Meta Platforms (META) has spent the past few months doubling down on an AI-led pivot, leaning into big capex plans and heavier R&D as it chases new ad and engagement opportunities, moves that have weighed on the stock despite solid top-line momentum.

That backdrop is precisely why Rothschild & Co. Redburn just bumped META stock to a “Buy,” also lifting its price target to $900, a call that assumes today’s worries about AI spending obscure much larger, long-term value.

The firm raised FY26 cost and capex forecasts, pushing near-term EPS down, yet says the upside from Meta’s AI-driven “demand machine” more than offsets those headwinds.

Cordwell even warns shares could briefly slip to the mid-$500s after earnings, creating what he sees as a buying opportunity for roughly a 40% upside from current levels.

About Meta Platforms Stock

Founded in 2004, Meta Platforms is unique as the parent of Facebook, Instagram, WhatsApp, and other apps. The company connects roughly 3.5 billion people daily across its social networks. This vast user base powers the world’s largest digital advertising business, and the company is now pouring resources into AI and immersive VR/AR via its Oculus unit alongside social media.

With millions logging in daily, Meta is turning its social networks into a testing ground for AI tools and new ad formats, aiming to boost revenue across its apps. Its Twitter-like Threads app has seen explosive growth; recent data show roughly 141.5 million daily mobile users on Threads versus about 125 million for Elon Musk’s X (formerly Twitter) as of early January 2026, and Meta has begun rolling out ads on Threads as a new revenue source.

However, on the regulatory front, Meta also faces some challenges. Recently, a Dutch court has ordered changes to Facebook/Instagram feeds under the EU’s Digital Services Act, demanding easier user opt-outs for recommended content. In the U.S., the FTC has asked an appeals court to revive its antitrust case over Meta’s Instagram/WhatsApp acquisitions. And in California, a jury trial just began over a claim that social media design fueled teen addiction and depression, with CEO Mark Zuckerberg expected to testify.

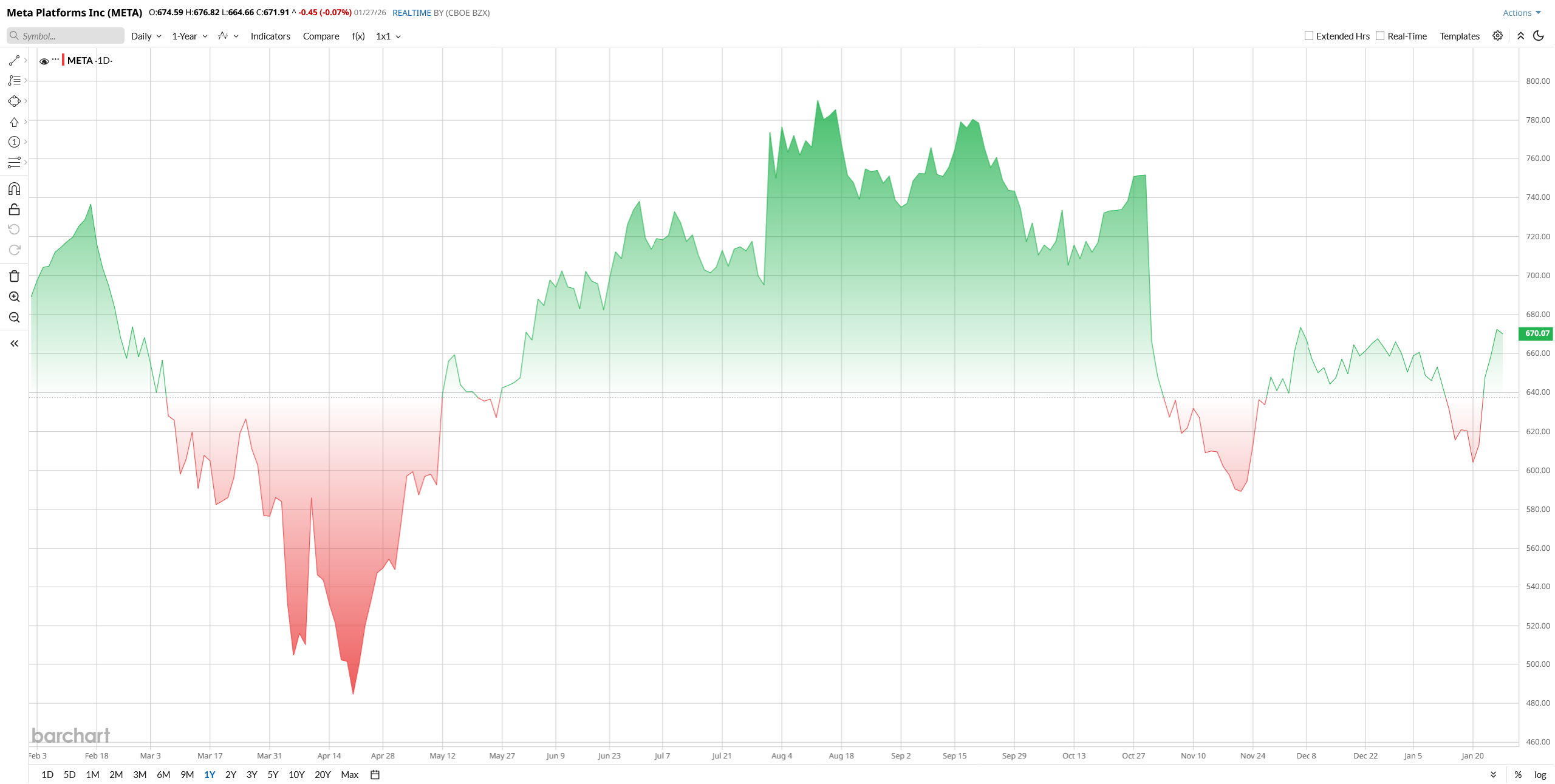

Valued at nearly $1.7 trillion by market cap, Meta’s shares were volatile in 2025 but finished higher. The stock logged a roughly 1% gain over the past 52 weeks. Heavy AI-driven capex and rising R&D costs pressured near-term profits and investor sentiment, leaving Meta behind the broader market in 2025. However, over the last week, the stock has jumped 10%, triggering the bullish momentum. Currently trades around $672 and sits above its 50-day moving average of $642, suggesting the recent uptrend has lifted it back above key technical support.

As expected, like other tech giants, investors are paying a premium for Meta's valuation. Its price/sales is at 9x compared to the sector median of 1.3x, and EV/sales is at 9x versus a sector of 2x. This indicates the stock might be overpriced compared to its peers. In short, META is not “cheap” by media-sector norms, though big investors point out its profits and cash flow remain very strong.

Why James Cordwell is Bullish on Meta

A notable call Meta got this week is when James Cordwell at Rothschild/Redburn upgraded Meta from “Neutral” to “Buy,” lifting his 12-month target to $900. META stock jumped about 2% on the news.

Cordwell cited Meta’s dominant ad platform and accelerating AI innovations, even as he raised estimates for 2026 capital spending. He warned that higher AI/data-center costs might shave $2.75 off 2026 EPS, possibly knocking consensus down to $27 to $28 from $29.55, which he said could send the stock into the mid-$500s if realized.

Nevertheless, he concluded that at $650, “the upside far outweighs any near-term risks.” In other words, Rothschild sees the current pullback, thanks to cost fears, as a buying opportunity given Meta’s long-term growth. This upbeat call has been widely noted: for example, a Benzinga roundup highlights the new $900 target, implying 37% upside. If it holds, it could bolster sentiment into the earnings release; conversely, any Q4 earnings miss might reverse these gains.

What to Expect From Q4 Earnings

Meta will report Q4 2025 results on Jan. 28 after the market closes. Analysts expect continued strong ad-driven growth. The current consensus is roughly $58 to 59 billion in revenue and about $8.3 EPS, which would mark about 20 to 21% revenue growth year-over-year (YoY). For reference, Q3 revenue was $51.24 billion, which delivered 26% YoY growth.

Guidance and expenses will be under the microscope. Management has signaled that 2026 capital spending will be significantly higher than 2025. Investors will watch for any signs that AI/data-center capex is starting to yield returns, e.g., higher ad load or better user engagement on Reels.

Wall Street checks suggest ad demand remains strong, with one large agency forecasting Q4 digital ad spend up 8 to 10%, with Meta’s slice growing even more.

Overall, analysts see a “modest beat” as plausible. For example, Bank of America projects $59.2 billion in revenue and $8.27 in EPS. But full-year guidance on expenses will be critical. Management has already noted that 2026 operating costs could grow “notably” as new data centers come online. In short, investors will parse not just the Q4 numbers but also the outlook, how fast Meta can turn its big investment cycle into revenue growth.

What Do Wall Street Analysts Think About META Stock?

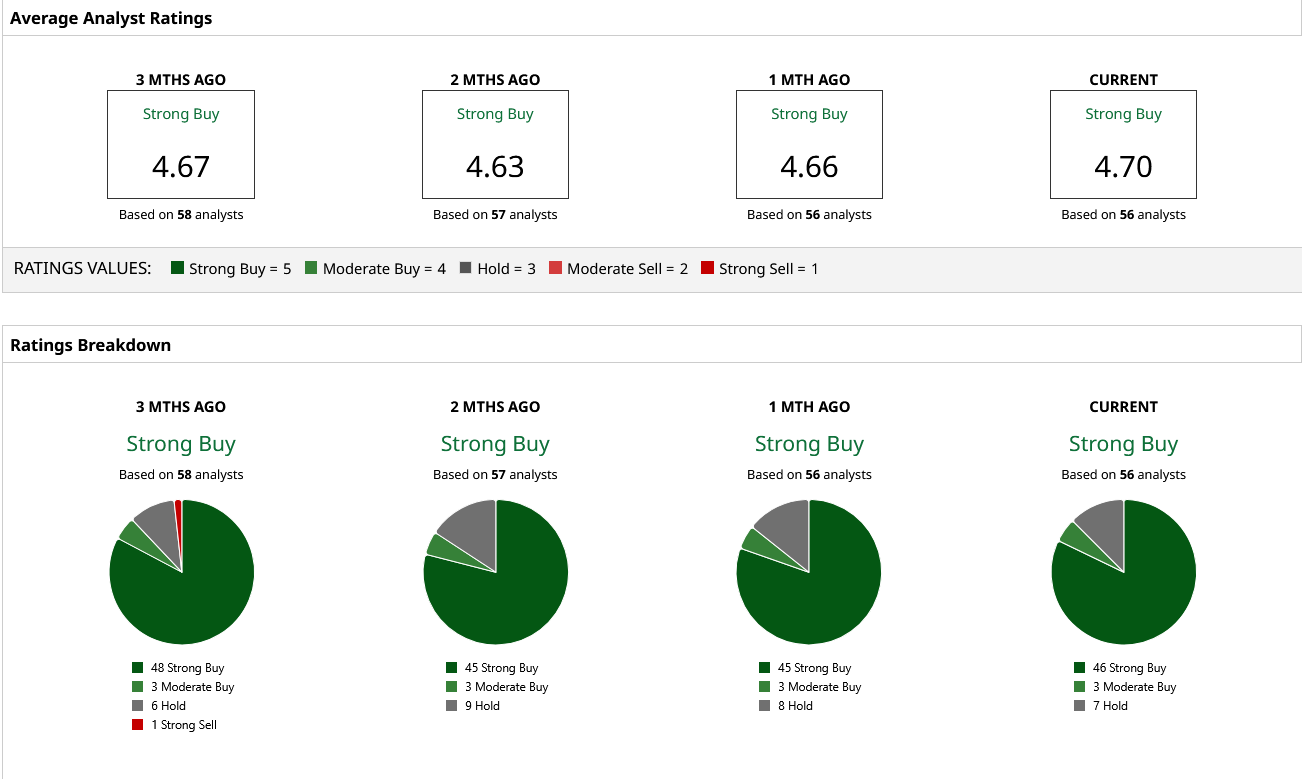

Wall Street is extremely bullish on META stock. The group of 56 analysts covering the stock has given a consensus “Strong Buy” rating, with 46 “Strong Buy,” three “Moderate Buy,” and seven “Hold.” Notably, no analysts gave a “Sell” rating to the stock. The bullish group has set a mean price target of $832.40, which implies an expected 33% upside potential over current levels.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoFi Is Poised to Report Strong Q4 Results. Is a Share-Price Rebound in SOFI Stock's Future?

- Dear Amazon Stock Fans, More Layoffs Are Coming This Week

- Bullish Price Surprise: Is Lands’ End’s Licensing JV the Beginning of the End or a New Beginning?

- Dear Starbucks Stock Fans, Mark Your Calendars for January 29