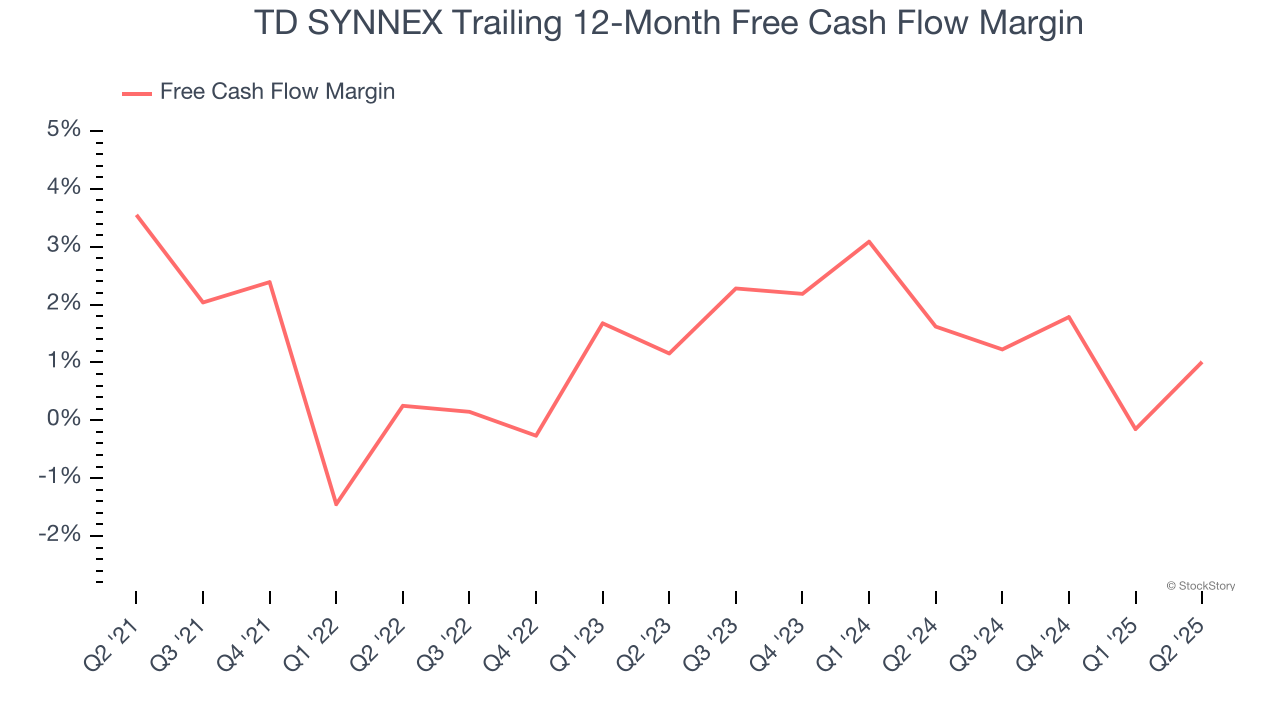

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

TD SYNNEX has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.2%, lousy for a business services business.

Final Judgment

TD SYNNEX’s business quality ultimately falls short of our standards. That said, the stock currently trades at 11.6× forward P/E (or $145.74 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of TD SYNNEX

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.