Electronic manufacturing services company Plexus (NASDAQ: PLXS) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 1.4% year on year to $980.2 million. The company expects next quarter’s revenue to be around $1.02 billion, close to analysts’ estimates. Its non-GAAP profit of $1.66 per share was 7.8% above analysts’ consensus estimates.

Is now the time to buy Plexus? Find out by accessing our full research report, it’s free.

Plexus (PLXS) Q1 CY2025 Highlights:

- Revenue: $980.2 million vs analyst estimates of $980.1 million (1.4% year-on-year growth, in line)

- Adjusted EPS: $1.66 vs analyst estimates of $1.54 (7.8% beat)

- Revenue Guidance for Q2 CY2025 is $1.02 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q2 CY2025 is $1.73 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 5%, in line with the same quarter last year

- Market Capitalization: $3.36 billion

Todd Kelsey, President and Chief Executive Officer, commented, “Plexus generated strong fiscal second quarter financial performance, demonstrating the continued momentum of our operational and working capital efficiency initiatives. We achieved revenue of $980 million, in-line with guidance, with non-GAAP operating margin of 5.7% at the high-end of guidance and non-GAAP EPS of $1.66 exceeding guidance. In addition, free cash flow exceeded our expectations.”

Company Overview

With over 20,000 team members across 26 global facilities, Plexus (NASDAQ: PLXS) designs, manufactures, and services complex electronic products for companies in aerospace/defense, healthcare, and industrial sectors.

Electronic Components & Manufacturing

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $3.97 billion in revenue over the past 12 months, Plexus is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

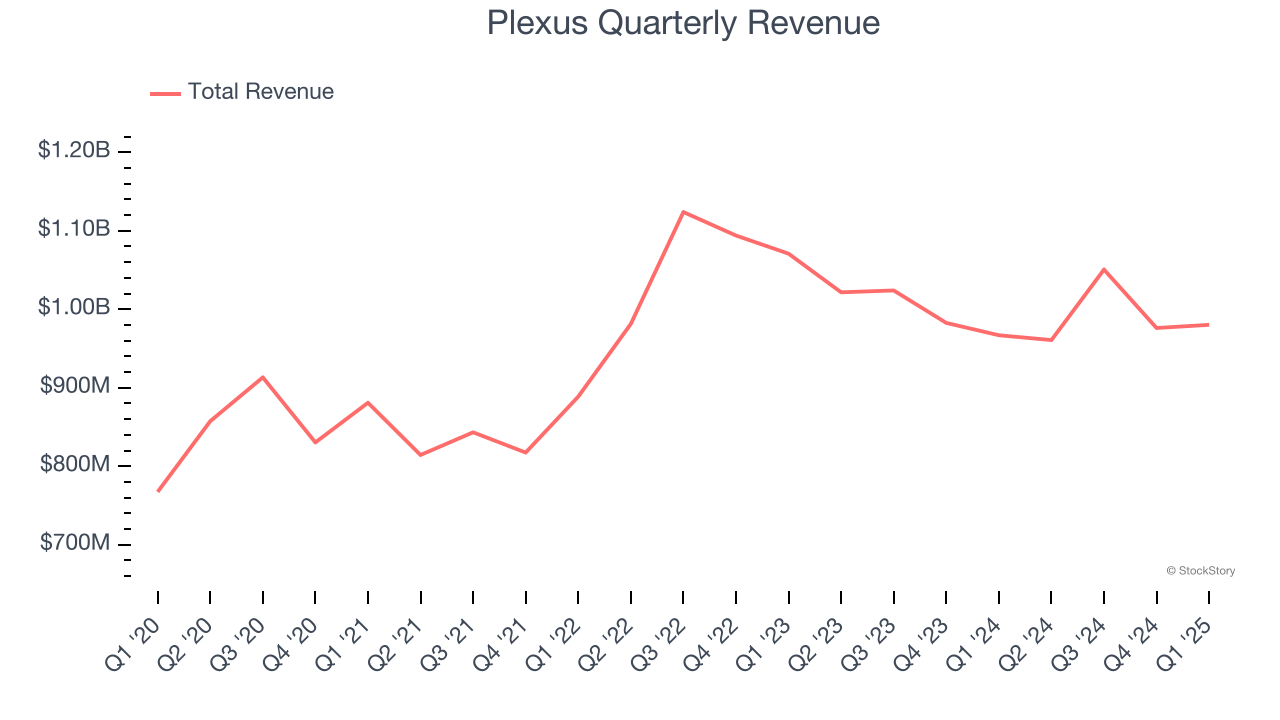

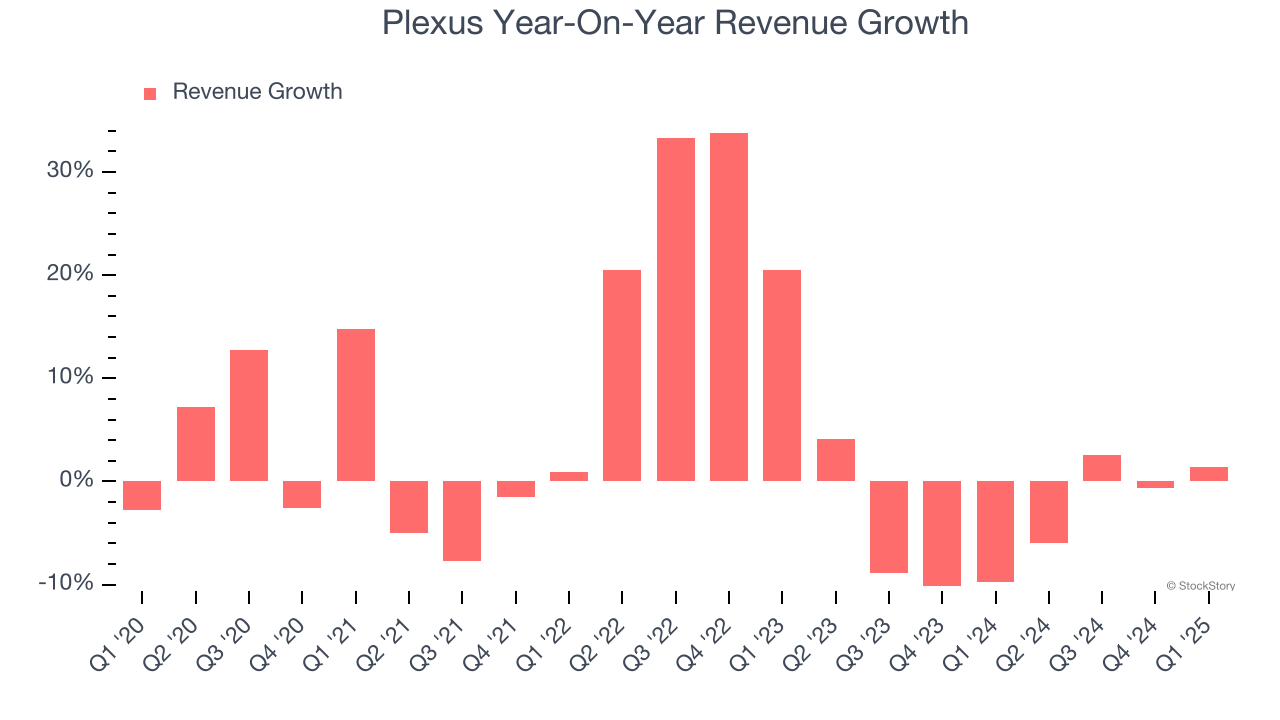

As you can see below, Plexus grew its sales at a mediocre 4.2% compounded annual growth rate over the last five years. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Plexus’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.6% annually.

This quarter, Plexus grew its revenue by 1.4% year on year, and its $980.2 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 6.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.4% over the next 12 months, an improvement versus the last two years. This projection is healthy and suggests its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

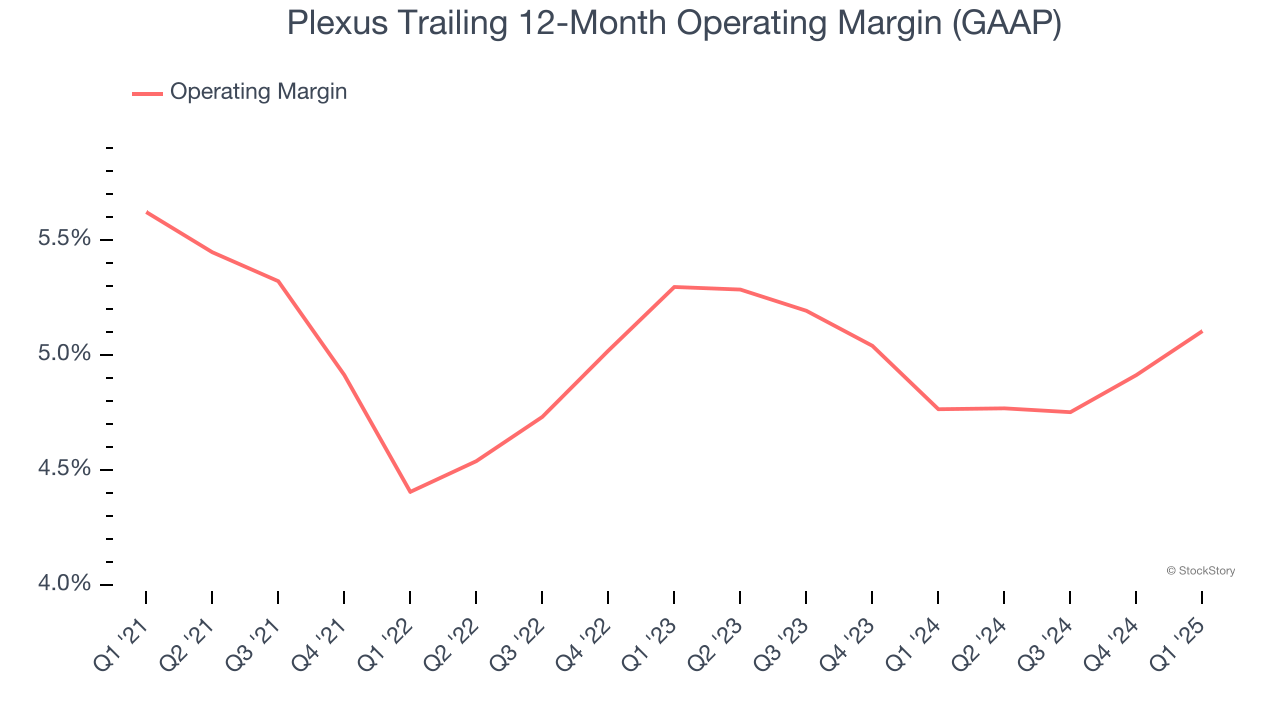

Plexus was profitable over the last five years but held back by its large cost base. Its average operating margin of 5% was weak for a business services business.

Looking at the trend in its profitability, Plexus’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, Plexus generated an operating profit margin of 5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

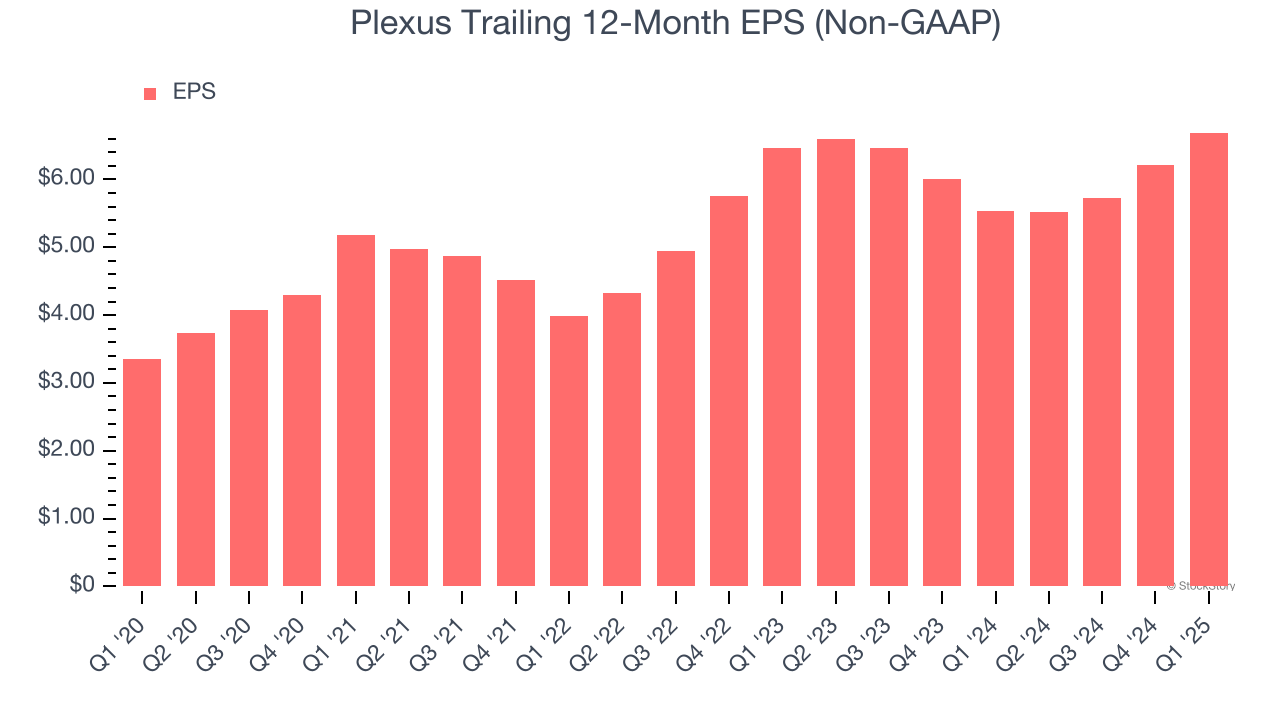

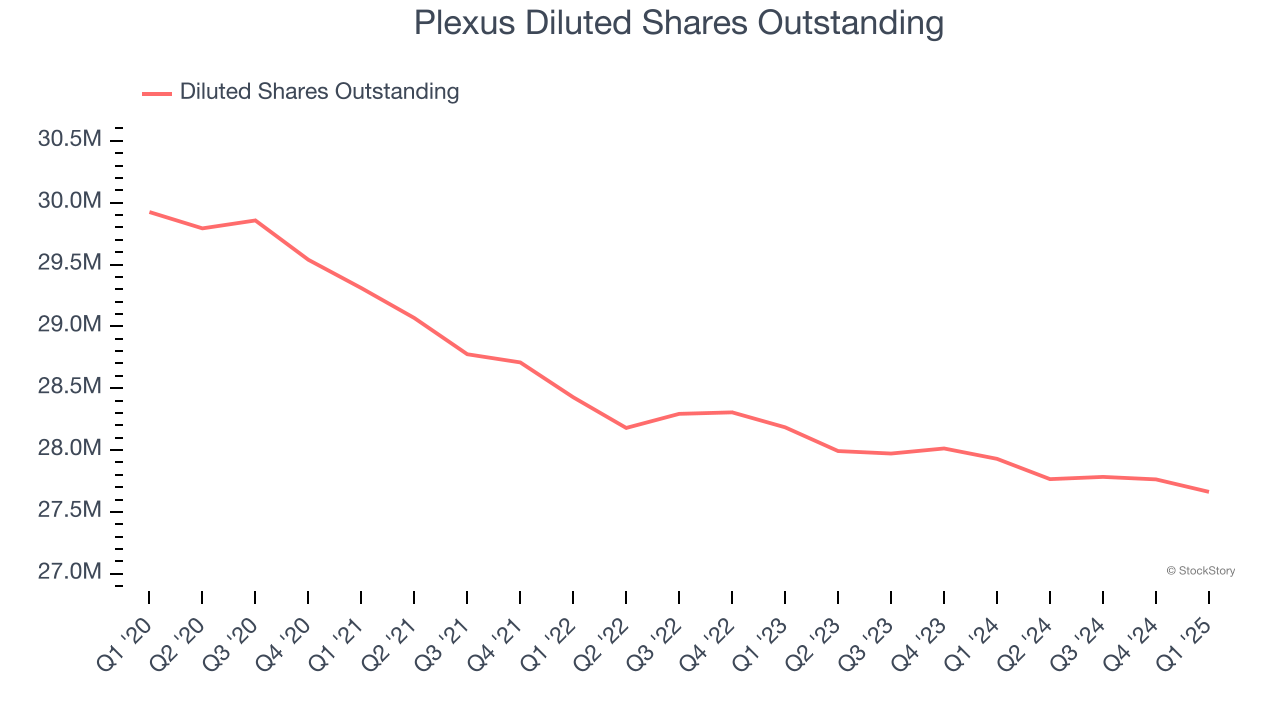

Plexus’s EPS grew at a spectacular 14.8% compounded annual growth rate over the last five years, higher than its 4.2% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Diving into Plexus’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Plexus has repurchased its stock, shrinking its share count by 7.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q1, Plexus reported EPS at $1.66, up from $1.19 in the same quarter last year. This print beat analysts’ estimates by 7.8%. Over the next 12 months, Wall Street expects Plexus’s full-year EPS of $6.69 to grow 8.2%.

Key Takeaways from Plexus’s Q1 Results

We enjoyed seeing Plexus beat analysts’ EPS expectations this quarter. Overall, this quarter had some key positives. The stock remained flat at $127.17 immediately after reporting.

Is Plexus an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.