Tesla (TSLA) shares closed down over 3% on Monday following news that influential investor Cathie Wood has trimmed her stake further in the electric vehicle (EV) specialist.

In recent sessions, the founder and chief executive of Ark Invest has unloaded another $30 million worth of TSLA to load up on gene-editing and autonomous mobility names.

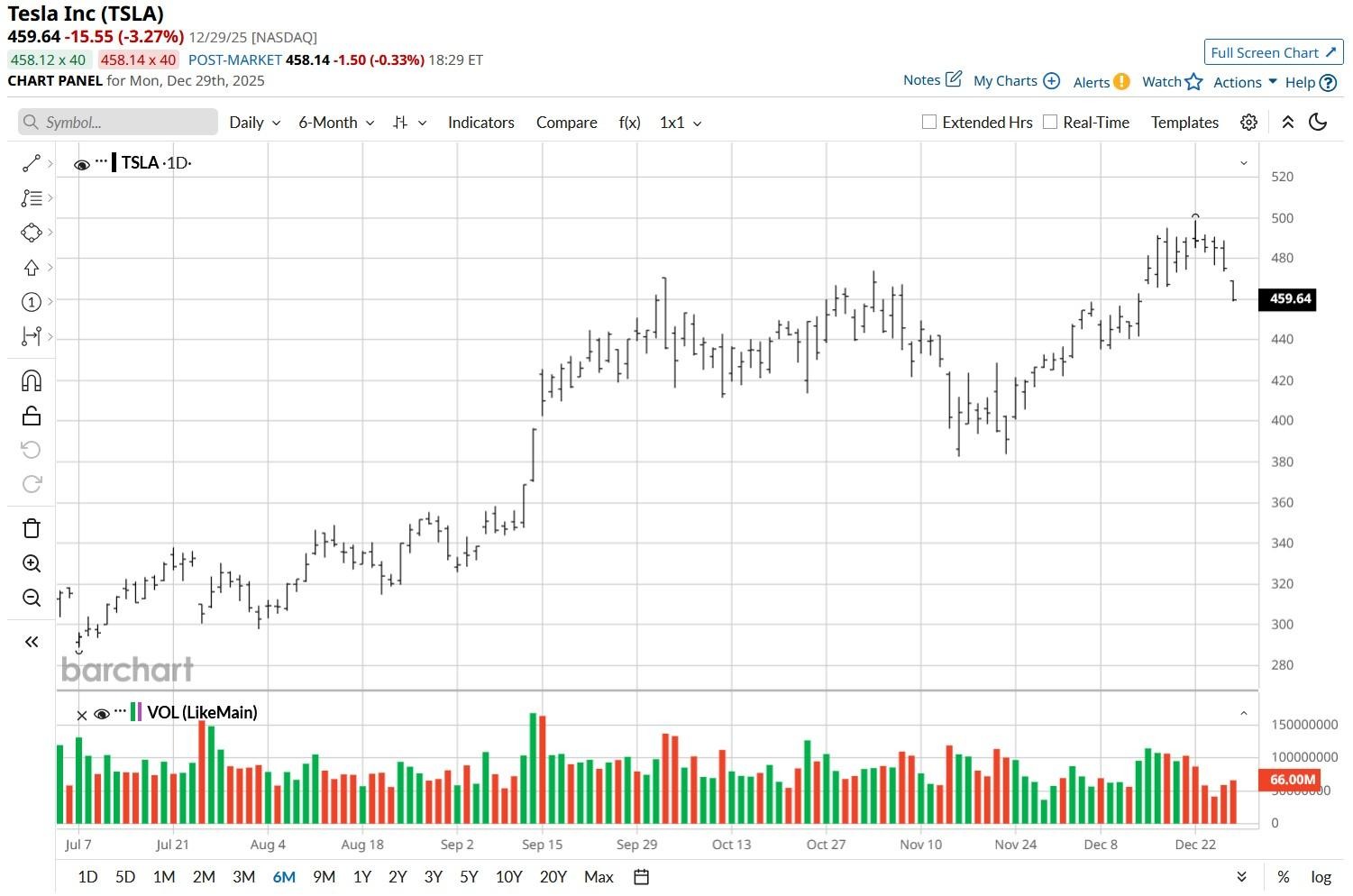

At the time of writing, Tesla stock is currently up more than 100% versus its year-to-date low.

Should You Sell Tesla Stock Too?

While Wood’s recent moves do suggest she’s turning bearish on TSLA stock, there are other reasons for retail investors to reevaluate their exposure to the EV firm heading into 2026.

According to Steve Westley – Tesla’s former board member – the multinational “will have to bend over backwards” to sustain its outperformance in the coming year.

While the Nasdaq-listed company has soared in the trailing nine months mostly on robotaxi-related optimism, it’s actually significantly behind Waymo on that front, he told CNBC last week.

“Waymo goes about 17,000 miles between critical interventions versus 1,500 only for Tesla.”

Moreover, Alphabet’s (GOOG) (GOOGL) subsidiary is already live in 20 markets compared to TSLA in two cities only, Westley added.

TSLA Shares Remain Overvalued

Another major reason to consider unloading Tesla shares is their egregiously stretched valuation.

The EV stock is currently going for a forward price-to-earnings (P/E) multiple of nearly 430x, which makes it one of the most expensive names in the benchmark S&P 500 Index ($SPX).

Plus, the automaker crashed below its near-term moving average (20-day) on Monday, signaling continued pressure ahead.

In the CNBC interview, Westley also warned that 2026 could be Tesla’s “second year of declining sales and shrinking profits,” which makes its stock even more poorly positioned for the coming year.

According to Barchart, options data also currently suggests potential downside in TSLA to about $387.

Wall Street Has a ‘Hold’ Rating on Tesla

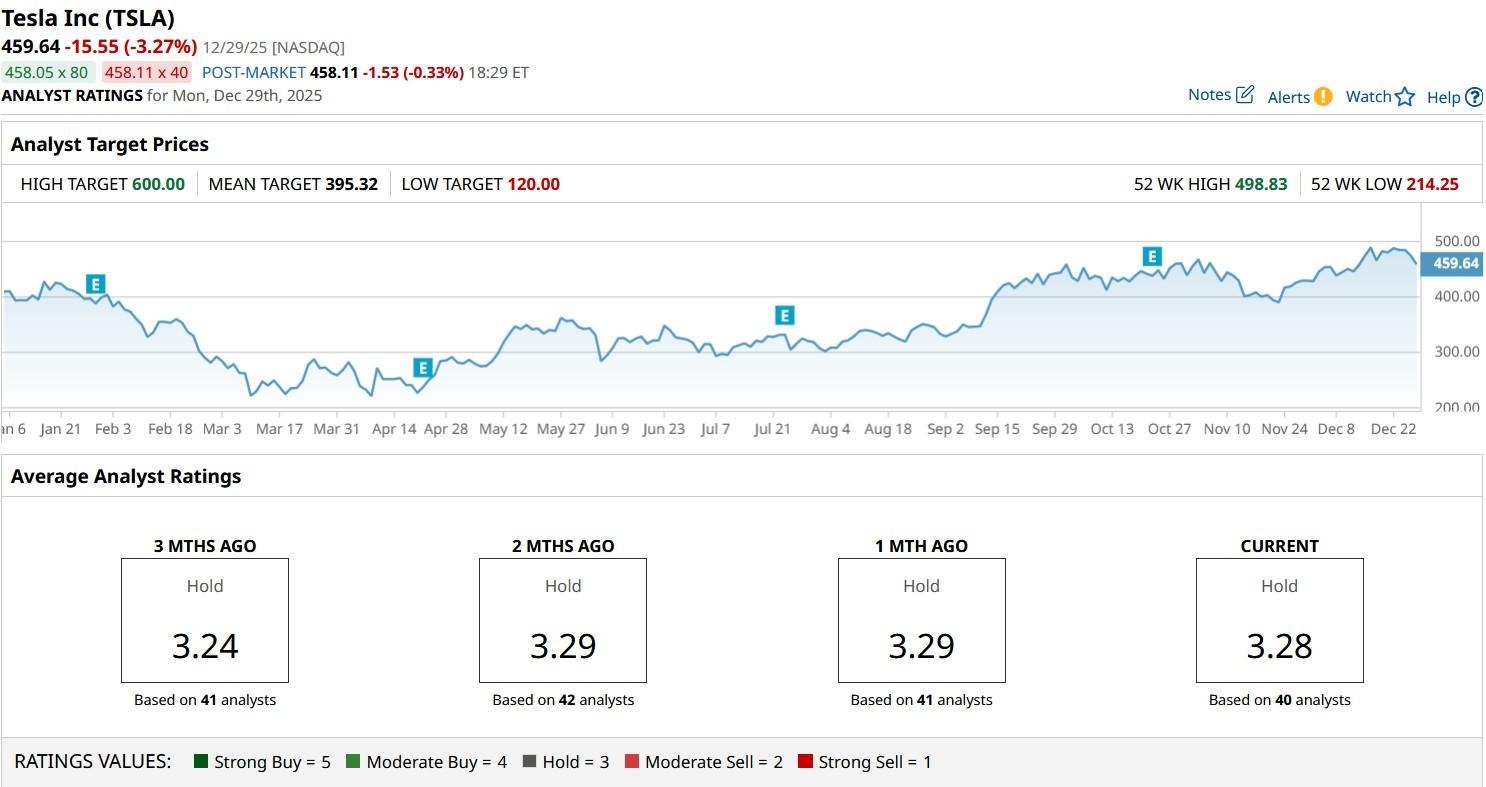

Wall Street analysts also currently see Tesla stock as overvalued at current levels.

The consensus rating on TSLA shares currently sits at “Hold” only with the mean target of about $395 indicating more than 13% downside potential from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Nvidia Reportedly Snubs the Intel 18A Process, How Should You Play INTC Stock for 2026?

- These 10 Stocks Are All Up More Than 99% in 2025. 3 of Them Look Likely to Keep Going Higher.

- Is One Asset Screaming that Stocks are Cheap Going into 2026? Can the S&P 500 Reach 10,000 in 2026?

- Worried About a Bust? 3 Old ETFs That Could Have New Appeal in 2026.