Luxury watch company Movado (NYSE: MOV) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 1.6% year on year to $161.8 million. Its GAAP profit of $0.13 per share was 57.5% below analysts’ consensus estimates.

Is now the time to buy Movado? Find out by accessing our full research report, it’s free.

Movado (MOV) Q2 CY2025 Highlights:

- Revenue: $161.8 million vs analyst estimates of $156.8 million (1.6% year-on-year growth, 3.2% beat)

- EPS (GAAP): $0.13 vs analyst expectations of $0.31 (57.5% miss)

- Adjusted EBITDA: $5.19 million (3.2% margin, 17.9% year-on-year decline)

- Operating Margin: 2.5%, in line with the same quarter last year

- Free Cash Flow was -$5.10 million compared to -$20.13 million in the same quarter last year

- Market Capitalization: $389.5 million

Efraim Grinberg, Chairman and Chief Executive Officer, stated, “We are pleased with our second quarter results, which were highlighted by increased net sales, a healthy gross margin despite tariff impacts, and a significant increase in operating income year over year. Our growth in a challenging environment reflects the power of our iconic portfolio of watch and jewelry brands, our compelling innovation, and the discipline with which we execute. International markets led our performance, driven by our licensed brands, with particular strength in our women’s watch collections and men’s jewelry. We also experienced growth in our global digital business. We concluded the quarter with $180.5 million in cash and no debt, positioning us well to invest in our growth initiatives and continue to return value to shareholders. We are also pleased to announce that our Board declared a quarterly dividend payment of $0.35 per share.”

Company Overview

With its watches displayed in 20 museums around the world, Movado (NYSE: MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Revenue Growth

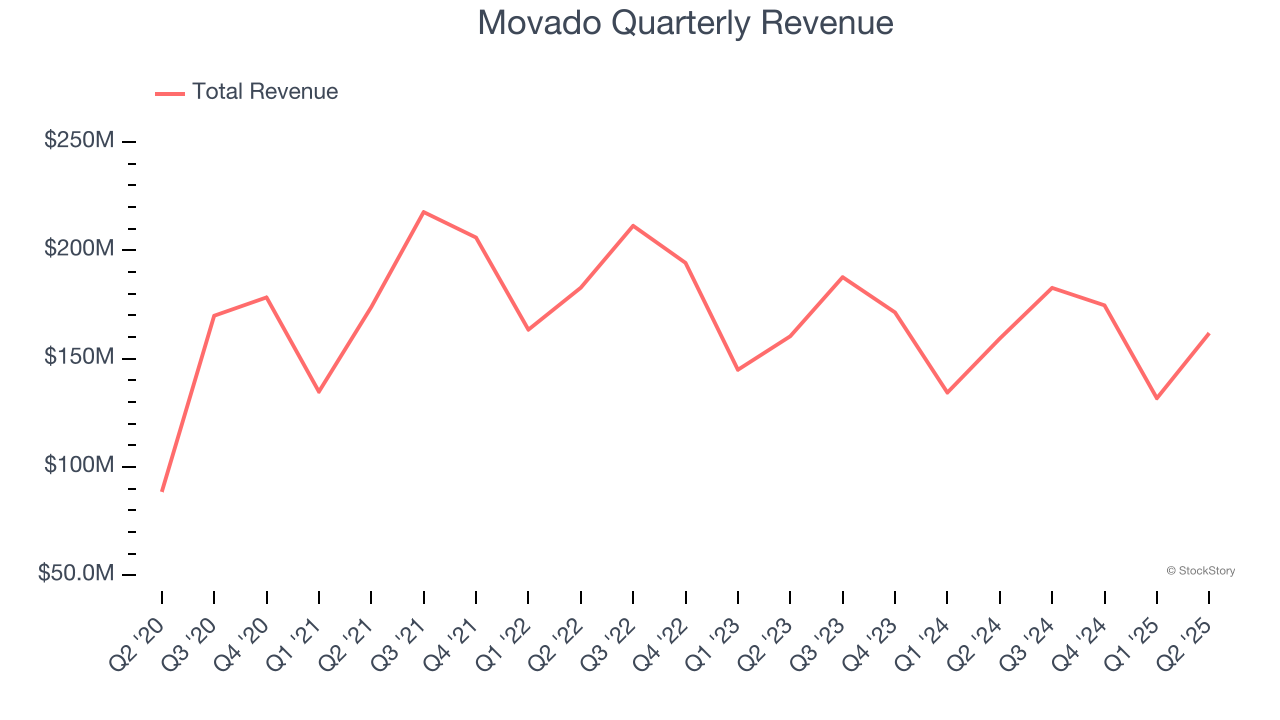

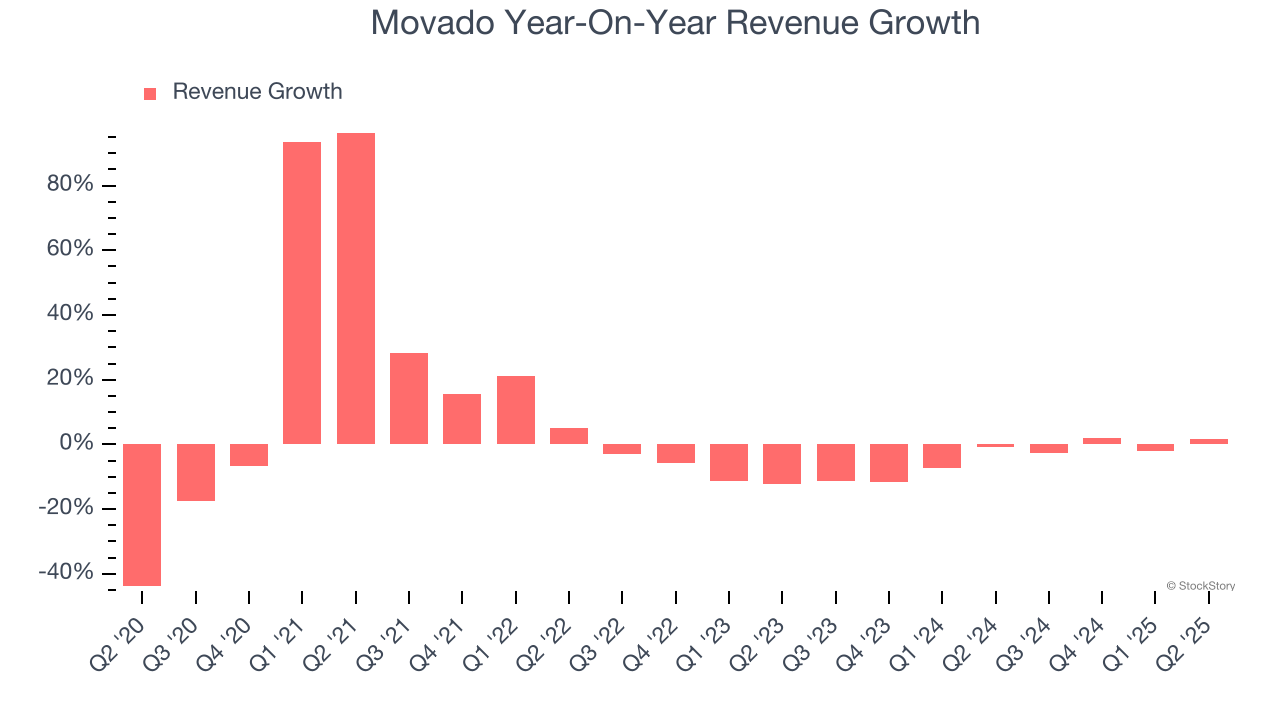

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Movado grew its sales at a sluggish 3.2% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Movado’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.3% annually.

This quarter, Movado reported modest year-on-year revenue growth of 1.6% but beat Wall Street’s estimates by 3.2%.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

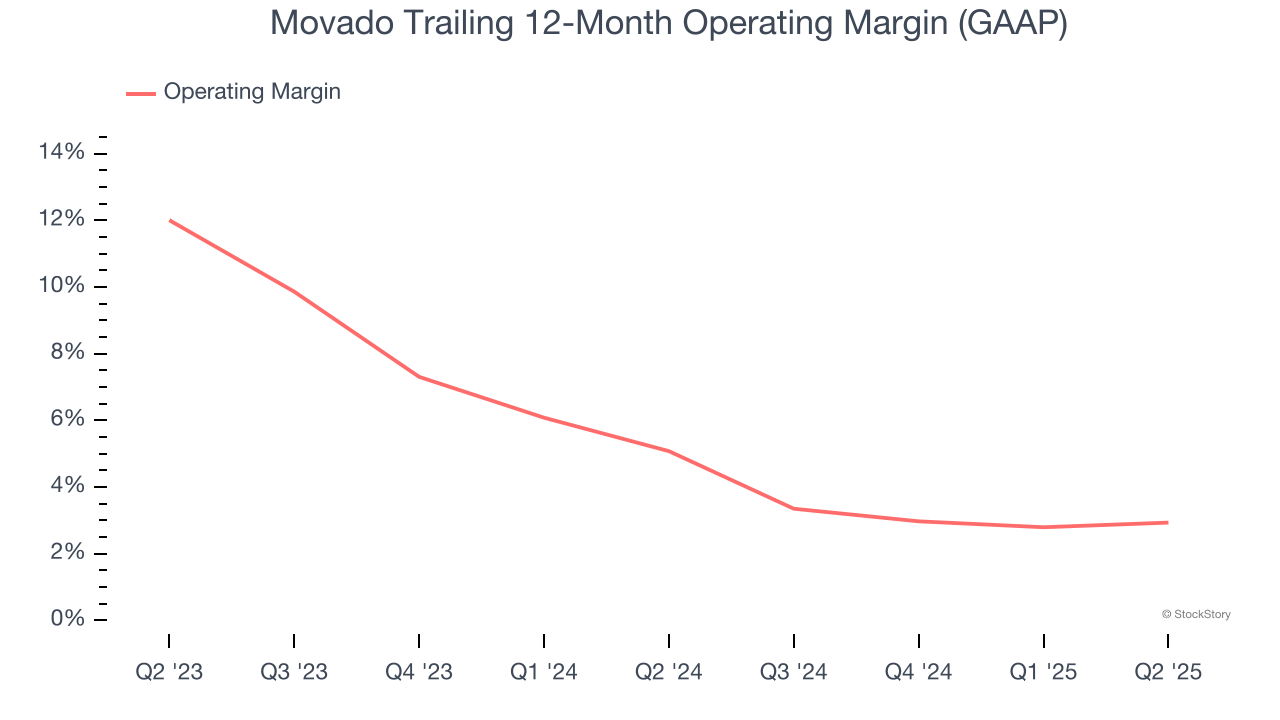

Movado’s operating margin has shrunk over the last 12 months and averaged 4% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q2, Movado generated an operating margin profit margin of 2.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

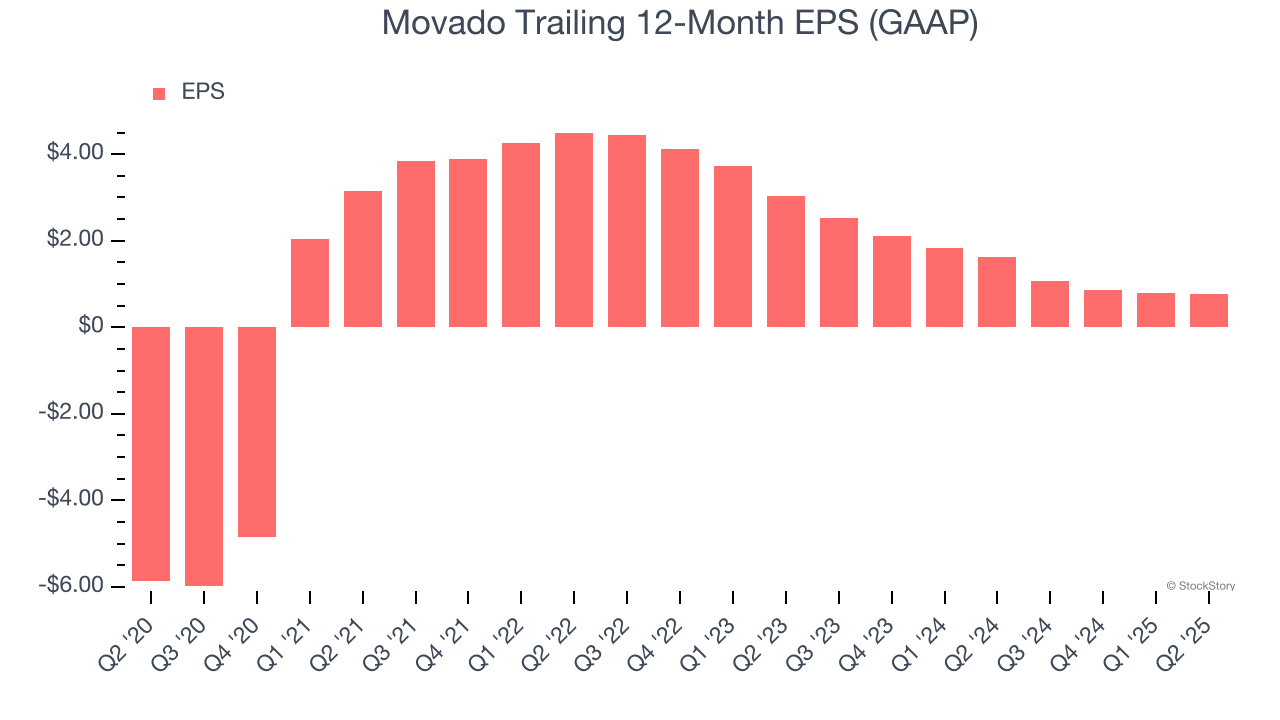

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Movado’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q2, Movado reported EPS of $0.13, down from $0.16 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Movado’s Q2 Results

It was encouraging to see Movado beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a softer quarter. The stock remained flat at $17.52 immediately following the results.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.