Cisco Systems, Inc. (CSCO) delivered 16% YoY lower free cash flow in its latest quarter, and its FCF margin fell from 24.9% to 19.4%. Its price target is still 6% higher than today's price, but has CSCO peaked here? One way to play it is to sell short out-of-the-money (OTM) put options in nearby expiry periods.

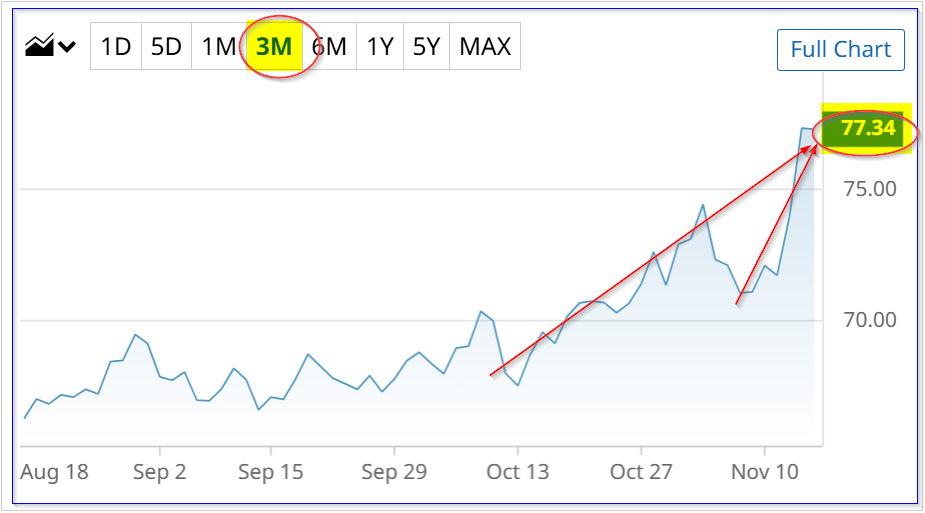

CSCO is trading at $78.28, a recent peak, up from its pre-earnings low on Nov. 6 of $71.06. My analysis shows that the stock could be worth just 6.7% more over the next 12 months (NTM), or $83.49 per share.

Cisco reported on Nov. 12 that its fiscal Q1 2026 revenue, for the quarter ending Oct. 25, 2025, increased by +7.97% to $14.9 billion.

This growth was driven by Networking product revenue, which increased 9.5% and accounted for almost 75% of total revenue (74.4%). In addition, its services revenue rose 2.1%.

More importantly, its operating and free cash flow were positive, but significantly lower than last year. So, why has the stock been rising? This implies that CSCO stock could be at a peak.

Let's look into what the stock could be worth.

Forecasting FCF Using Its Historical FCF Margin

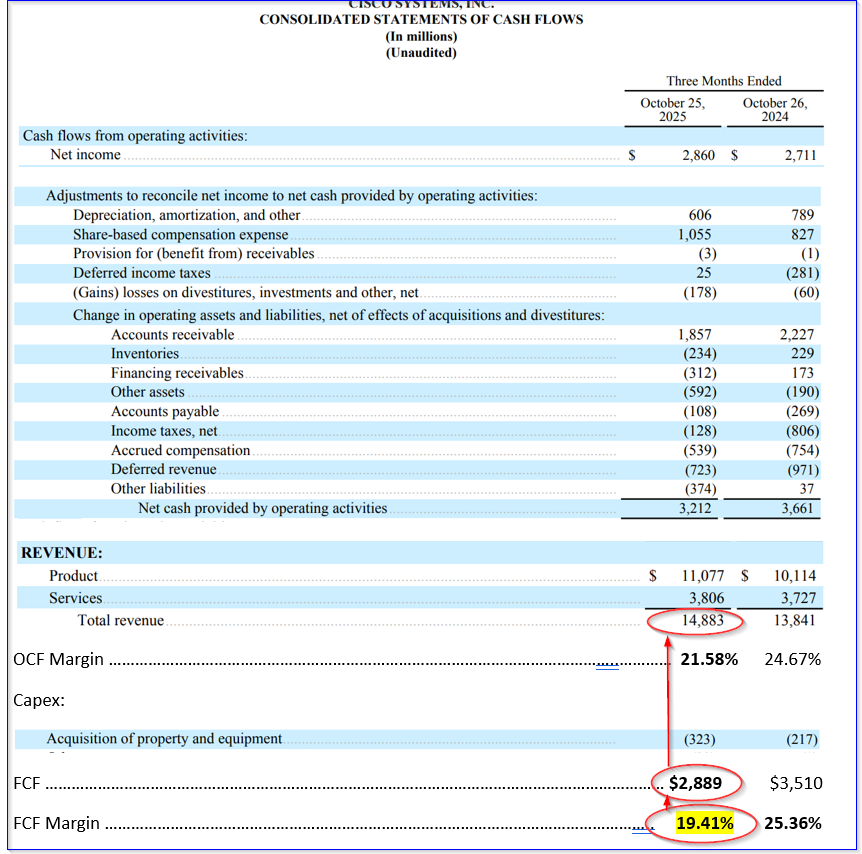

For example, operating cash flow (OCF) for the quarter was $3.212 billion, compared to $3.661 billion a year ago. That's a decline of -12.26% over the last 12 months. That implies its cash expenses have been rising.

In addition, free cash flow (FCF) was -16.1% lower at $2.889 billion in the latest quarter, compared to $3.444 billion a year ago. That was partly due to slightly higher capex spending.

In fact, since revenue was up 8% YoY, the FCF margin (i.e., FCF/revenue) was down from a year ago. Stock Analysis shows that the FY Q1 2026 FCF margin was 19.41%, compared to 24.88% a year ago.

Moreover, it was down from a 27.88% margin last quarter. However, over the trailing 12 months (TTM), Cisco's FCF margin has averaged about 22% (22.07% according to Stock Analysis). We can use that to estimate its valuation.

For example, analysts now project that revenue this fiscal year ending June 30, 2026, will be $60.73 billion. Next fiscal year, they project $63.7 billion.

So, for the next 12 months (NTM), since there are only 3 quarters left this fiscal year, the projected revenue is:

(0.75 x $60.73 billion) + (0.25 x $63.7 billion) = $45.4375b + $15.925b = $61.3625 billion NTM revenue

So, if we assume Cisco can raise its FCF margin from 19.41% this past quarter to the 22.07% TTM rate over the NTM:

0.2207 x $61.3625 billion = $13.5427 billion FCF

We can use this to project its target price.

Target Price for CSCO Stock

One way to value a stock is to use its historical FCF yield. For example, right now the stock has a dividend yield of 2.095% (i.e., $1.64/$78.28).

Similarly, its TTM FCF of $12.733 billion represents 4.1% of its $309.6757 billion market cap today. (This is based on its Q1 2026 3.956 billion shares outstanding x $78.28 price per share).

So, as a result, if we assume that 100% of it FCF were to be paid out to shareholders, its NTM FCF can be divided by 4.1% to determine the future market value:

$13.5427b NTM FCF / 0.041 = $330.3 billion mkt value

That implies that Cisco's valuation could rise by +6.66% (i.e., $330.3b / $309.68b today) from today's valuation. This means that CSCO is worth:

1.0666 x $78.28 = $83.49 per share

That is not much of an upside. Of course, it's always possible the stock market can push a stock higher than its valuation. Nevertheless, it makes sense to look to buy in at a lower price.

One way to set a lower buy-in and get paid while waiting is to sell short out-of-the-money (OTM) put options in nearby expiry periods.

Shorting OTM CSCO Puts

For example, Dec. 12, 2025, expiry period shows that the $75.00 strike price put option contract has a midpoint premium of $0.86.

That means that an investor who secures $7,500 in cash with their brokerage firm can enter an order to “Sell to Open” 1 put contract. That account will then receive $86.00.

This represents a one-month yield of 1.5% (i.e., $86.00 / $7,500 = 0.011467 = 1.1467%).

This is a pretty good one-month return, even if CSCO doesn't fall 3% to $75.00 over the period. But, even if it does, the investor has a lower breakeven buy-in average:

$75.00 - $0.86 = $74.14 breakeven

That is $4.00 below today's price, or -5.1% lower, based on the income already received.

This allows the investor to make a potentially better expected return, assuming the $83.49 target price hits:

$83.49 / $74.14 -1 = 0.126 = +12.6% upside

Keep in mind, there is no guarantee that the investor won't end up with an unrealized capital loss.

That would happen if CSCO falls below the breakeven point. But at least, at that point, the investor could sell covered calls or sell short more OTM puts. That could mitigate any unrealized losses.

The bottom line here is that CSCO stock may be near a peak, but shorting OTM puts is one way to play it. That way, an investor can make income and set a lower buy-in price.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- These 3 Unusually Active Puts Deep ITM Offer Strategic Plays for Both Bulls and Bears

- Cisco Delivered Strong, But Lower Free Cash Flow and FCF Margins - Has CSCO Stock Peaked?

- These 2 ETFs May Be the Best-Kept Secrets on Wall Street

- Two Straddles Define Wednesday’s Unusual Options Activity Across Key Stocks