Valued at a market cap of $44.6 billion. Yum! Brands, Inc. (YUM) is a global quick-service restaurant franchisor headquartered in Louisville, Kentucky. The company operates one of the world’s largest restaurant systems through its iconic brands, KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill, spanning more than 55,000 restaurants in more than 155 countries and territories.

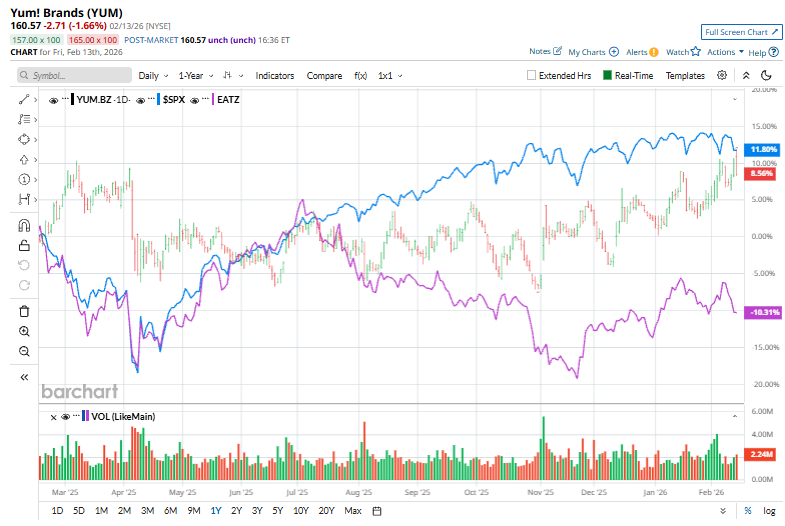

Shares of this fast-food company have gained 8%, trailing the broader S&P 500 Index ($SPX), which has rallied nearly 11.8%. However, YUM’s stock rose 6.1% on a year-to-date basis, compared to SPX’s marginal fall.

Narrowing the focus, YUM has outperformed the AdvisorShares Restaurant ETF (EATZ), which has declined 11% over the past year and gained 3.9% on a YTD basis.

On Feb. 4, Yum! Released its fiscal 2025 Q4 results, and its shares rose marginally. Its revenue rose 6% year over year to $2.51 billion, and global same-store sales were up 3%, driving a 5% increase in system sales. However, adjusted EPS of $1.73, though up about 8% year over year, came in slightly below analyst expectations, tempering an otherwise healthy quarter marked by steady sales growth and margin expansion.

For the current fiscal year, ending in December 2026, analysts expect YUM’s EPS to grow 9.4% to $6.07. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

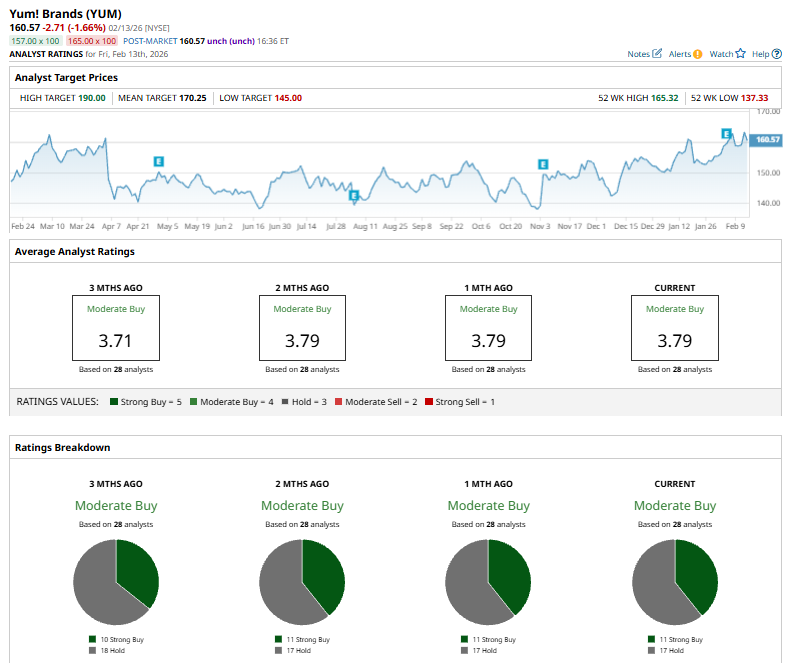

Among the 28 analysts covering YUM stock, the consensus is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings and 17 “Holds.”

This configuration is slightly more bullish than three months ago, when there were ten “Strong Buy” suggestions.

On Feb. 13, Evercore ISI analyst Matt McGinley raised his price target on Yum! Brands to $190 from $180, which is also the Street-high price target. The analyst reiterated an “Outperform” rating, signaling continued confidence in the stock’s upside potential.

The mean price target of $170.25 represents a 6% premium to YUM’s current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What are Global Markets Watching Monday?

- Markets Don’t Bottom On Fear. They Bottom When Forced Sellers Are Done

- AI Disruption Fear, FOMS and Other Key Things to Watch this Week

- Warren Buffett Says Only Buy Stocks You’re Comfortable Holding For Ten Years, Otherwise Don’t Bother Even ‘Owning it for Ten Minutes’