In the fast-moving retail landscape, where consumer sentiment can pivot with a viral post, execution often determines leadership. This year, American Eagle Outfitters (AEO) executed decisively, transforming cultural relevance into financial performance and emerging as the top-performing apparel retail stock of the year.

The company delivered better-than-expected quarterly results and followed through with bullish holiday guidance while raising its full-year outlook. Sydney Sweeney played a key role in a high-impact marketing effort that led to a record-breaking Thanksgiving sales period and demonstrated that prompt brand alignment can immediately result in increased sales and investor confidence.

But the campaign did more than generate buzz. It brought Gen Z into stores and prompted Wall Street to reassess the stock’s growth trajectory. Within the broader consumer discretionary index, American Eagle shares now lead apparel retailers by a wide margin, posting a year-to-date (YTD) gain of 59.87%.

With the stock outperforming its peers and expectations building, the narrative now moves beyond past wins to future potential. So, let us see whether the momentum still signals upside or if much of the success is already priced into the stock.

About American Eagle Stock

Headquartered in Pittsburgh, Pennsylvania, American Eagle is a global specialty retailer offering trend-driven apparel, accessories, and personal care products. Through its American Eagle® and Aerie® brands, the company targets value-conscious consumers, positioning itself at the intersection of affordability and fashion relevance.

The company commands a market cap of approximately $4.5 billion and ships to nearly 80 countries through its websites. Additionally, licensees operate more than 260 international locations across approximately 30 countries, expanding global reach.

American Eagle’s stock performance reflects powerful momentum. Shares have climbed nearly 61.4% over the past 52 weeks, accelerated 172.5% in the last six months, and surged 39.5% in just the past month, highlighting aggressive repricing as investors react to improving fundamentals and renewed brand relevance.

At the same time, valuation demands attention. Trading at 20.43 times forward adjusted earnings, above both industry and five-year historical averages, AEO stock already reflects strong growth expectations.

American Eagle pays an annual dividend of $0.50, yielding 1.84%. Its most recent quarterly cash dividend of $0.125 per share is payable on Jan. 23, 2026, to shareholders of record on Jan. 9, 2026. While modest, the payout reinforces balance-sheet stability and shareholder alignment.

American Eagle Surpasses Q3 Earnings

On Dec. 2, American Eagle reported Q3 fiscal 2025 earnings that exceeded expectations on both revenue and profit, sending shares up 15.1% the following session. Revenue rose 5.7% year-over-year (YOY) to $1.36 billion, surpassing Wall Street’s $1.32 billion forecast.

The company delivered record third-quarter revenue, led by Aerie’s double-digit comparable sales growth and positive momentum at American Eagle. Net income climbed 14.2% from the prior year to $91.34 million, while EPS increased 29.3% to $0.53, beating the $0.44 Street estimate.

Buoyed by stronger trends, American Eagle’s management has raised fourth-quarter operating income guidance to $155–$160 million, based on comparable sales growth of 8% to 9%. This marks a significant upgrade from prior guidance of $125–$130 million, which assumed low single-digit comps.

For the full year, adjusted operating income guidance has risen to $303–$308 million, with comparable sales in the low single digits. This compares with prior guidance of $255–$265 million on flat comps.

Meanwhile, analysts project fiscal 2025 Q4 EPS to rise 22.2% YOY to $0.66. However, full-year fiscal 2025 EPS may decline 23.6% to $1.33, before rebounding 18.8% to $1.58 in fiscal year 2026, reflecting normalization after outsized volatility.

What Do Analysts Expect for American Eagle Stock?

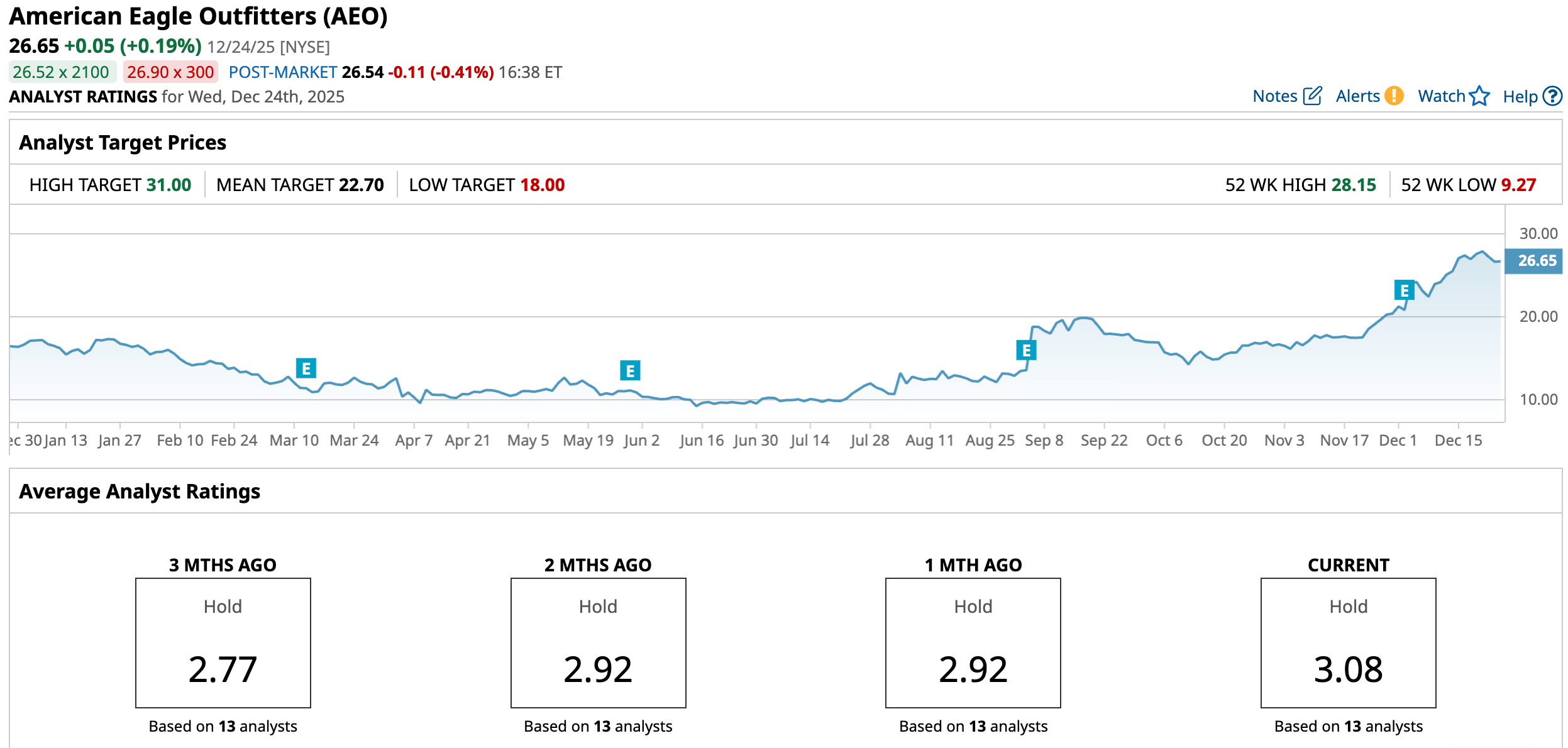

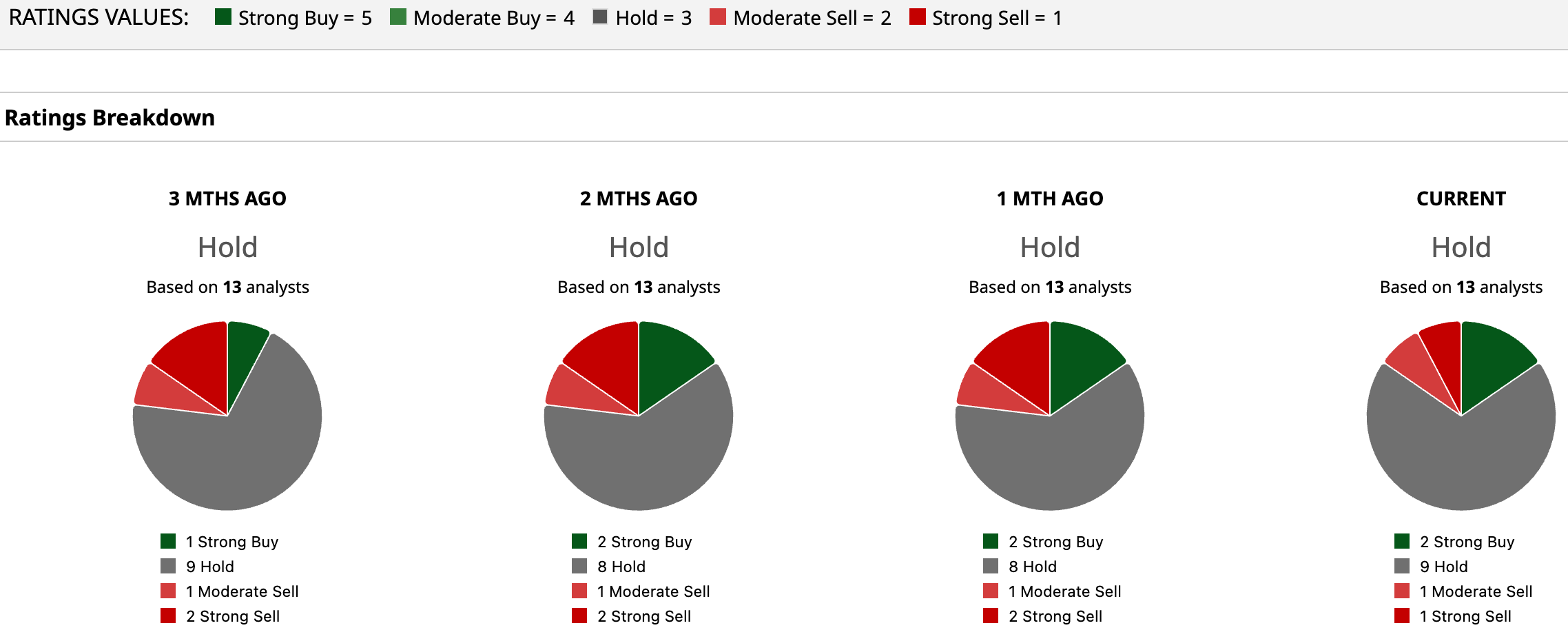

Wall Street maintains a cautious stance on AEO. The stock holds a consensus “Hold” rating, with two of 13 analysts recommending “Strong Buy,” nine advising “Hold,” one suggesting “Moderate Buy,” and one issuing a “Strong Sell,” underscoring divided conviction.

AEO stock already trades above its average price target of $22.70, signaling that much optimism is priced in. However, the Street-high target of $31 implies potential upside of 16.3% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Sydney Sweeney Made American Eagle Stock a Star in 2025. Should You Keep Buying AEO in 2026?

- CEO Satya Nadella Is Doubling Down on AI at Microsoft. Does That Make MSFT Stock a Buy Here?

- Wall Street Thinks This 1 Psychedelic Stock Can Gain 335% in 2026

- As the FDA Approves a Wegovy Pill, Should You Buy, Sell, or Hold Novo Nordisk Stock?