Over the past six months, Bank of Hawaii’s stock price fell to $62.28. Shareholders have lost 15.6% of their capital, which is disappointing considering the S&P 500 has climbed by 4.5%. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Bank of Hawaii, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Bank of Hawaii Not Exciting?

Even with the cheaper entry price, we don't have much confidence in Bank of Hawaii. Here are three reasons why you should be careful with BOH and a stock we'd rather own.

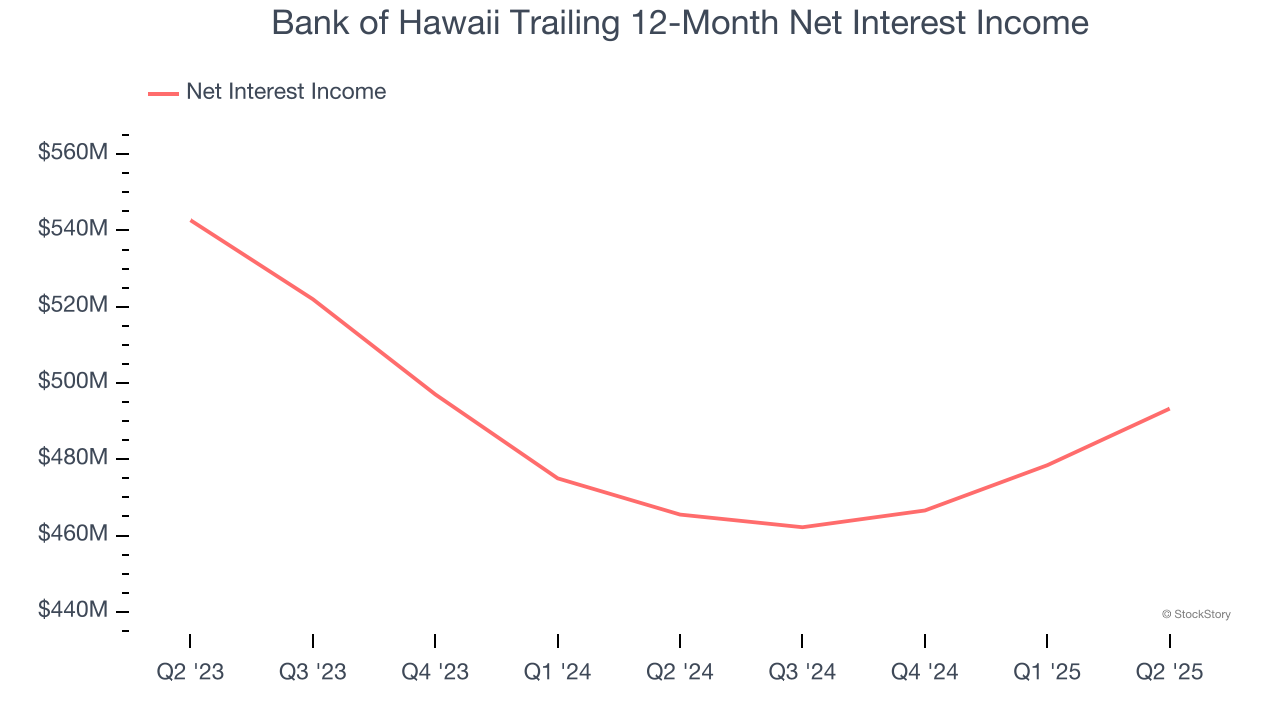

1. Net Interest Income Hits a Plateau

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Bank of Hawaii’s net interest income was flat over the last five years, much worse than the broader bank industry and in line with its total revenue. This was driven by an increasing loan book and falling net interest margin, which represents how much a bank earns in relation to its outstanding loans.

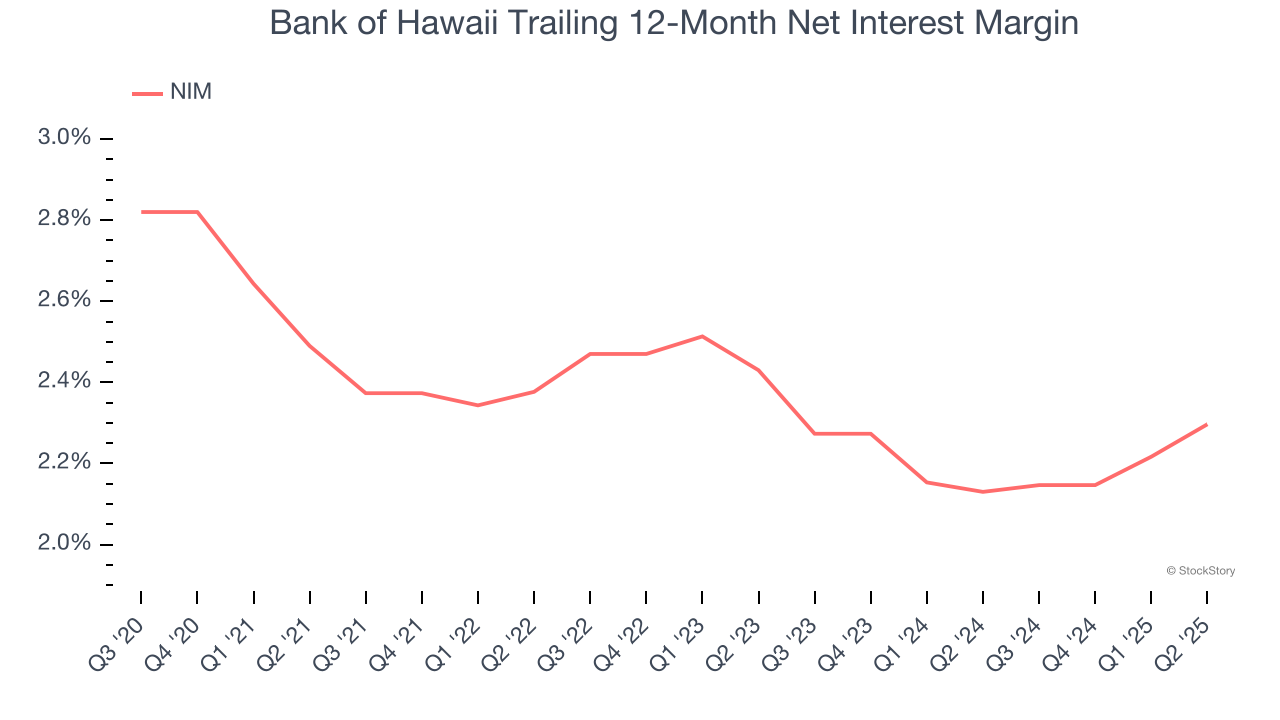

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, we can see that Bank of Hawaii’s net interest margin averaged a poor 2.2%, indicating the company has weak loan book economics.

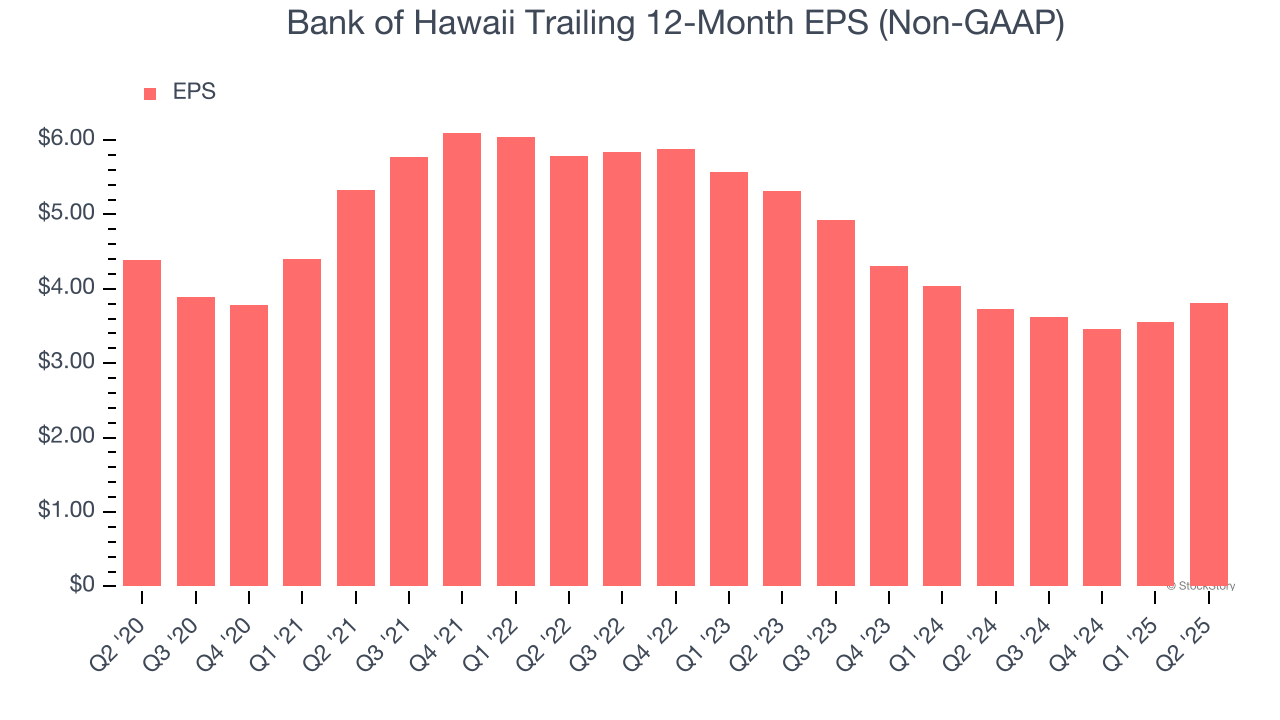

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Bank of Hawaii, its EPS declined by 2.8% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Final Judgment

Bank of Hawaii’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 1.7× forward P/B (or $62.28 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Bank of Hawaii

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.