Temporary space provider WillScot (NASDAQ: WSC) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 6.1% year on year to $566 million. On the other hand, the company’s full-year revenue guidance of $2.18 billion at the midpoint came in 1.5% below analysts’ estimates. Its non-GAAP profit of $0.29 per share was 11% below analysts’ consensus estimates.

Is now the time to buy WillScot Mobile Mini? Find out by accessing our full research report, it’s free.

WillScot Mobile Mini (WSC) Q4 CY2025 Highlights:

- Revenue: $566 million vs analyst estimates of $545.2 million (6.1% year-on-year decline, 3.8% beat)

- Adjusted EPS: $0.29 vs analyst expectations of $0.33 (11% miss)

- Adjusted EBITDA: $250 million vs analyst estimates of $249.3 million (44.2% margin, in line)

- EBITDA guidance for the upcoming financial year 2026 is $900 million at the midpoint, below analyst estimates of $928 million

- Operating Margin: -32.5%, down from 28.9% in the same quarter last year

- Free Cash Flow Margin: 16.2%, down from 22.7% in the same quarter last year

- Market Capitalization: $4.02 billion

Tim Boswell, President and Chief Executive Officer of WillScot, commented, "We ended 2025 in a solid position to execute our strategic priorities entering 2026. Market activity remains heavily bifurcated with significant demand across mega projects in our industrial sectors compared to overall non-residential construction square footage starts down 12% year-over-year in the quarter and down 6% for the year. Our team is focused on executing the commercial and operational initiatives that are within our control and showing encouraging results entering 2026. Modular activations were up 3% year-over-year in the fourth quarter and pending orders across all products were up more than 10% year-over-year entering January with further strength since. This reflects growing demand for modular complexes and Flex for larger projects, as well as strong order growth for traditional and cold storage, particularly in our retail vertical. We continue to expect that our Enterprise Accounts portfolio will deliver high single digit revenue growth in 2026. And improved staffing and systems enabling our field sales organization are potential tailwinds entering 2026. Operationally, we are progressing initiatives across our field and shared services teams, which are driving an improved customer experience, resilient margins, and outstanding free cash flow generation."

Company Overview

Originally focusing on mobile offices for construction sites, WillScot (NASDAQ: WSC) provides ready-to-use temporary spaces, largely for longer-term lease.

Revenue Growth

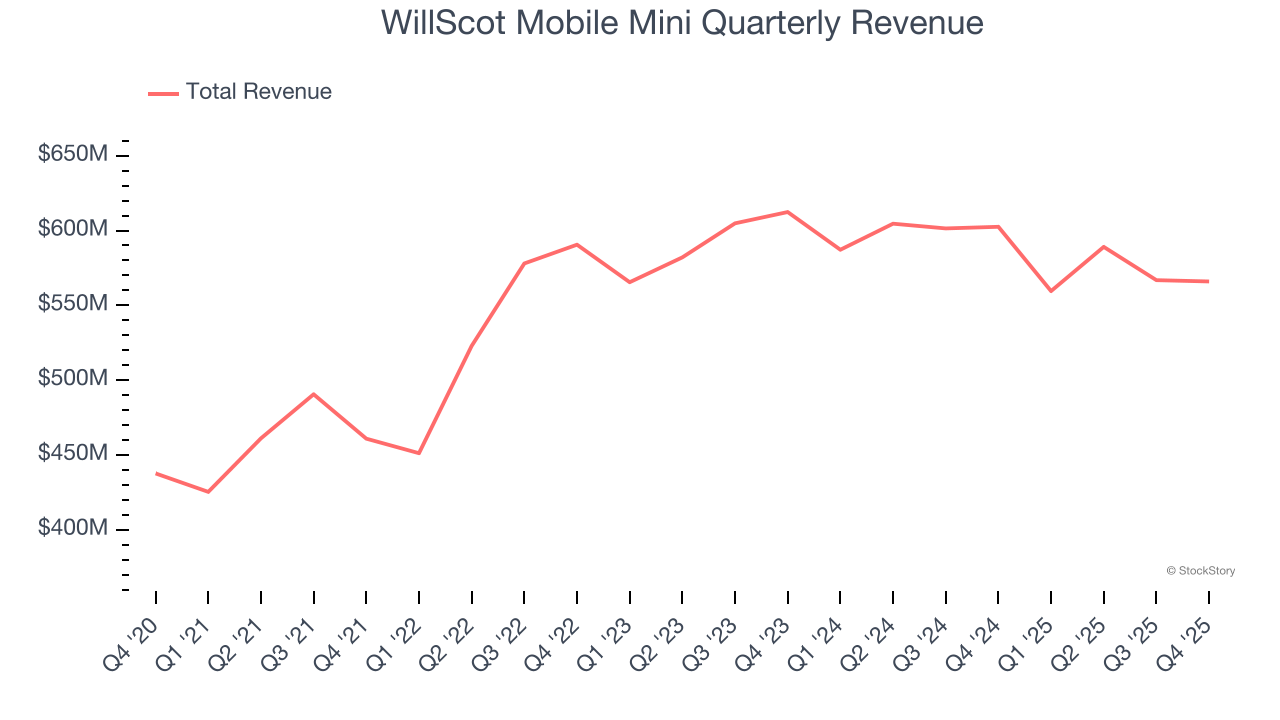

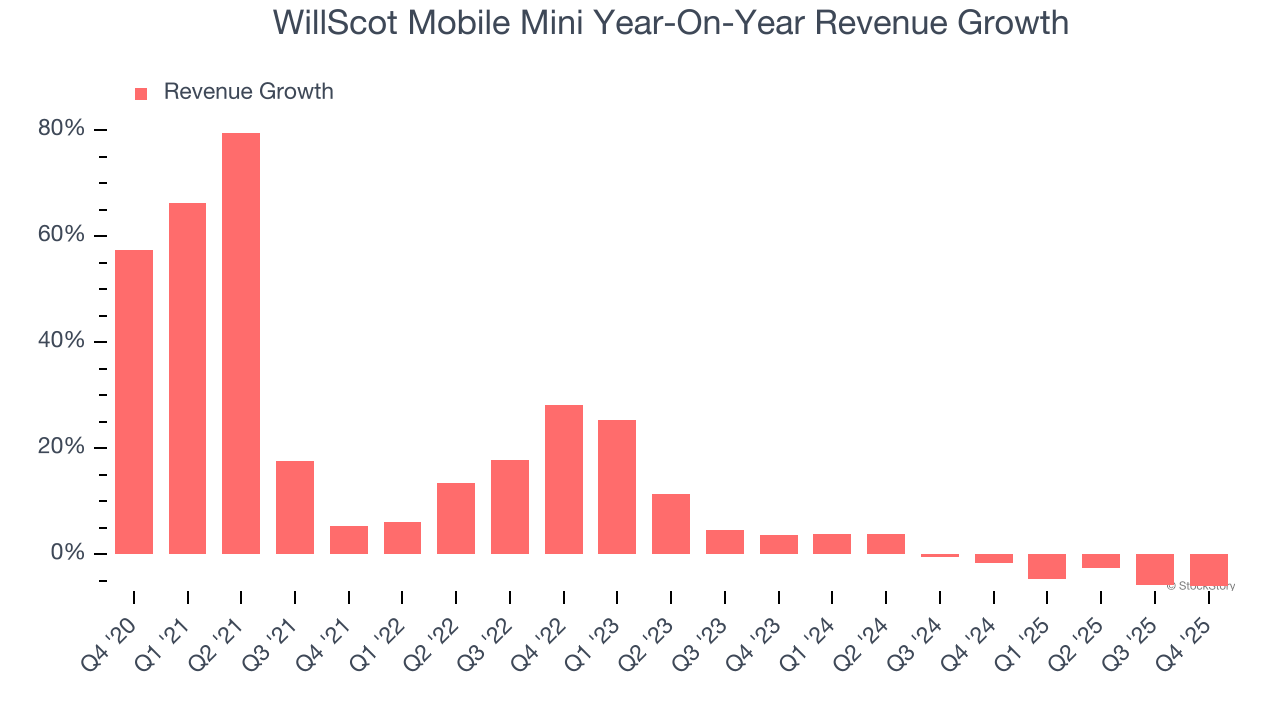

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, WillScot Mobile Mini grew its sales at an impressive 10.8% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. WillScot Mobile Mini’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.8% over the last two years.

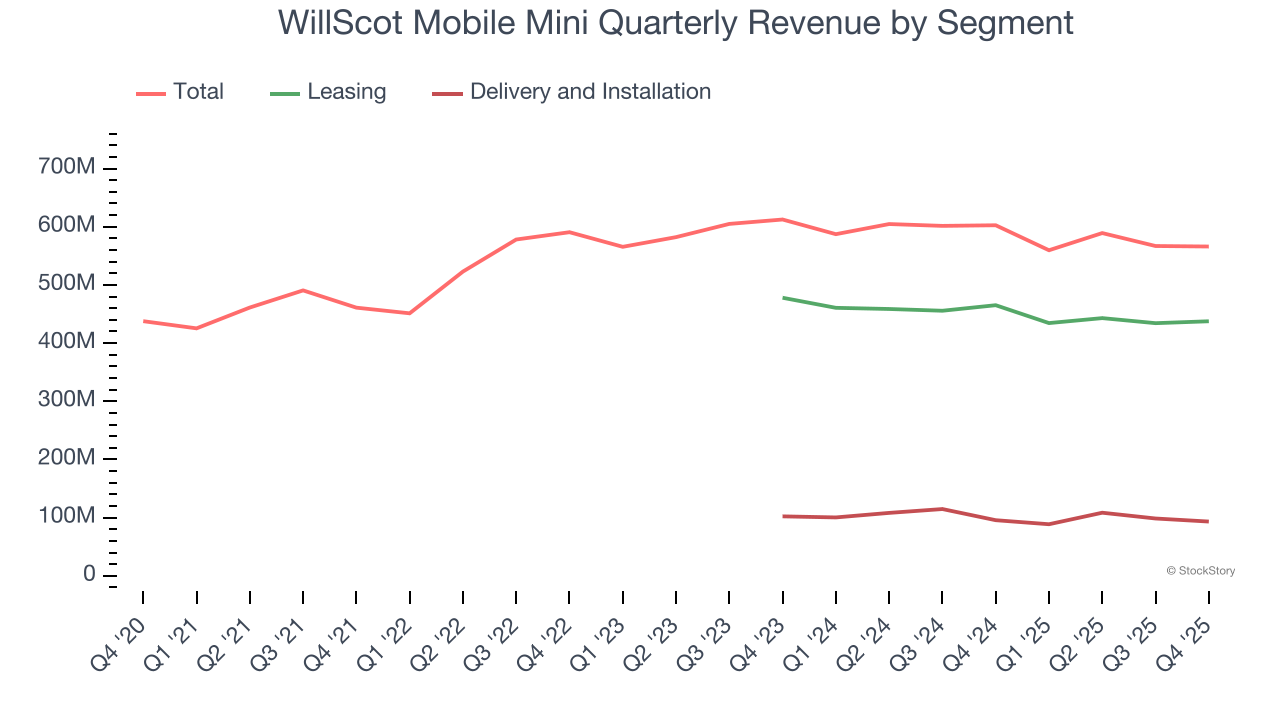

We can better understand the company’s revenue dynamics by analyzing its most important segments, Leasing and Delivery and Installation, which are 77.3% and 16.5% of revenue. Over the last two years, WillScot Mobile Mini’s Leasing revenue (recurring) averaged 4.5% year-on-year declines while its Delivery and Installation revenue (non-recurring) averaged 6.9% declines.

This quarter, WillScot Mobile Mini’s revenue fell by 6.1% year on year to $566 million but beat Wall Street’s estimates by 3.8%.

Looking ahead, sell-side analysts expect revenue to decline by 3.5% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

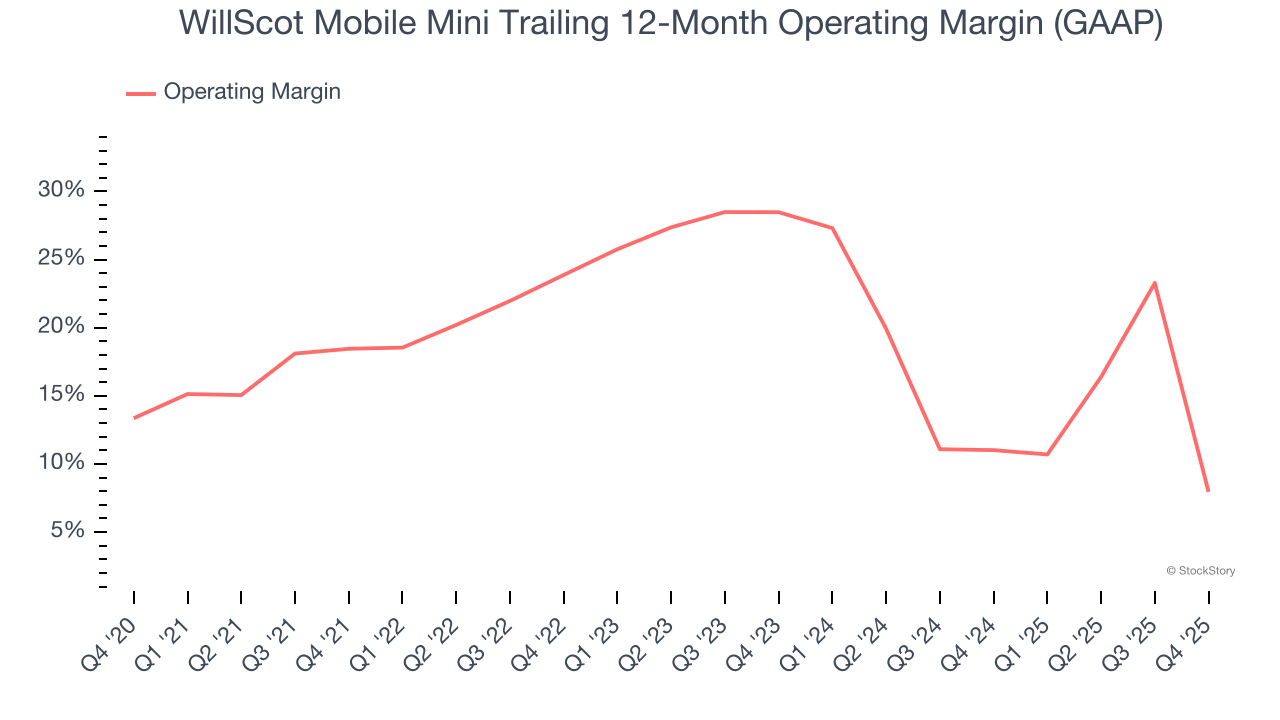

Operating Margin

WillScot Mobile Mini has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, WillScot Mobile Mini’s operating margin decreased by 10.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, WillScot Mobile Mini generated an operating margin profit margin of negative 32.5%, down 61.4 percentage points year on year. Since WillScot Mobile Mini’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

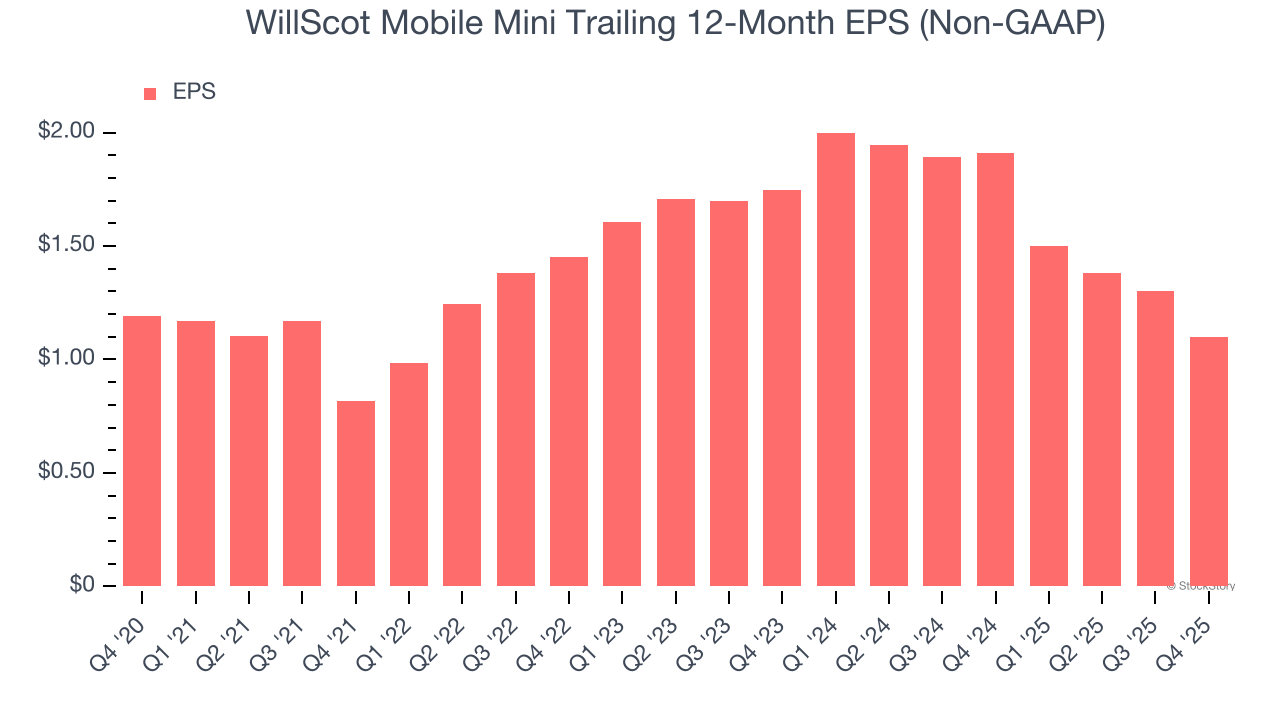

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

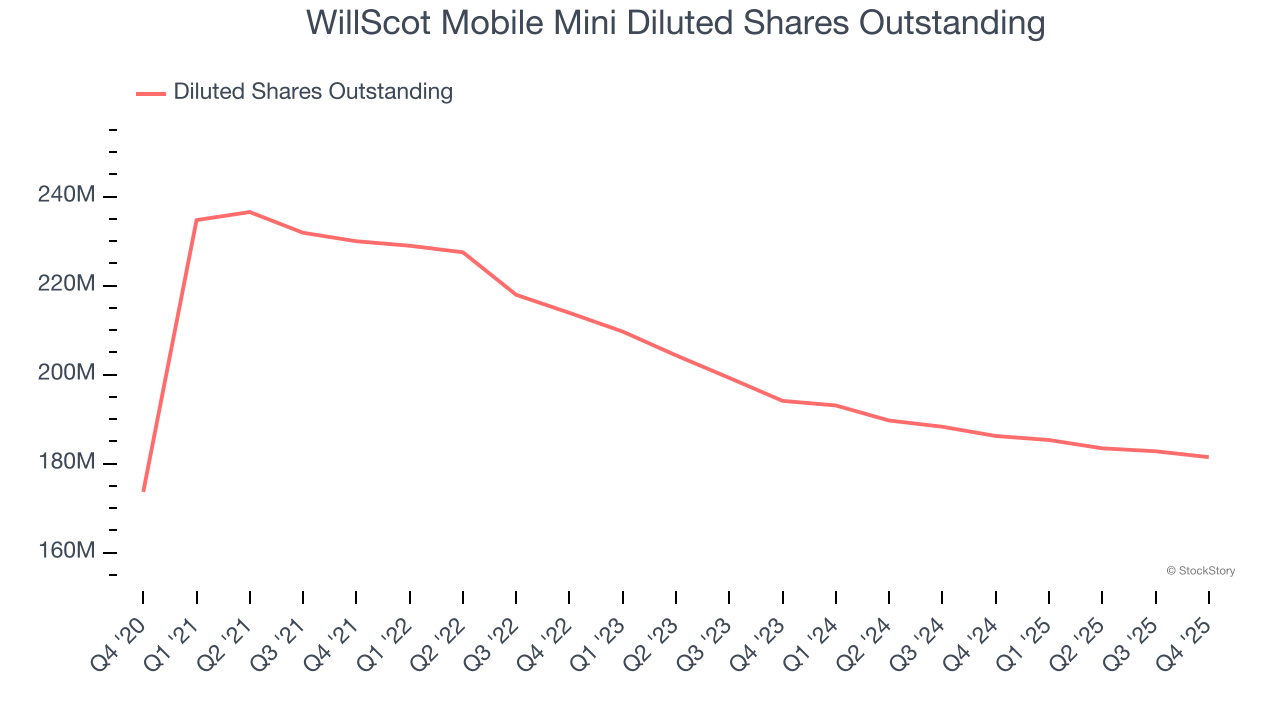

Sadly for WillScot Mobile Mini, its EPS declined by 1.6% annually over the last five years while its revenue grew by 10.8%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of WillScot Mobile Mini’s earnings can give us a better understanding of its performance. As we mentioned earlier, WillScot Mobile Mini’s operating margin declined by 10.5 percentage points over the last five years. Its share count also grew by 4.5%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For WillScot Mobile Mini, its two-year annual EPS declines of 20.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, WillScot Mobile Mini reported adjusted EPS of $0.29, down from $0.49 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects WillScot Mobile Mini’s full-year EPS of $1.10 to shrink by 3.1%.

Key Takeaways from WillScot Mobile Mini’s Q4 Results

We were impressed by how significantly WillScot Mobile Mini blew past analysts’ revenue expectations this quarter. On the other hand, its full-year EBITDA guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 3.8% to $21.29 immediately following the results.

WillScot Mobile Mini may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).