Over the past six months, BOK Financial’s stock price fell to $104.45. Shareholders have lost 5.6% of their capital, which is disappointing considering the S&P 500 has climbed by 5.4%. This may have investors wondering how to approach the situation.

Is now the time to buy BOK Financial, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is BOK Financial Not Exciting?

Even with the cheaper entry price, we're swiping left on BOK Financial for now. Here are three reasons why we avoid BOKF and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

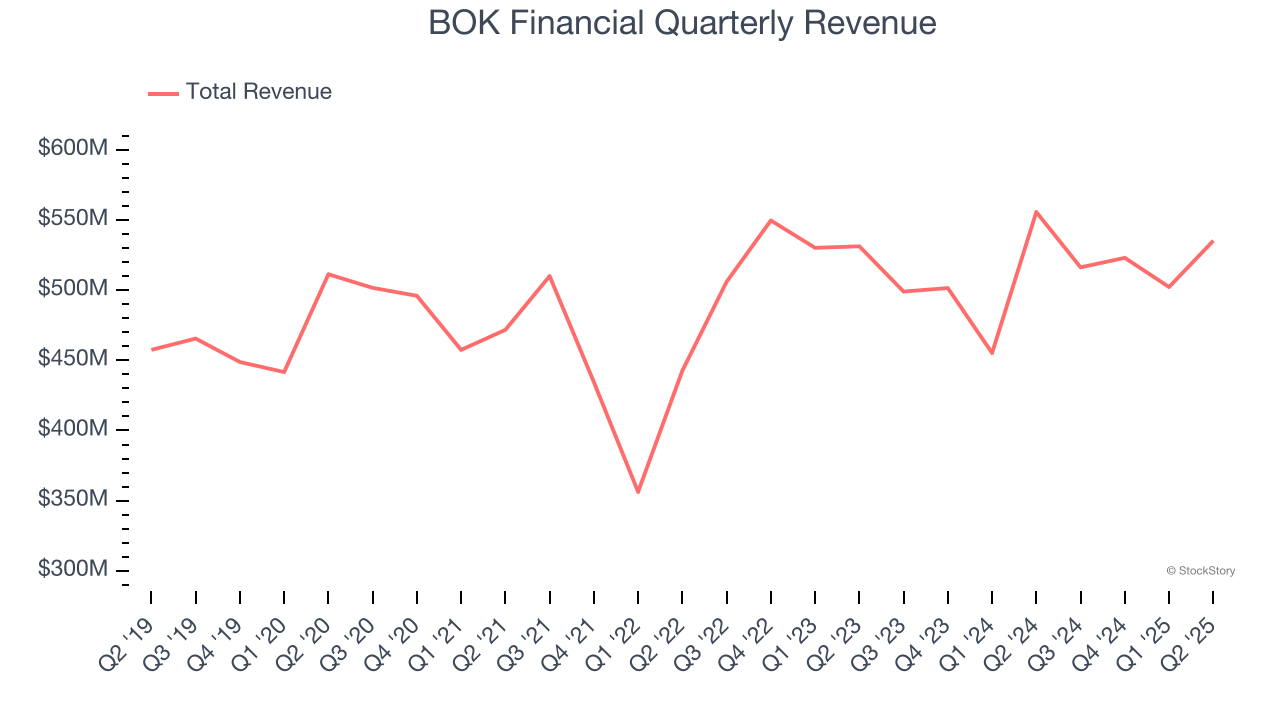

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income.

Unfortunately, BOK Financial’s 2.1% annualized revenue growth over the last five years was tepid. This fell short of our benchmarks.

2. Net Interest Income Points to Soft Demand

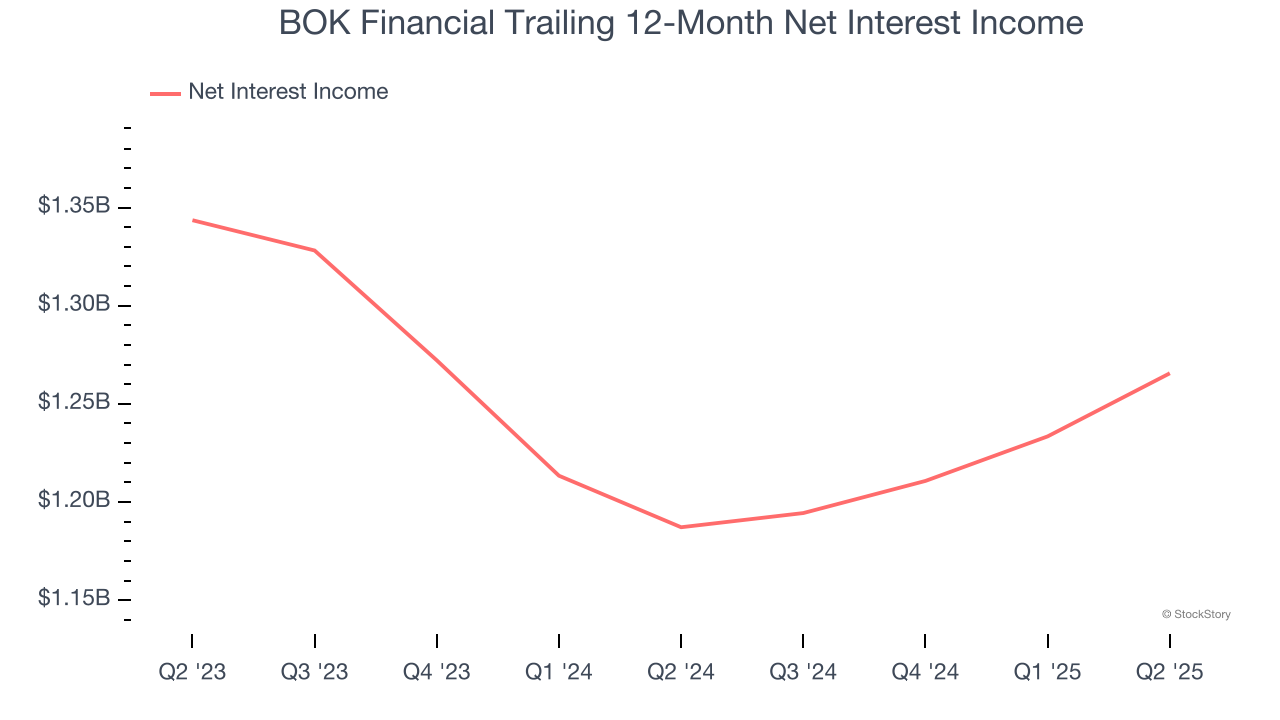

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

BOK Financial’s net interest income has grown at a 3.6% annualized rate over the last five years, worse than the broader banking industry.

3. Net Interest Margin Dropping

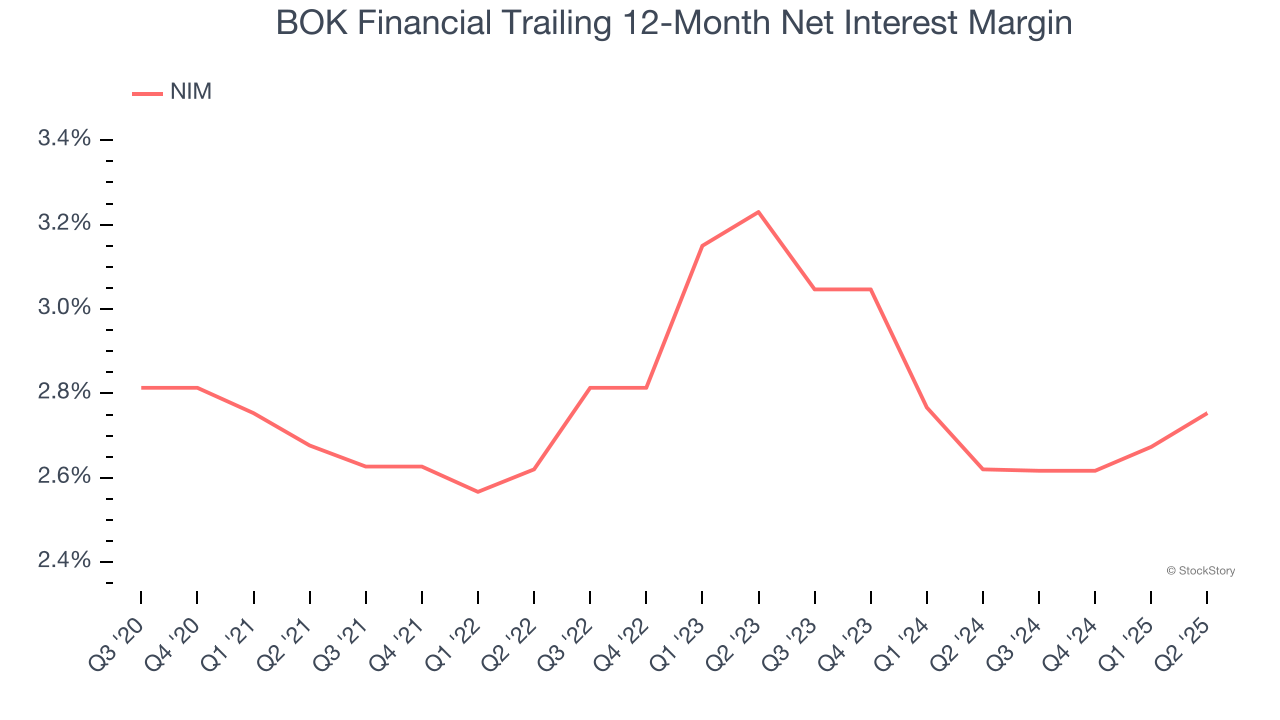

Net interest margin (NIM) serves as a critical gauge of a bank's fundamental profitability by showing the spread between interest income and interest expenses. It's essential for understanding whether a firm can sustainably generate returns from its lending operations.

Over the past two years, BOK Financial’s net interest margin averaged 2.7%. Its margin also contracted by 47.7 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean that BOK Financial either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

Final Judgment

BOK Financial isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 1.1× forward P/B (or $104.45 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.