Taylor Morrison Home currently trades at $64.32 per share and has shown little upside over the past six months, posting a middling return of 3.4%.

Is there a buying opportunity in Taylor Morrison Home, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Taylor Morrison Home Will Underperform?

We don't have much confidence in Taylor Morrison Home. Here are three reasons why TMHC doesn't excite us and a stock we'd rather own.

1. Backlog Declines as Orders Drop

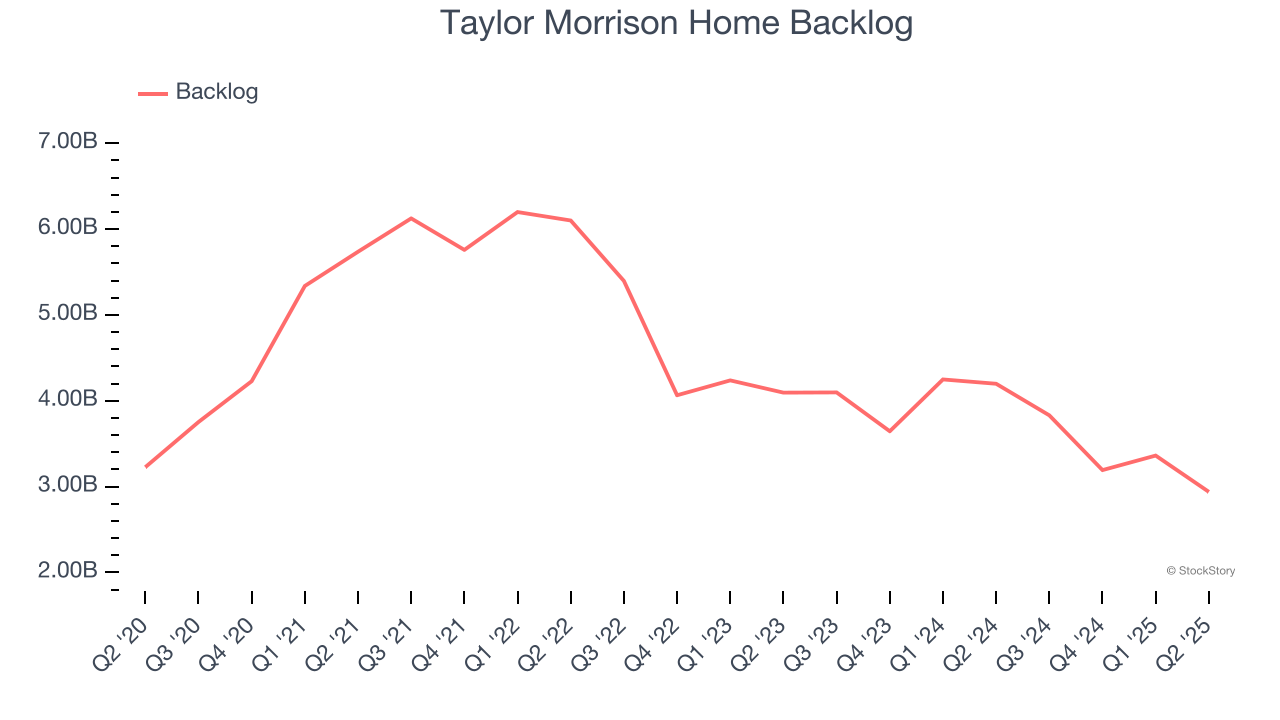

Investors interested in Home Builders companies should track backlog in addition to reported revenue. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Taylor Morrison Home’s future revenue streams.

Taylor Morrison Home’s backlog came in at $2.94 billion in the latest quarter, and it averaged 12.7% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Taylor Morrison Home’s revenue to drop by 8.2%, a decrease from its 9.1% annualized growth for the past five years. This projection is underwhelming and implies its products and services will see some demand headwinds.

3. EPS Took a Dip Over the Last Two Years

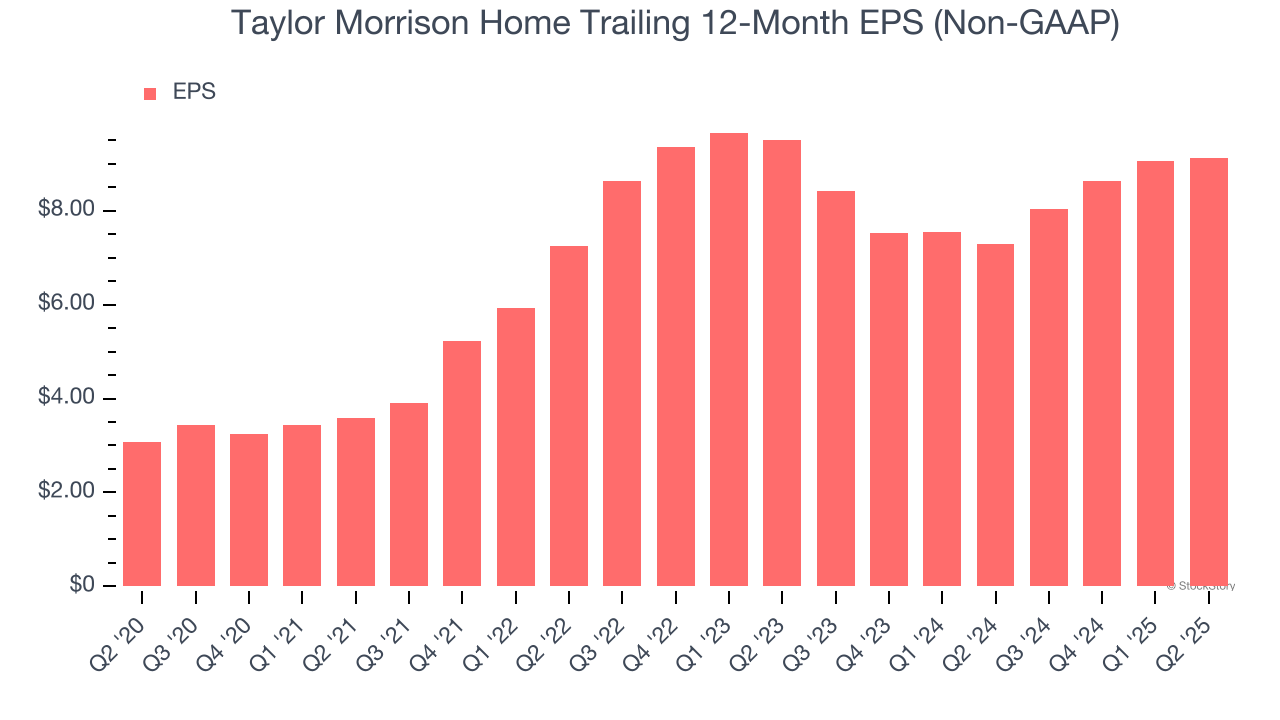

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Taylor Morrison Home, its EPS declined by 2.1% annually over the last two years while its revenue was flat. This tells us the company struggled to adjust to choppy demand.

Final Judgment

We see the value of companies helping their customers, but in the case of Taylor Morrison Home, we’re out. That said, the stock currently trades at 8.4× forward P/E (or $64.32 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Taylor Morrison Home

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.