SaaS Growth of 49%; Sale Contracted in May 2022 to Fund Business Plan to Cash Flow Positive

CALGARY, AB / ACCESSWIRE / August 10, 2022 / FLYHT Aerospace Solutions Ltd. (TSXV:FLY) (OTCQX:FLYLF) (the "Company" or "FLYHT") today reported financial results for the second quarter ended June 30, 2022 ("Q2 2022"). All figures are Canadian dollars unless otherwise stated.

Management Commentary

"FLYHT delivered improved results quarter over quarter, demonstrating the increasing traction we have in our business as well as the unfolding recovery of our airline customers," said Bill Tempany, Interim CEO. "We delivered the second highest revenue quarter in two years driven by growth in SaaS, Licensing and Technical Services, as well as the first full quarter including CrossConsense in our financial results. Revenue of $4.9 million would have been even stronger without licensing shipment delays resulting from short-term supply chain issues at quarter end. Shipments of licensing revenue in the first week of Q3 which were originally scheduled for Q2 amounted to another $900k and likely would have pushed revenue closer to record territory. With the momentum and visibility we have, I am confident that we are on track for a solid year in 2022."

Added Tempany, "Delivery in Q2 of the first few shipments of modems and associated licenses under the purchase order for $5.65 million USD announced on May 4, 2022 contributed to our Q2 increases in the Licensing revenue category. We anticipate delivering on the full purchase order requirements over the remaining quarters of 2022, which will more than provide the funding for FLYHT to execute on our business plan.

Concluded Tempany, "The AFIRS Edge is without a doubt the biggest opportunity that FLYHT has had in years. Driven by the demise of 2G and 3G networks, there is a massive replacement cycle ahead of the global aviation industry, which we think favors FLYHT since we have the only multi-function 3G, 4G and 5G capable solution to serve the estimated 15,000 aircraft around the world. We are making good progress in order to be able to realize this opportunity: the first manufactured AFIRS Edge units have been received from our supplier and are undergoing the final testing and certification steps, while development on the A320and B737 Supplemental Type Certificates (STC's) is well underway."

Operating Results

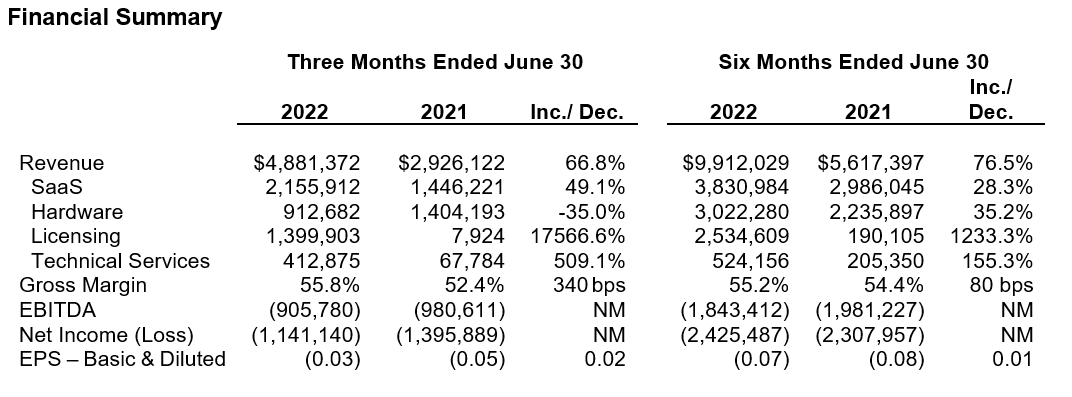

Revenue increased by 67% to $4,881,372 in Q2 2022 compared to Q2 2021, driven by growth in SaaS, Licensing and Technical Services, including $1,144,590 of contribution from CrossConsense which was consolidated into FLYHT's results beginning March 17, 2022. Excluding CrossConsense, revenue increased 28% compared to Q2 2021.

SaaS revenue increased by 49% to $2,155,912 in Q2 2022. The addition of a full quarter of CrossConsense SaaS revenues more than offset a decrease of 5.1% in AFIRS SaaS revenues resulting from a drop in customers' flight hours and active aircraft in some geographies with recent waves of the pandemic. Licensing revenue increased from $7,924 to $1,399,903 due to increases in the number of modems and associated license fees ordered for delivery in comparative periods, as the Company began delivering on an order received in mid-Q2 2022 for US$5.65 million. Technical Services revenue increased by 509% to $412,875 with contributions from CrossConsense services offsetting a decrease of 32.9% from traditional services. Hardware revenue decreased by 35% to $912,682 offsetting a portion of the large increases in hardware shipments seen in Q1 2022. A total of 46 installation kits were shipped YTD 2022 compared withing to 41 shipped YTD 2021.

Gross margin was 56% of revenue in Q2 2022 compared to 52% in Q2 2021. The increase in gross margin was due primarily to changes in the mix of revenue sources during the quarter.

Operating expenses increased by 40% from Q2 2021, driven by a 50% increase in Distribution expenses by 50% and an 84% increase in Administration expenses Research and Development and certification engineering expenses were flat compared to Q2 2021. These increases were largely driven by the Q2 2022 inclusion of a full quarter of CrossConsense's contributions.

EBITDA[1] loss totaled $905,780 in Q2 2022 compared to EBITDA loss of $980,611 in Q2 2021.

Net loss was $1,141,140 in Q2 2022 compared to Net loss of $1,395,889 in Q2 2021.

Balance Sheet and Liquidity

Cash and short-term investments were $2,431,920 at June 30, 2022, compared to $4,520,591 at December 31, 2021.

Trade and other receivables increased by 102% to $3,216,068 compared to YE 2021, and Trade payables and accrued liabilities increased by 68% to $2,855,923 compared to YE 2021. The combination of the addition of CrossConsense working capital balances calculated as part of the acquisition purchase price allocation, in tandem with increased sales in Q2 and associated costs resulted in an increase in both the receivables and payables balances.

Conference Call Information

FLYHT will host a conference call to discuss its second quarter 2022 financial results on Thursday, August 11, 2022, at 7:30am MT (9:30 am ET). The conference call will include a brief presentation from FLYHT's Interim CEO Bill Tempany and CFO Alana Forbes followed by a question-and-answer session. To access the conference call by phone within Canada and the U.S., the toll-free number is 1-800-319-4610. Outside Canada and the U.S., dial 1-604-638-5340. Callers should dial in five to ten minutes prior to the scheduled start time.

Management will accept questions by telephone and e-mail. Individuals wishing to ask a question during the call can do so by pressing *1. Questions can be emailed in advance or during the conference call toinvestors@flyht.com. An archive of the conference call will be posted on the Investor Communications section of FLYHT's website following the meeting.

Additional Information

FLYHT's Q2 2022 Report, which contains more detailed information including the CEO's Letter to Shareholders, Management Discussion and Analysis and Financial Statements, can be accessed on the Company's website. The MD&A and Financial Statements have also been filed with SEDAR and will be accessible at www.sedar.com.

Incentive Options Granted

FLYHT has granted incentive options for an aggregate of 135,000 common shares, subject to regulatory approval, to consultants under the stock option plan approved at the Annual and Special Meeting held on May 4, 2022.

The stock options are exercisable at a price of $0.82 per share. A total of 15,000 options will vest 1/3 on each of August 10, 2023, 2024 and 2025, and will expire on August 10, 2026. A total of 120,000 options will vest quarterly on each of November 10, 2022, February 10, May 10 and August 10, 2023 and will expire August 10, 2026. A maximum of 10% of the issued and outstanding shares are reserved under the Company's stock option plan. The options, and any common shares issued upon exercise of the stock options, are subject to a four-month resale restriction.

About FLYHT Aerospace Solutions Ltd.

FLYHT provides airlines with Actionable Intelligence to transform operational insight into immediate, quantifiable action, and delivers industry leading solutions to improve aviation safety, efficiency, and profitability. This unique capability is driven by a suite of patented aircraft certified hardware products. These include AFIRS™, an aircraft satcom/interface device, which enables cockpit voice communications, real-time aircraft state analysis, and the transmission of aircraft data while inflight. The AFIRS Edge is a state-of-the-art 5G Wireless Quick Access Recorder (WQAR), Aircraft Interface Device (AID), and Aircraft Condition and Monitoring System (ACMS). The Edge can be interfaced with FLYHT's TAMDAR probe or the FLYHT-WVSS-II relative humidity sensor to deliver airborne weather and humidity data in real-time.

CrossConsense, FLYHT's wholly-owned subsidiary, offers highly skilled services to the commercial aviation industry and provides preventative maintenance solutions. These include Aircraft Fleet View, a native application that gives a real-time view of airline fleet status; AviationDW, a managed data warehouse for enhanced business intelligence; and ACSIS, a visualization and predictive maintenance alerting tool.

FLYHT is headquartered in Calgary, Canada, and is an AS9100 Quality registered company. CrossConsense, located in Frankfurt, Germany, is an ISO9001 certified operation. For more information, visit www.flyht.com.

Cautionary Note Regarding Forward-Looking Statements

Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. In particular, forward-looking information in this press release includes, but is not limited to, statements with respect to the anticipated/projected revenues and related matters. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information.

Forward-looking information is based on the opinions and estimates of management at the date the statements are made and are founded on the basis of expectations, assumptions and hypotheses made by the Company, including, but not limited to projected revenues. Such forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada, the United States and globally; industry conditions, and supply chain delays. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Contact Information:

FLYHT Aerospace Solutions Ltd. FNK IR LLC

Alana Forbes Matt Chesler, CFA

Chief Financial Officer Investor Relations

403.291.7437 646.809.2183

aforbes@flyht.com flyht@fnkir.com

investors@flyht.com

Join us on social media!

www.twitter.com/flyhtcorp

https://www.linkedin.com/company/flyht/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

[1] EBITDA: defined as earnings before interest, income tax, depreciation and amortization (a non-GAAP financial measure). EBITDA is provided to aid in analysis and profitability comparisons among companies and industries, by segregating operating results from the effects of financing and capital expenditures.

SOURCE: FLYHT Aerospace Solutions Ltd.

View source version on accesswire.com:

https://www.accesswire.com/711685/FLYHT-Reports-Second-Quarter-2022-Results