Woonsocket, Rhode Island-based CVS Health Corporation (CVS) provides health solutions in the United States. With a market cap. of $102 billion, it operates through Health Care Benefits, Health Services, and Pharmacy & Consumer Wellness segments.

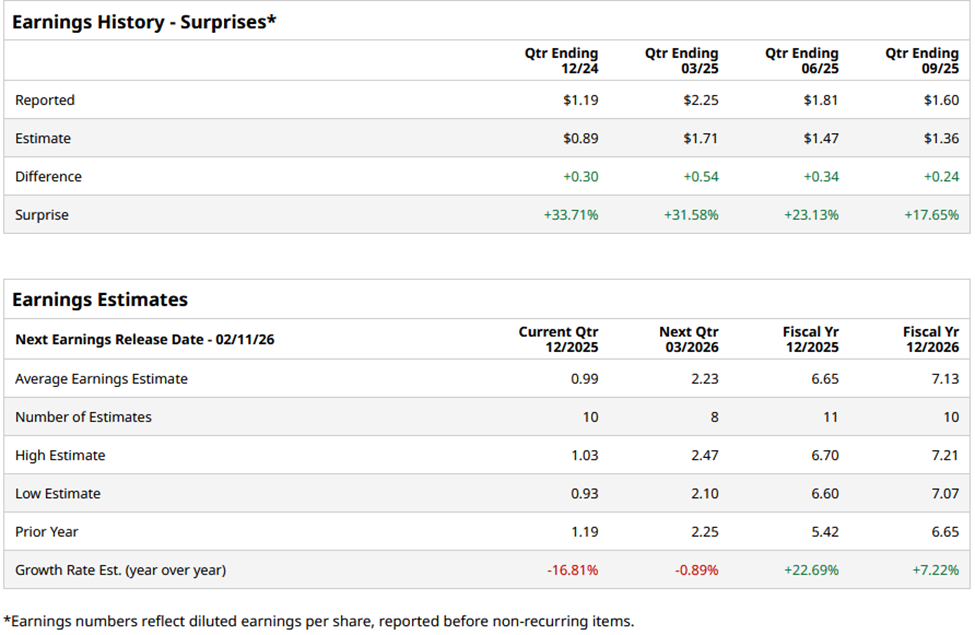

CVS is expected to release its Q4 2025 results before the market opens on Wednesday, Feb. 11. Ahead of this event, analysts anticipate CVS to post an adjusted EPS of $0.99, a decline of 16.8% from $1.19 reported in the same quarter last year. However, it has surpassed the Street’s bottom-line estimates in the past four quarters.

For fiscal 2025, analysts expect the company to report an adjusted EPS of $6.65, a 22.7% increase from $5.42 reported in fiscal 2024.

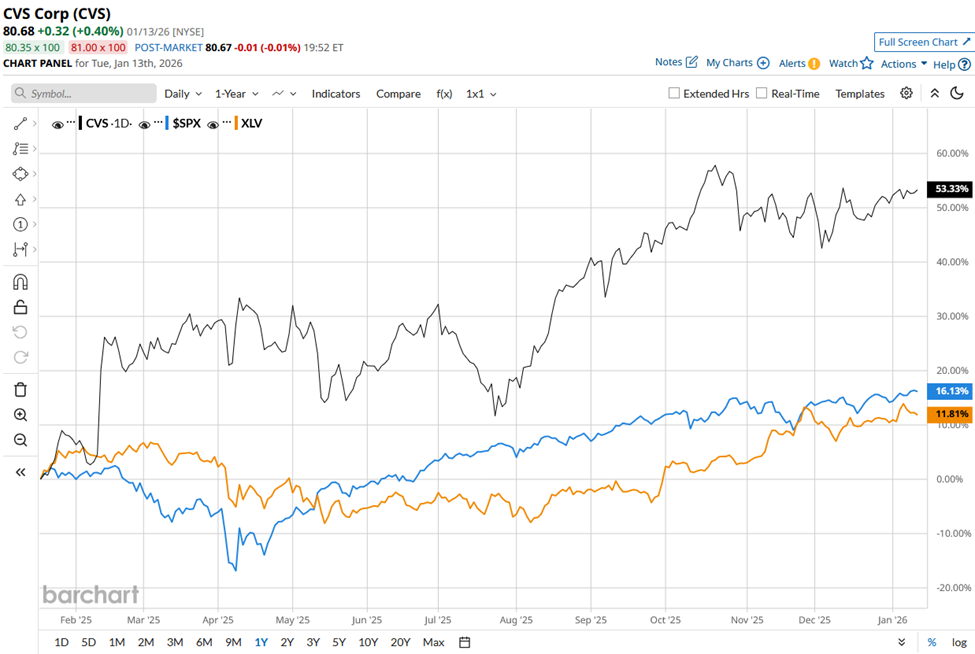

Shares of CVS have surged 55.6% over the past 52 weeks, outperforming the S&P 500 Index’s ($SPX) 18.3% rise and the State Street Health Care Select Sector SPDR ETF’s (XLV) 11.9% return during the same time frame.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $1.60 and revenue of $102.9 billion, CVS stock fell almost 2% on Oct. 29. Investor confidence was shaken by a $5.7 billion non-cash goodwill impairment charge in its Health Care Delivery segment, which led to the stock’s underperformance despite better-than-expected earnings.

Analysts’ consensus view on CVS is highly bullish, with a “Strong Buy” rating overall. Among 24 analysts covering the stock, 19 suggest a “Strong Buy,” two recommend a “Moderate Buy,” and three analysts give a “Hold.” The average analyst price target et of $94.74 represents a 17.4% potential upside to current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Broadcom CEO Hock Tan Just Sold $24 Million Worth of AVGO Stock. Should You Dump Shares Too?

- HSBC Says These 2 AI Stocks Are Likely to Be Earnings Winners. Should You Buy Them Now?

- Behind Berkshire’s Curtain: Is Greg Abel Preparing to Cut Davita Loose?

- Thursday Earnings Preview: Look to These Banking Giants for Key Consumer Insights