The cannabis sector is one that most investors would probably describe as a former bubble. But today, with valuations coming down significantly across the board and recent news that President Trump signed an executive order reclassifying marijuana as a less dangerous drug, we've seen some major cannabis players in this market surge lately.

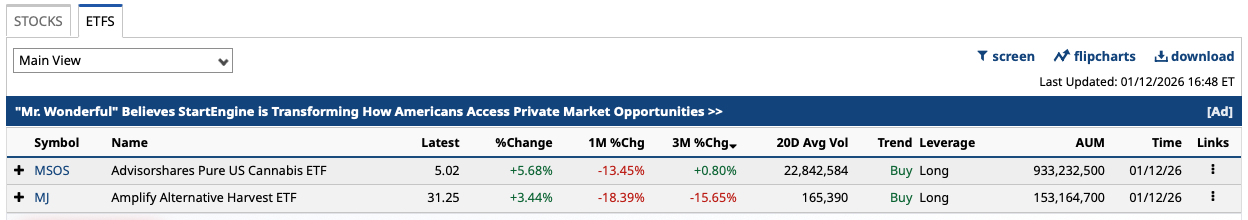

However, as most investors who have been paying attention may have noticed, that's not true across the board. Below is a list of two of the major U.S.-traded exchange-traded funds (ETFs) following this sector and their relative performance.

I'm going to focus on the AdvisorShares Pure US Cannabis ETF (MSOS), which has actually seen positive performance over the past month, due in part to this ETF's complexion. Let's dive into why this particular ETF is outperforming and whether investors here in the U.S. should consider adding exposure to this particular fund (or any cannabis ETF for that matter) right now.

Why Is the MSOS ETF Outperforming?

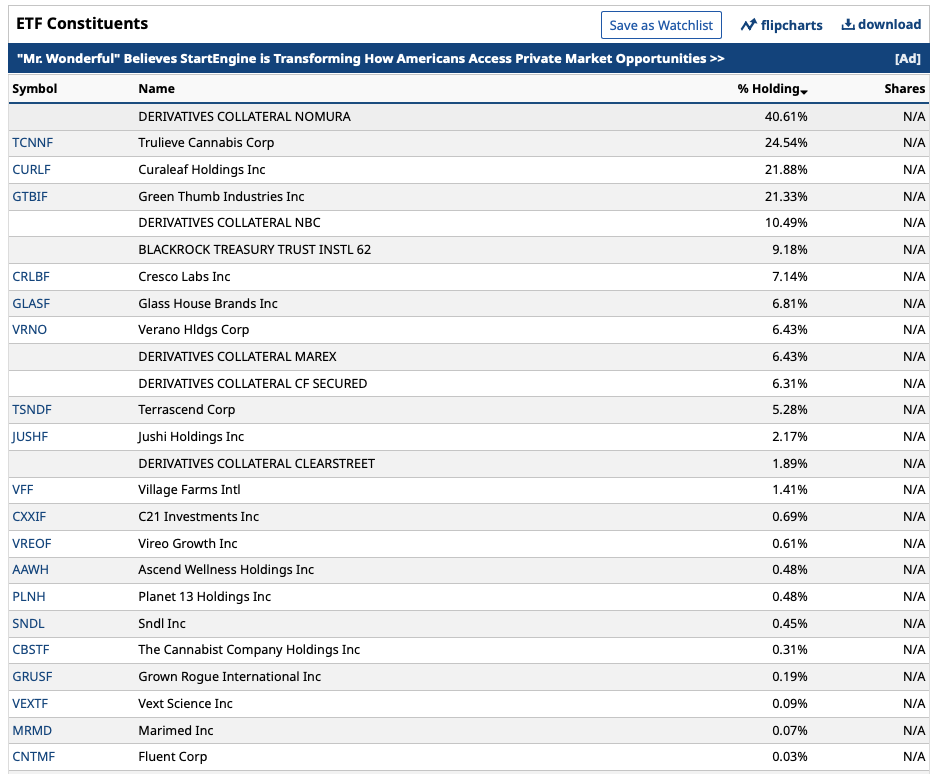

The AdvisorShares Pure US Cannabis ETF is an actively managed ETF that tracks a broad range of cannabis producers and hemp companies but has a distinct focus on MSOs (multi-state operators). These MSOs are U.S.-based cannabis firms that operate in states that have legalized the sale of recreational marijuana.

To a certain extent, the MJ ETF listed above also tracks similar stocks (though with more of an emphasis on producers, which have been more challenged of late). That's led to some relatively close alignment in both ETFs' respective price movements but also explains why MSOS has outperformed. Because the majority of both ETFs aren't laser-focused on medical marijuana firms (those most likely to benefit from the research implications of the hyperlinked reclassification news above), there hasn't been as much upside with holding either particular ETF following this news.

That makes sense. The U.S. cannabis sector is still one that's relatively gated off to the world, and one in which specific operators can only put up locations in specific locales across the country. That makes for a complicated mishmash of a system that some companies have moved away from in recent years.

That said, for those bullish on the potential long-term implications of federal legalization (if and when that happens is very uncertain), these are the sorts of ETFs that can provide the best upside for investors during those periods.

Is This ETF Worth a Gamble Right Now?

I maintain that the cannabis sector is one that's inherently risky and speculative. That's because investors essentially have to bet not only on the federal government to legalize marijuana over the long term but also that companies operating in this space will eventually be profitable (even after various “sin” taxes that are likely to be imposed on future sales). For Canadian cannabis companies, it hasn't turned out to be the party many thought it would be, let's put it that way.

That said, it's also true that the MSOS ETF and others tracking this sector have performed quite well over the past year. Zooming out, the chart looks a lot different going back five years (but that's true for the entire sector). I think that investors who have some risk capital to put to work and are willing to stick it out five or 10 years from now may benefit from having some limited exposure to MSOS relative to other ETFs in this space. Though the jury is very much out on such a bet for now.

This isn't a sector I currently have any exposure to, but there are future catalysts that could change my mind. For now, this is an ETF with some decent momentum, and one investors may want to at least follow, particularly given its massive spike seen in recent weeks.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Want to Buy Some of the Best Marijuana Stocks for 2026? Consider This ETF.

- S&P Futures Muted as Investors Weigh JPMorgan Earnings, U.S. Inflation Data in Focus

- Stocks Set to Open Lower Amid Fed Fears, U.S. Inflation Data and Big Bank Earnings Awaited

- Earnings Kickoff, CPI and Other Can't Miss Items this Week