Valued at a market cap of $10.8 billion, Charles River Laboratories International, Inc. (CRL) is a global contract research organization (CRO) headquartered in Wilmington, Massachusetts. It supports the drug discovery and development process for pharmaceutical, biotechnology, medical device, and government clients worldwide.

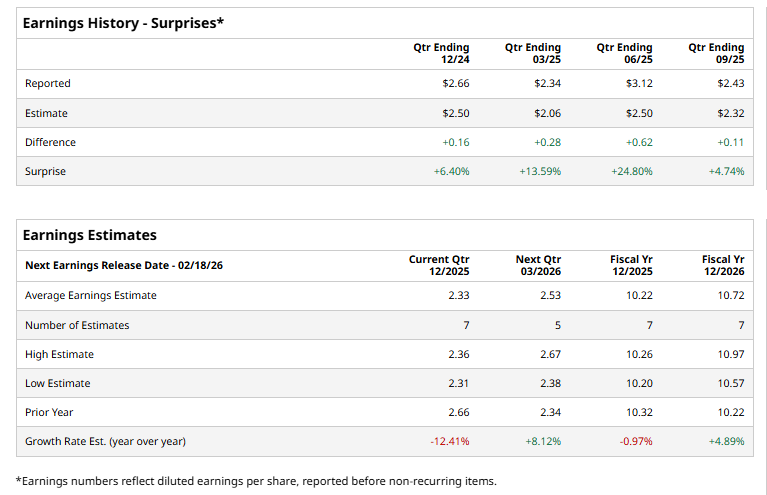

It is expected to announce its fiscal Q4 earnings for 2025 soon. Before this event, analysts expect this healthcare company to report a profit of $2.33 per share, down 12.4% from $2.66 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters.

For fiscal 2025, analysts expect CRL to report a profit of $10.22 per share, down 1% from $10.32 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 4.9% year over year to $10.72 in fiscal 2026.

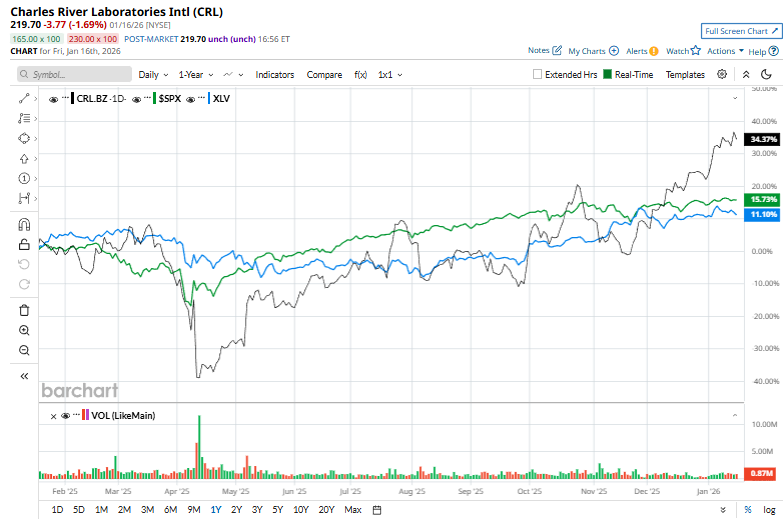

CRL has increased 32.5% over the past 52 weeks, outperforming the S&P 500 Index's ($SPX) 16.9% uptick and the Health Care Select Sector SPDR Fund’s (XLV) 10.4% rise over the same time period.

Shares of Charles River Laboratories rose about 3% on Dec. 22, after BofA Securities upgraded the stock to “Buy” and the SEC closed its investigation into the company’s primate sourcing practices without taking enforcement action, removing a major overhang for investors.

Wall Street analysts are moderately optimistic about CRL’s stock, with an overall "Moderate Buy" rating. Among 16 analysts covering the stock, 11 recommend "Strong Buy," and five suggest "Hold.” While the stock currently trades above the mean price target of $209.57, its Street-high target of $260 implies an upswing potential of 18.3% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart