Valued at a market cap of $21.6 billion, SBA Communications Corporation (SBAC) is a real estate investment trust (REIT) that owns and operates wireless communications infrastructure, primarily cell towers, leased to mobile network operators. Headquartered in Boca Raton, Florida, the company generates recurring revenue by renting antenna space on its towers and related sites to carriers such as AT&T, Verizon, and T-Mobile under long-term contracts with built-in escalators.

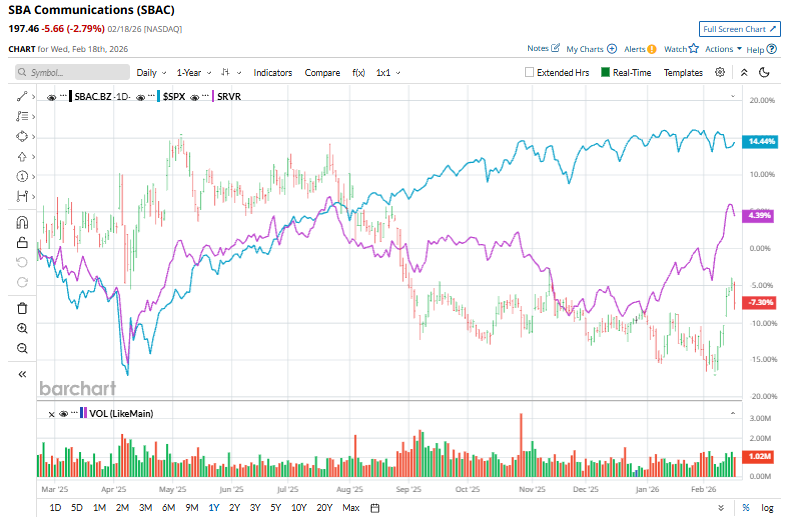

This specialty REIT has considerably underperformed the broader market over the past 52 weeks. Shares of SBAC have declined 4.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. However, on a YTD basis, the stock is up 2.1%, compared to SPX’s marginal uptick.

Narrowing the focus, SBAC has also underperformed the Pacer Benchmark Data & Infrastructure Real Estate ETF’s (SRVR) 5.5% rise over the past 52 weeks.

SBA Communications has underperformed the broader market over the past year, mainly due to moderating tower-leasing demand after the initial 5G build-out cycle, which slowed organic growth and revenue momentum. At the same time, the company’s REIT structure and relatively high leverage made the stock more sensitive to elevated interest rates, pressuring valuation. Additional headwinds, including tenant churn linked to the Sprint/T-Mobile merger, foreign-exchange weakness in key markets such as Brazil, and a muted near-term AFFO growth outlook, further weighed on investor sentiment.

For FY2025 that ended in December, analysts expect SBAC’s FFO to decline 8.8% year over year to $12.20. On the bright side, the company’s FFO surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

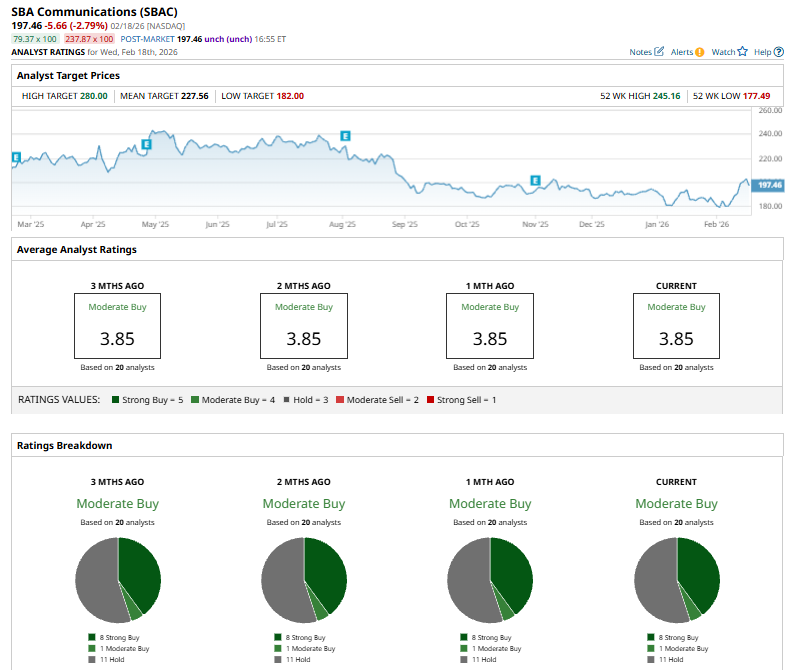

Among the 20 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy,” one "Moderate Buy,” and 11 "Hold” ratings.

On Jan. 20, 2026, UBS analyst Batya Levi reiterated a “Buy” rating on SBA Communications but cut the price target to $260 from $275.

The mean price target of $227.56 represents a 15.2% premium from SBAC’s current price levels, while the Street-high price target of $280 suggests an ambitious 41.8% potential upside from the current levels

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart