Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Napco (NASDAQ: NSSC) and its peers.

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

The 8 specialized technology stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

Luckily, specialized technology stocks have performed well with share prices up 25.7% on average since the latest earnings results.

Napco (NASDAQ: NSSC)

Protecting everything from schools to government facilities since 1969, Napco Security Technologies (NASDAQ: NSSC) manufactures electronic security devices, access control systems, and communication services for intrusion and fire alarm systems.

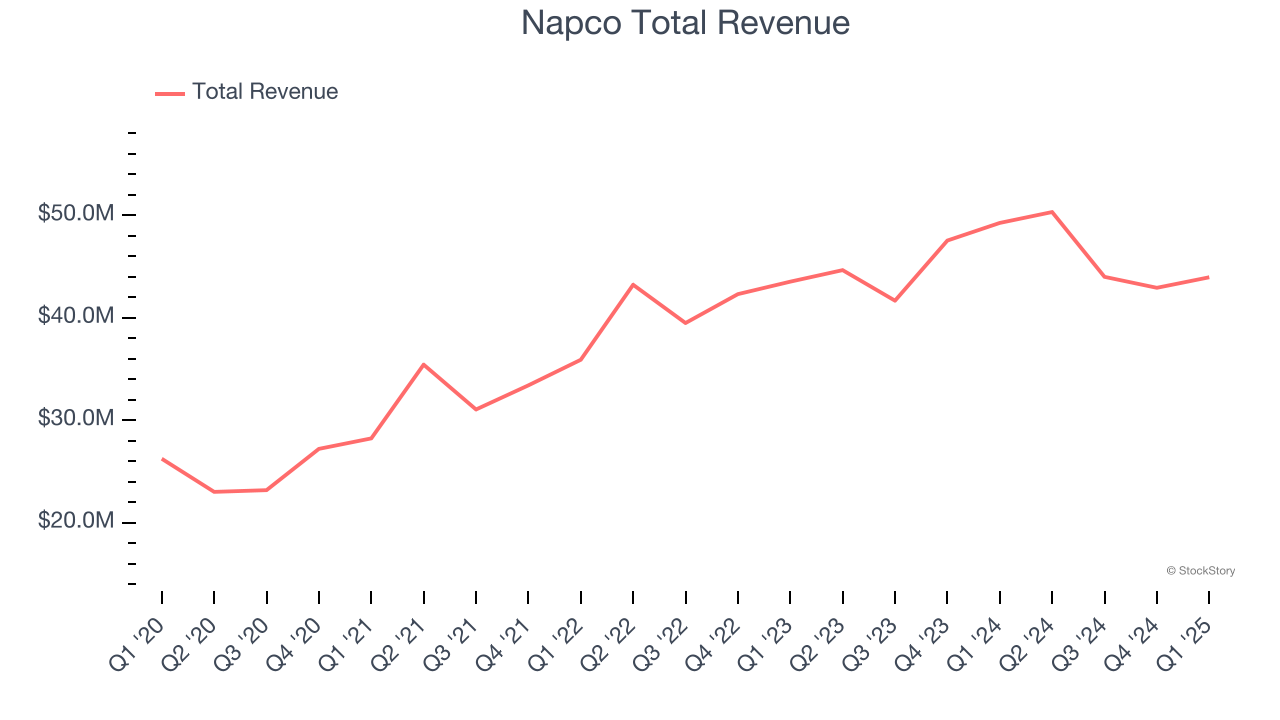

Napco reported revenues of $43.96 million, down 10.8% year on year. This print exceeded analysts’ expectations by 1.9%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EPS estimates.

Richard Soloway, Chairman and CEO, commented, "With the completion of our third quarter of Fiscal 2025, we are pleased with our 30% adjusted EBITDA return and the continued strong gross margin of 91% of our RSR and the increase of 10.6% to $21.6 million. RSR represents 49% of total revenue in Q3 and our RSR had a prospective run rate of approximately $89 million based on our April 2025 recurring service revenue. The decrease in our equipment revenue for the quarter was primarily due to reduced sales to three of our larger distributors, two of whom were managing their corporate-wide existing inventory levels and the third which was driven by the timing of project work with their customer.

Napco delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 26.1% since reporting and currently trades at $30.

Is now the time to buy Napco? Access our full analysis of the earnings results here, it’s free.

Best Q1: Arlo Technologies (NYSE: ARLO)

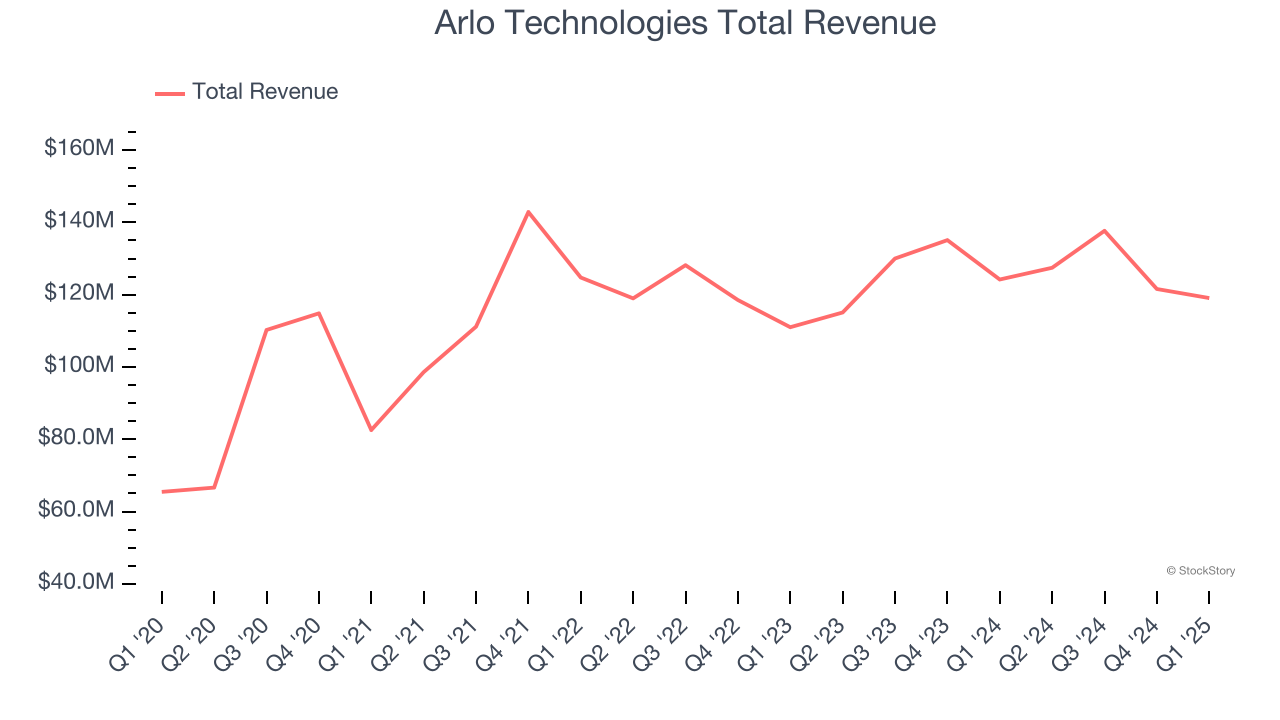

Originally spun off from networking equipment maker Netgear in 2018, Arlo Technologies (NYSE: ARLO) provides cloud-based smart security devices and subscription services that help consumers and businesses monitor and protect their homes, properties, and loved ones.

Arlo Technologies reported revenues of $119.1 million, down 4.1% year on year, outperforming analysts’ expectations by 0.6%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 64% since reporting. It currently trades at $17.48.

Is now the time to buy Arlo Technologies? Access our full analysis of the earnings results here, it’s free.

Zebra (NASDAQ: ZBRA)

Taking its name from the black and white stripes of barcodes, Zebra Technologies (NASDAQ: ZBRA) provides barcode scanners, mobile computers, RFID systems, and other data capture technologies that help businesses track assets and optimize operations.

Zebra reported revenues of $1.31 billion, up 11.3% year on year, exceeding analysts’ expectations by 1.4%. Still, it was a slower quarter as it posted a significant miss of analysts’ EPS guidance for next quarter estimates and revenue guidance for next quarter meeting analysts’ expectations.

Interestingly, the stock is up 29.9% since the results and currently trades at $316.49.

Read our full analysis of Zebra’s results here.

Mirion (NYSE: MIR)

With its technology protecting workers in over 130 countries and equipment used in 80% of cancer centers worldwide, Mirion Technologies (NYSE: MIR) provides radiation detection, measurement, and monitoring solutions for medical, nuclear energy, defense, and scientific research applications.

Mirion reported revenues of $202 million, up 4.9% year on year. This result surpassed analysts’ expectations by 0.6%. Overall, it was an exceptional quarter as it also recorded a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

The stock is up 32.4% since reporting and currently trades at $20.62.

Read our full, actionable report on Mirion here, it’s free.

PAR Technology (NYSE: PAR)

Originally founded in 1968 as a defense contractor for the U.S. government, PAR Technology (NYSE: PAR) provides cloud-based software, payment processing, and hardware solutions that help restaurants manage everything from point-of-sale to customer loyalty programs.

PAR Technology reported revenues of $103.9 million, up 48.2% year on year. This print came in 1.4% below analysts' expectations. Aside from that, it was a mixed quarter as it also logged a solid beat of analysts’ EPS estimates but a miss of analysts’ ARR estimates.

PAR Technology delivered the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is up 7.1% since reporting and currently trades at $66.82.

Read our full, actionable report on PAR Technology here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.