With a market cap of $42.4 billion, Monolithic Power Systems, Inc. (MPWR) is a fabless semiconductor company that designs and markets high-performance analog and mixed-signal power solutions used across industrial, automotive, cloud computing, consumer, and communications applications. The company leverages proprietary process technologies and a global customer base spanning the United States, Asia, and Europe.

Shares of the Kirkland, Washington-based company have surpassed the broader market over the past 52 weeks. MPWR stock has surged 51% over this time frame, while the broader S&P 500 Index ($SPX) has risen 12.3%. Moreover, shares of the company have surged 49.5% on a YTD basis, compared to SPX's 12.9% gain.

Looking closer, the chipmaker stock has exceeded the Technology Select Sector SPDR Fund's (XLK) 21.5% return over the past 52 weeks.

On Oct. 30, Monolithic Power Systems reported better-than-expected Q3 2025 adjusted EPS of $4.73 and revenue of $737.2 million, driven by strong momentum in its AI-driven power-management business and guidance for Q4 revenue of $730 million to $750 million. However, shares of the company tumbled 7.6% the next day.

For the fiscal year ending in December 2025, analysts expect MPWR's EPS to grow 26.4% year-over-year to $13.50. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

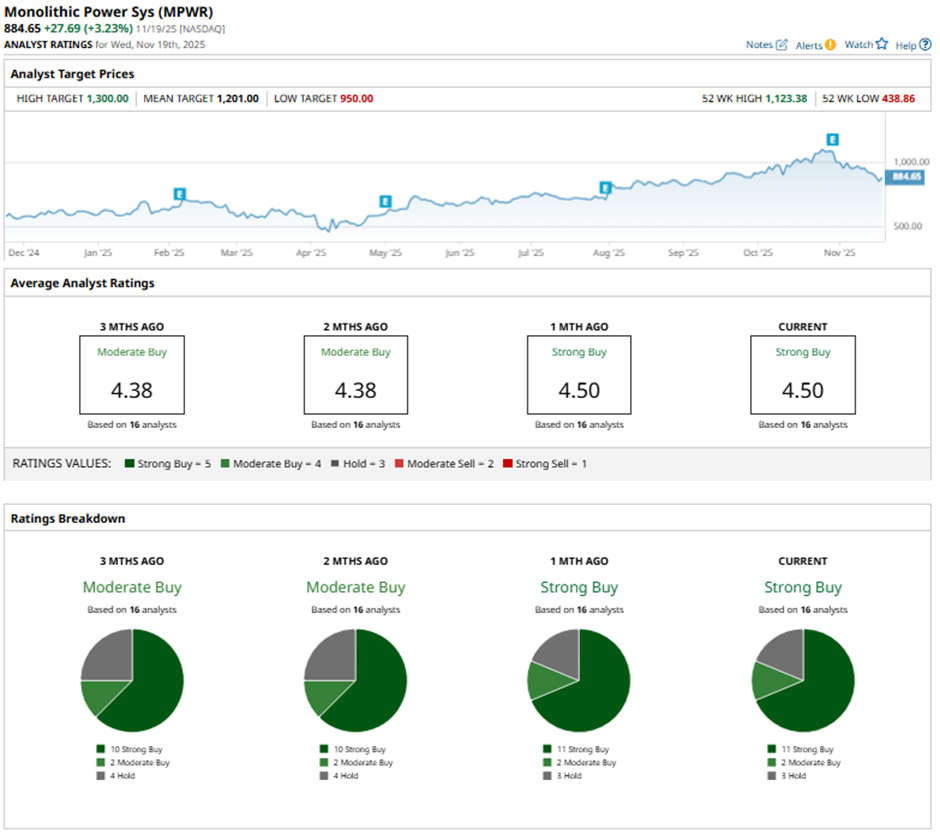

Among the 16 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 11 “Strong Buy” ratings, two “Moderate Buys,” and three “Holds.”

This configuration is slightly more bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Nov. 2, Truist raised its price target on Monolithic Power to $1,163 while maintaining a “Buy” rating.

The mean price target of $1,201 represents a 35.8% premium to MPWR’s current price levels. The Street-high price target of $1,300 suggests a nearly 47% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Burry Calls ‘Fraud’ on Hyperscalers: 4 Pins Set to Pop the AI Bubble and the ‘Big Short’ Math on Big Tech

- The Dow Jones Looks Ready for Death, But These 3 Blue-Chip Stocks Have More Life (and Gains) Ahead

- Jensen Huang Says ‘Blackwell Sales Are Off the Charts, and Cloud GPUs Are Sold Out’ as Nvidia Crushes Q3 Earnings and Beats Analyst Expectations

- Stocks Rally Before the Open on Upbeat Nvidia Earnings, U.S. Jobs Report in Focus