The stunning U.S. military operation that toppled Venezuelan President Nicolás Maduro has suddenly put the global oil world on high alert, and energy stocks in the spotlight. Venezuela isn’t just any oil nation. It sits on a jaw-dropping 303 billion barrels of proven crude reserves, roughly 17 % of the world’s total, according to the U.S. Energy Information Administration. Considering that, investors are now busy trying to figure out which energy companies might cash in on drilling into that black gold once the dust settles.

In fact, less than a week after Maduro’s removal, President Donald Trump hosted more than a dozen top oil executives at the White House to lay out the vision for Venezuela’s energy future. At that meeting, Trump boldly said oil companies will pour at least $100 billion into rebuilding Venezuela’s creaking oil infrastructure, with the U.S. promising security and protection so “they get their money back and make a very nice return.”

Among the heavyweights at the table was London-based oil giant Shell Plc ADR (SHEL), whose CEO Wael Sawan said the company is “ready to go” and already has “a few billion dollars’ worth of opportunities to invest” in Venezuela if it obtains the proper licenses. So, with Shell now aiming to tap the world’s largest crude reserves, the company has emerged as a key player to watch, making this an especially compelling moment to take a closer look at the stock.

About Shell Stock

Shell is one of the world’s largest and most influential energy companies, with operations in more than 70 countries and a customer base spanning every corner of the global economy. The company serves over one million commercial and industrial clients and welcomes around 33 million customers every day at its Shell-branded service stations. For more than a century, Shell has helped power homes, hospitals, factories, and transportation networks worldwide, making it a true backbone of the modern energy system.

What makes Shell stand out is the sheer scale and diversity of its operations. The company runs major oil and gas production projects, a world-class LNG and Integrated Gas business, and a vast downstream network that spans refineries, chemicals, fuels, and retail. At the same time, Shell is investing heavily in the future through electric-vehicle charging, biofuels, hydrogen, renewable power, and carbon-capture technologies.

Supported by one of the world’s largest energy trading and shipping operations, Shell has the global reach, infrastructure, and financial strength to compete in both today’s fossil-fuel market and tomorrow’s low-carbon energy economy.

Currently valued at a hefty market capitalization of about $203.65 billion, the European energy giant has delivered a decent run in 2025, with shares up 10.35%. That performance even edges out the broader energy sector. For comparison, the iShares Global Energy ETF (IXC) has gained 8.74% over the same period, showing that Shell is quietly pulling ahead of the pack.

And, Shell is a standout pick for income investors, offering a forward annualized dividend of $2.86 per share that translates into a generous 4.04% yield, giving shareholders a steady paycheck while they wait for the stock’s next move higher.

Shell’s Q3 Earnings Snapshot

In late October last year, Shell delivered a standout fiscal 2025 third-quarter earnings report, easily topping Wall Street’s expectations thanks to strong operations and a surge in trading activity. The London-listed energy giant posted adjusted earnings of $5.4 billion, up from $4.3 billion in Q2 2025 and well ahead of analysts’ forecast of $5.05 billion, a clear sign that Shell’s core businesses were firing on all cylinders.

That strong performance translated directly into bigger rewards for shareholders. Shell announced another $3.5 billion in share buybacks for the next three months, extending its streak to 16 straight quarters of returning at least $3 billion through buybacks. Few companies in the energy sector can match that level of consistency when it comes to putting cash back into investors’ hands.

The company’s financial engine remains equally impressive. Cash flow from operations reached $12.21 billion, slightly higher than the previous quarter’s $11.93 billion, giving Shell ample room to fund buybacks, dividends, and growth investments while also strengthening its balance sheet. Net debt fell to $41.2 billion, down from $43.2 billion in the prior quarter, highlighting Shell’s improving financial position.

CEO Wael Sawan credited the results to strong execution across the portfolio, especially in Shell’s Marketing business and deepwater assets in the Gulf of Mexico and Brazil, even as markets remained volatile. Looking ahead, Shell is keeping capital spending disciplined, with $21 billion in cash capital expenditures in 2024 and a 2025 target range of $20–$22 billion, positioning the company for both steady growth and continued shareholder return.

How Are Analysts Viewing Shell Stock?

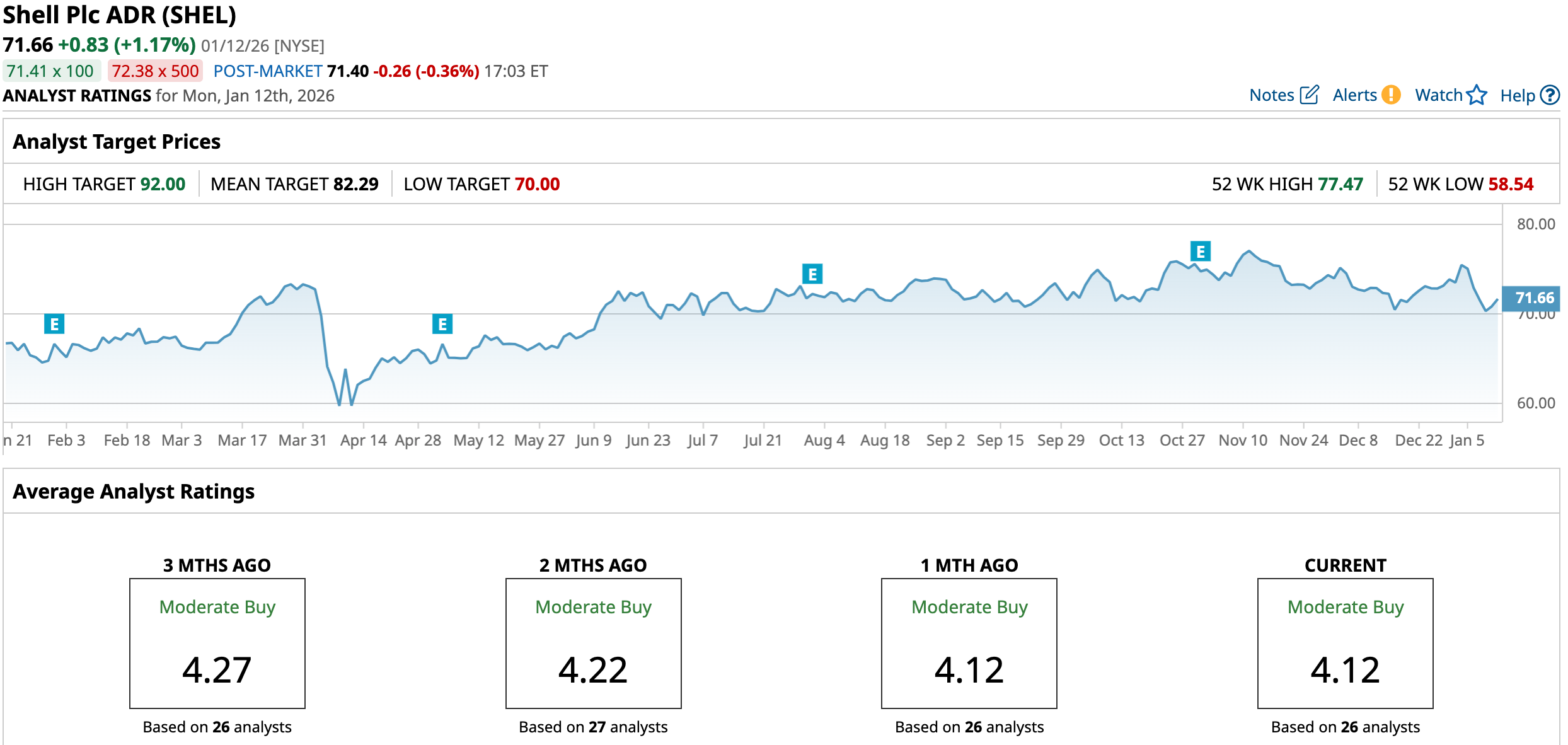

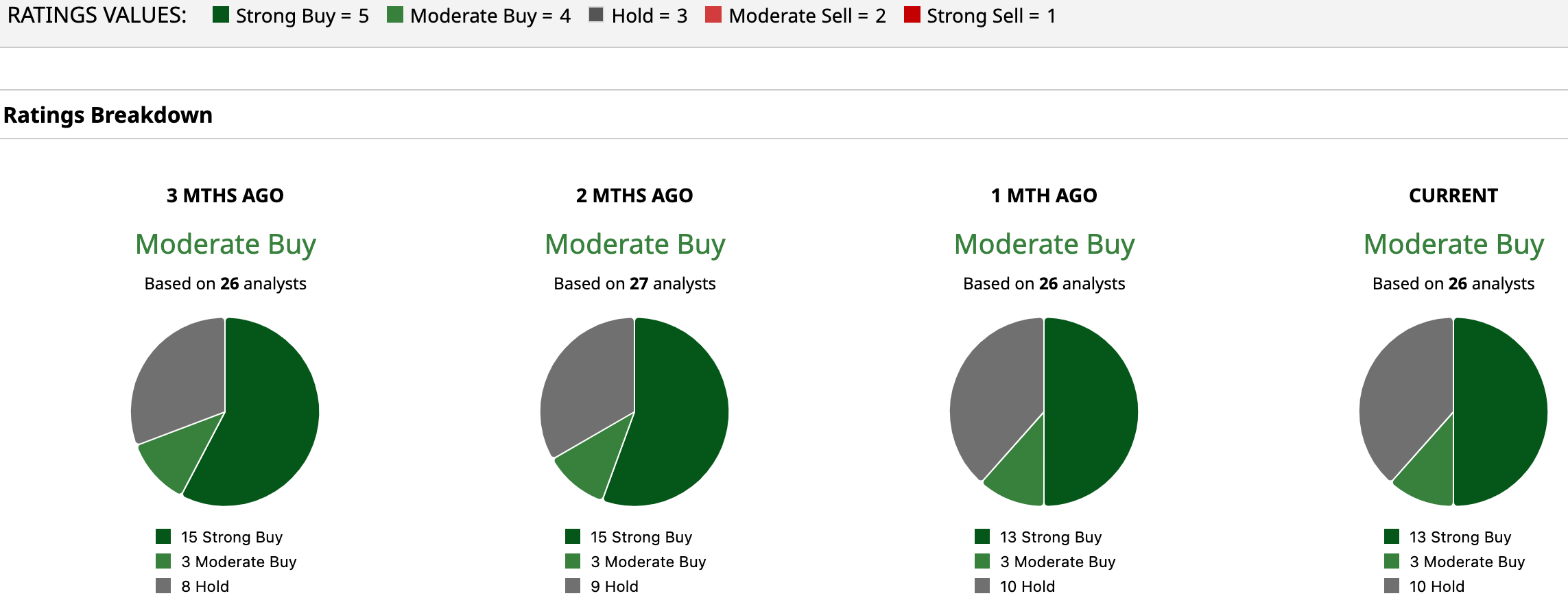

Wall Street is leaning bullish on Shell, with the stock carrying a “Moderate Buy” consensus rating that reflects growing confidence in its outlook. Out of 26 analysts covering the stock, 13 rate it a “Strong Buy,” three call it a “Moderate Buy,” and just 10 remain on the sidelines with a “Hold.” The numbers also point to solid upside ahead. The average price target of $82.29 suggests Shell could climb 13.44%, while the most optimistic target of $92 implies a nearly 28.38% rally from current levels.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Mizuho Says This 1 Lesser-Known Chip Stock Is a Top Buy for 2026

- Citi Is Betting on Another ‘Supercycle’ in Palantir Stock. Should You Buy PLTR Here?

- Palmer Luckey Warns China’s ‘Most Powerful Weapon’ Isn’t a ‘Missile or Drone, It’s Their Ability to Control People’s Minds Through the Media’

- Analysts Say Capital One Stock Is a ‘Strong Buy.’ Did Trump Just Change That?