With a market cap of $25.7 billion, Eversource Energy (ES) is a public utility holding company engaged in energy delivery through its Electric Distribution, Electric Transmission, Natural Gas Distribution, and Water Distribution segments across Connecticut, Massachusetts, and New Hampshire. It is expected to unveil its fiscal Q4 2025 results soon.

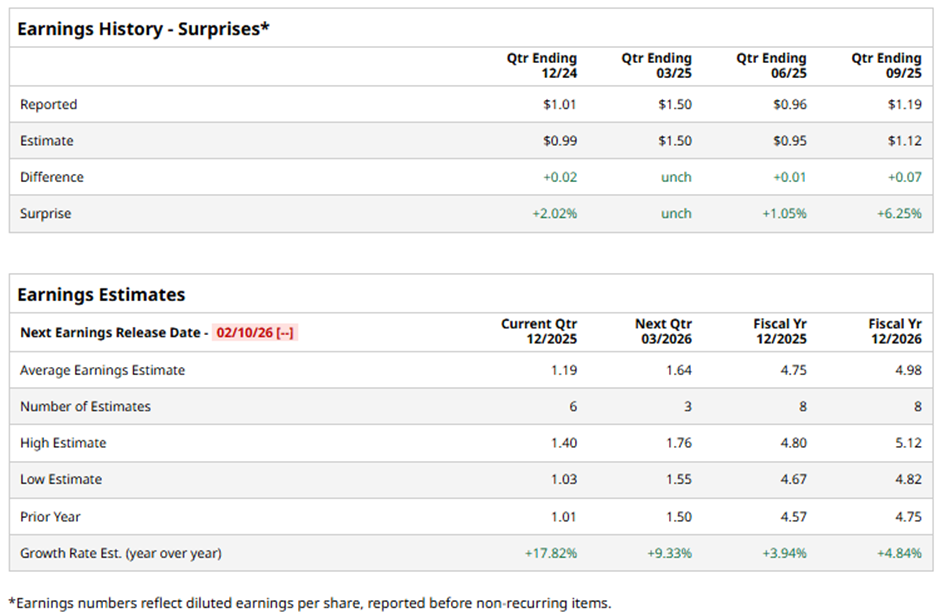

Before the event, analysts anticipate the Springfield, Massachusetts-based company to report an adjusted EPS of $1.19, up 17.8% from $1.01 in the year-ago quarter. It has surpassed or met Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts expect the power provider to report adjusted EPS of $4.75, a rise of 3.9% from $4.57 in fiscal 2024. Moreover, adjusted EPS is projected to grow 4.8% year-over-year to $4.98 in fiscal 2026.

ES stock has soared 22.5% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 19.3% gain and the State Street Utilities Select Sector SPDR ETF's (XLU) 14.7% increase over the same period.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $1.19 on Nov. 4, Eversource Energy’s shares fell 1.2% the next day. The company took a $75 million (or $0.20 per share) charge tied to increased liability from its previously sold offshore wind projects, signaling lingering risks in its clean-energy transition.

Analysts' consensus rating on ES stock is cautious, with a "Hold" rating overall. Out of 16 analysts covering the stock, opinions include five "Strong Buys," eight "Holds," one "Moderate Sell," and two "Strong Sells." The average analyst price target for Eversource Energy is $72.92, indicating a potential upside of 6.6% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AMD Is Almost Sold Out of CPUs for 2026. Does That Make AMD Stock a Buy Now?

- KeyBanc Says Intel Has Made ‘Significant Progress.’ Does That Make INTC Stock a Buy Here?

- UnitedHealth Just Got a Checkup, and UNH Stock Has Some Big Problems to Treat in 2026. The Bull and Bear Cases Now.

- This Trade for Microsoft Profits if the Stock Stays Above $435