AAR trades at $71.65 per share and has stayed right on track with the overall market, gaining 5.8% over the last six months. At the same time, the S&P 500 has returned 6.9%.

Is now the time to buy AAR, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is AAR Not Exciting?

We're cautious about AAR. Here are three reasons why AIR doesn't excite us and a stock we'd rather own.

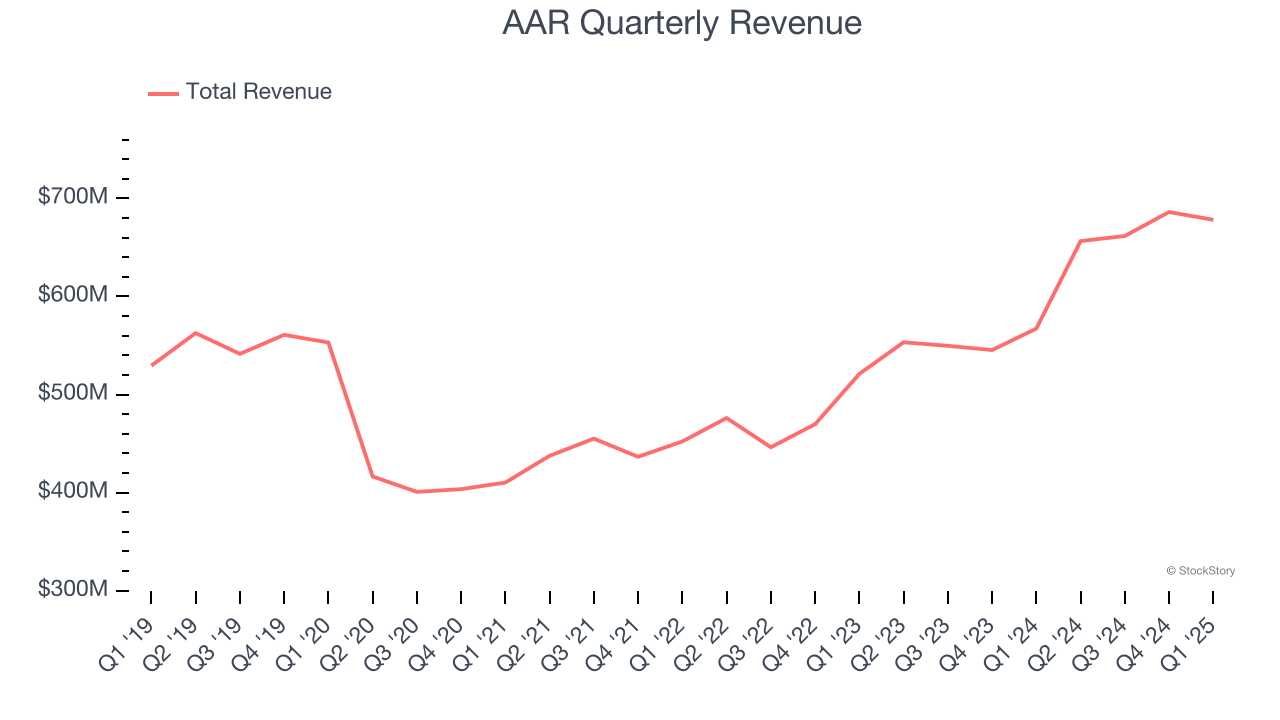

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, AAR grew its sales at a sluggish 3.9% compounded annual growth rate. This fell short of our benchmark for the industrials sector.

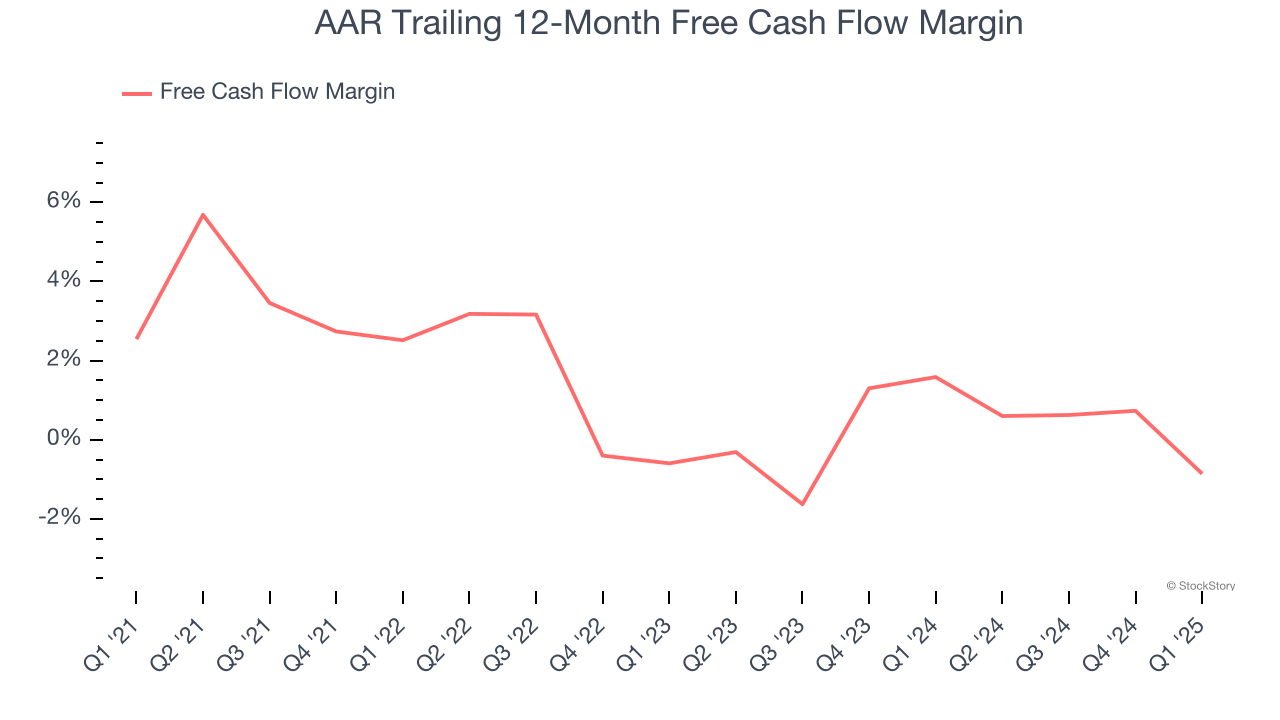

2. Breakeven Free Cash Flow Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

AAR broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

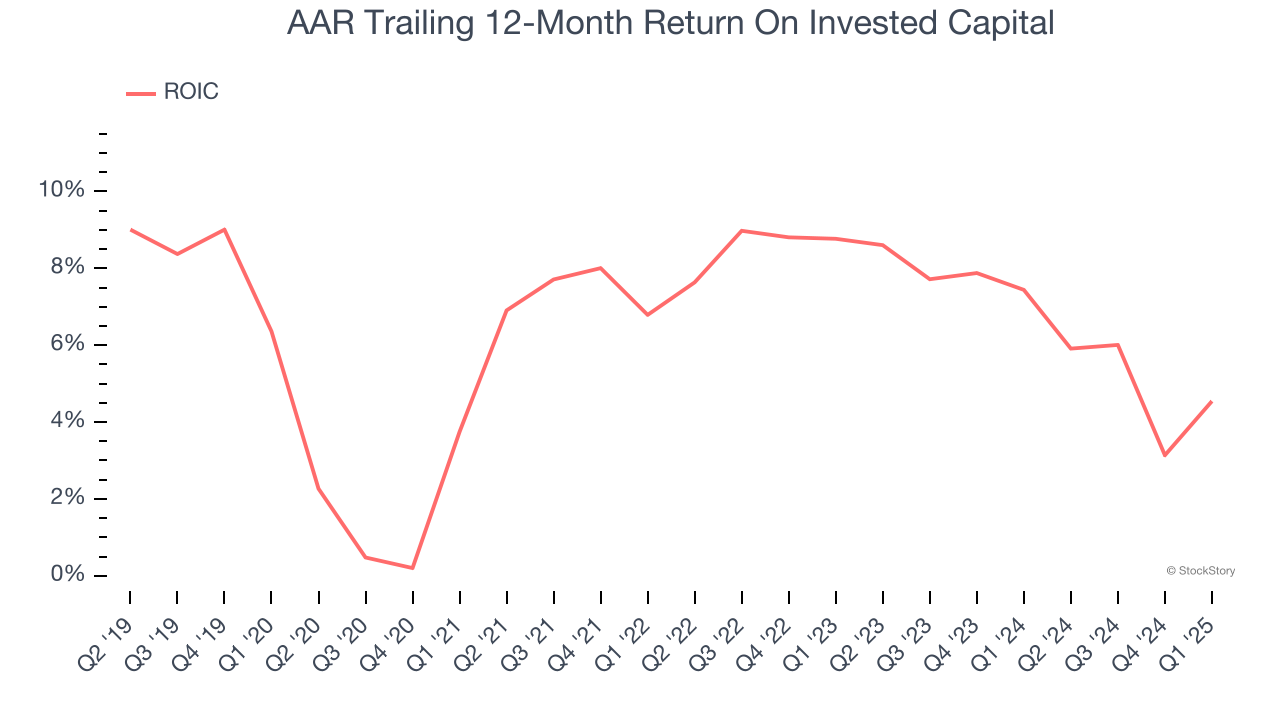

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

AAR historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.3%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

AAR’s business quality ultimately falls short of our standards. That said, the stock currently trades at 16.6× forward P/E (or $71.65 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than AAR

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.